Form 990 Filing Instructions for 2023: Step-by-Step instructions

- Updated February 07, 2024 - 2.00 PM - Admin, Tax990

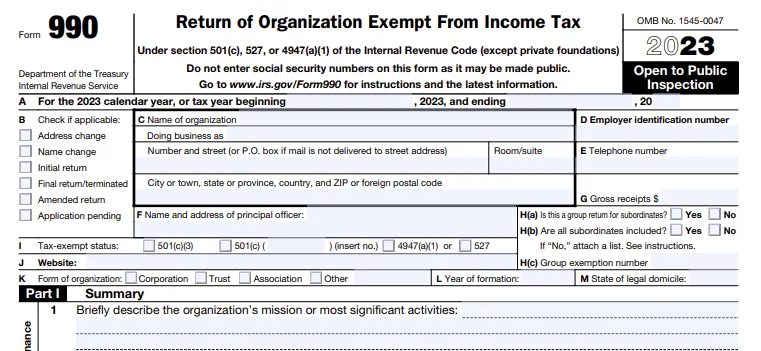

Form 990 is filed by certain tax-exempt organizations, nonexempt charitable trusts, and section 527 political organizations whose gross receipts are more than or equal to $200,000 (or) total assets more than or equal to $500,000 to report the annual information required by section 6033 to the IRS.

The deadline to file Form 990 for these organizations is the 15th day of the 5th month after their accounting period ends.

You can find out more details on how to complete Form 990 in this article.

Additional Filing Requirements for Form 990

The organizations filing Form 990 may also be required to report additional information by attaching

various Schedules.

There are 16 Schedules available for Form 990 to provide more information about the Organization. Failing to attach the required schedules may result in an incorrect filing, leading to IRS penalties.

Schedule A - Public Charity Status and Public Support

Schedule B - Schedule of Contributors

Schedule C - Political Campaign and Lobbying Activities

Schedule D - Supplemental Financial Statements

Schedule E - Schools

Schedule F - Statement of Activities Outside the United States

Schedule G - Supplemental Information

Schedule H - Hospitals

Schedule I - Grants and Other Assistance to Organizations, Governments, and Individuals in the U.S

Schedule J - Compensation Information

Schedule K - Supplemental Information on Tax-Exempt Bonds

Schedule L - Transactions with Interested Persons

Schedule M - Noncash Contributions

Schedule N - Liquidation, Termination, Dissolution, or Significant Disposition of Assets

Schedule O - Supplemental Information to Form 990

Schedule R - Related Organizations and Unrelated Partnerships

For more information, visit here

Get Started with Tax 990 to E-file Form 990 with Complete Ease!

Tax 990, the IRS-authorized e-file provider, offers a simple way to file your Form 990. Our amazing features are sure to make your e-filing experience smooth and hassle-free.

You can fill out your Form 990 easily using our Form-based filing or Interview-style filing options.

The applicable 990 Schedules will be automatically included for free based on the data you enter.

To ensure the accuracy of your Form 990, our Built-in error check system audits it before transmission.

Our Multi-user access allows you to invite your staff to assist you in form preparation.

In case of any issues, you can get in touch with our Dedicated Support Team for instant solutions.

Steps to File your Form 990:

Step 1

Add Organization Details

Just search for your EIN, and our system will automatically import your organization’s details from the IRS. You can also enter your details manually.

Step 2

Choose Tax Year

Tax 990 supports current and previous years’ filings. Choose the tax year for which you are filing, select the 990 Form, and continue.

Step 3

Enter Required Form Data

Enter all the information required to complete your Form 990.

Step 4

Review your Form Information

After providing all the required information, review your form, make any necessary changes,

and proceed.

Step 5

Transmit directly to the IRS

Once your form is reviewed and approved, you can transmit your Form 990 to the IRS.