Exclusive Features for Seamless 1120-POL E-Filing

Easy Form Preparation

You can prepare your Form 1120-POL easily and accurately using our Interview style filing option.

Internal Audit Check

Our built-in audit check reviews your completed form and displays IRS instruction errors

before transmission

Multi-User Access

You can invite team members from your organization to assist with form preparation or help manage the filing process.

Supports 1120-POL Amendment

If you need to correct any data reported in your 1120-POL return filed already, Tax990 enables you to file an amendment.

Re-Transmit Rejected Return

If you filed Form 1120-POL with us and it was rejected for any reason, you can fix the errors and re-transmit it for free.

Dedicated Support Team

We have a team of experts available via live chat, phone, and email to assist you with your questions during and after filing.

Ready to start your 1120-POL E-filing?

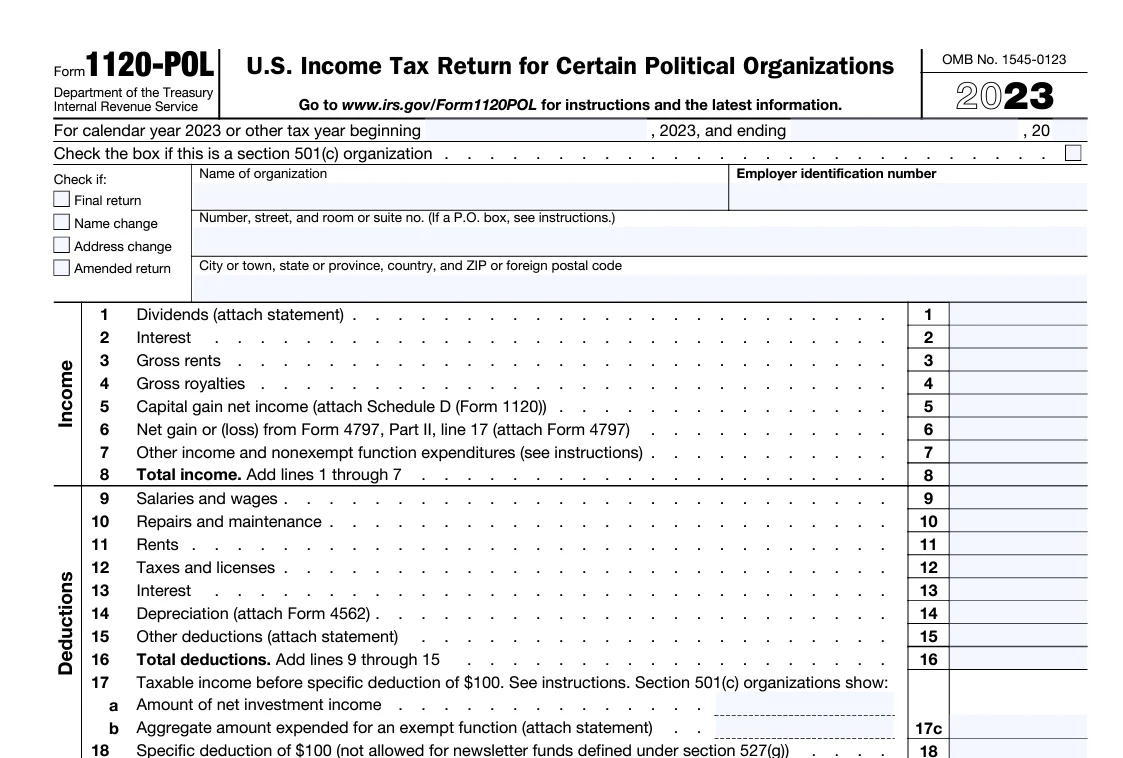

Information Required to E-file Form 1120-POL Online

Here is the list of major information that you’ll need to file

Form 1120-POL online,

- The organization’s basic Information

- Financial information such as income and deductions

- Program service accomplishments

- Taxable income and tax credits

- Tax dues and Overpayment

- Books are in the care of details

How to file Form 1120-POL Electronically

-

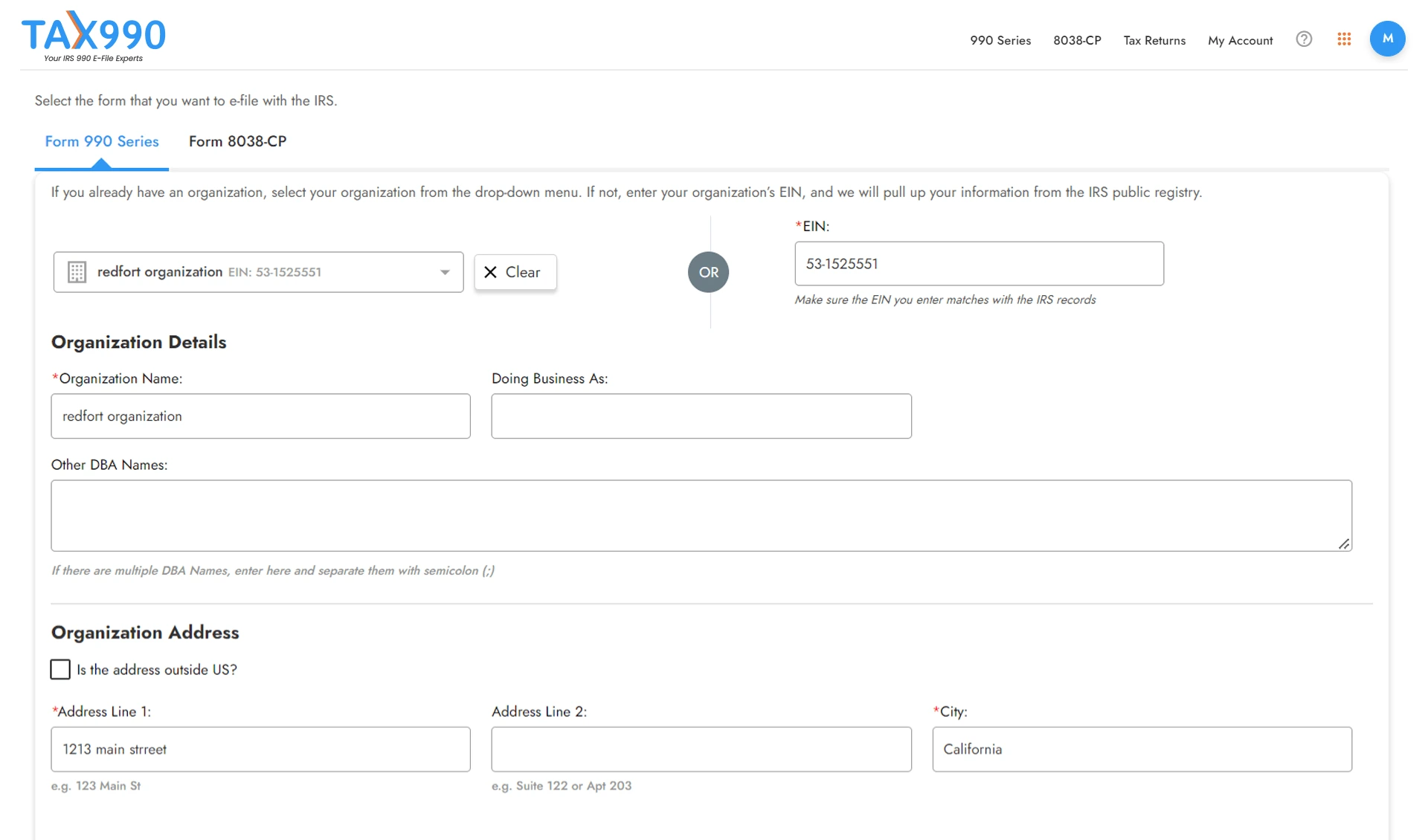

Enter your EIN and provide all the basic information about your organization, such as name, address, and principal officer details.

-

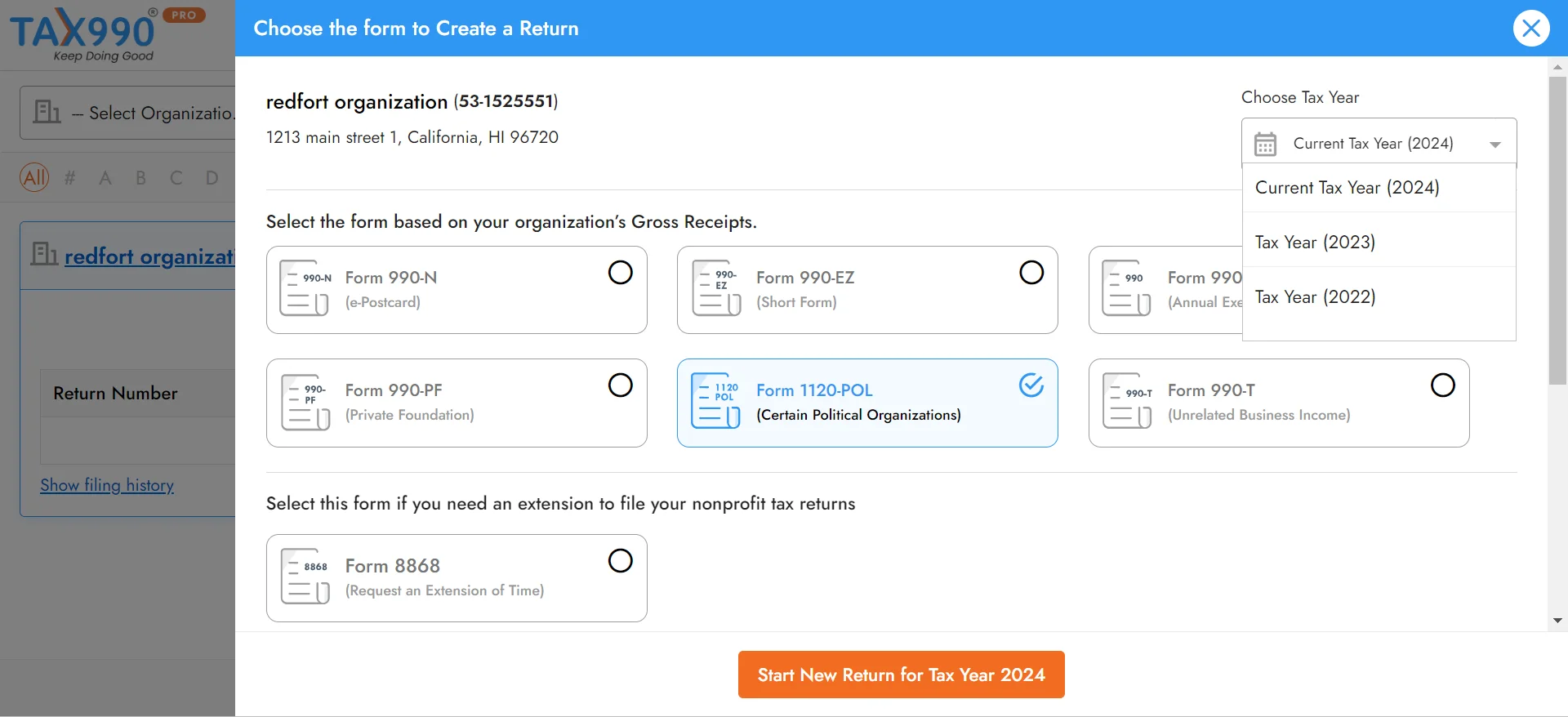

Tax 990 supports filing for the current and previous tax years. Choose the tax year for which you are required to file, select Form 1120-POL, and continue.

-

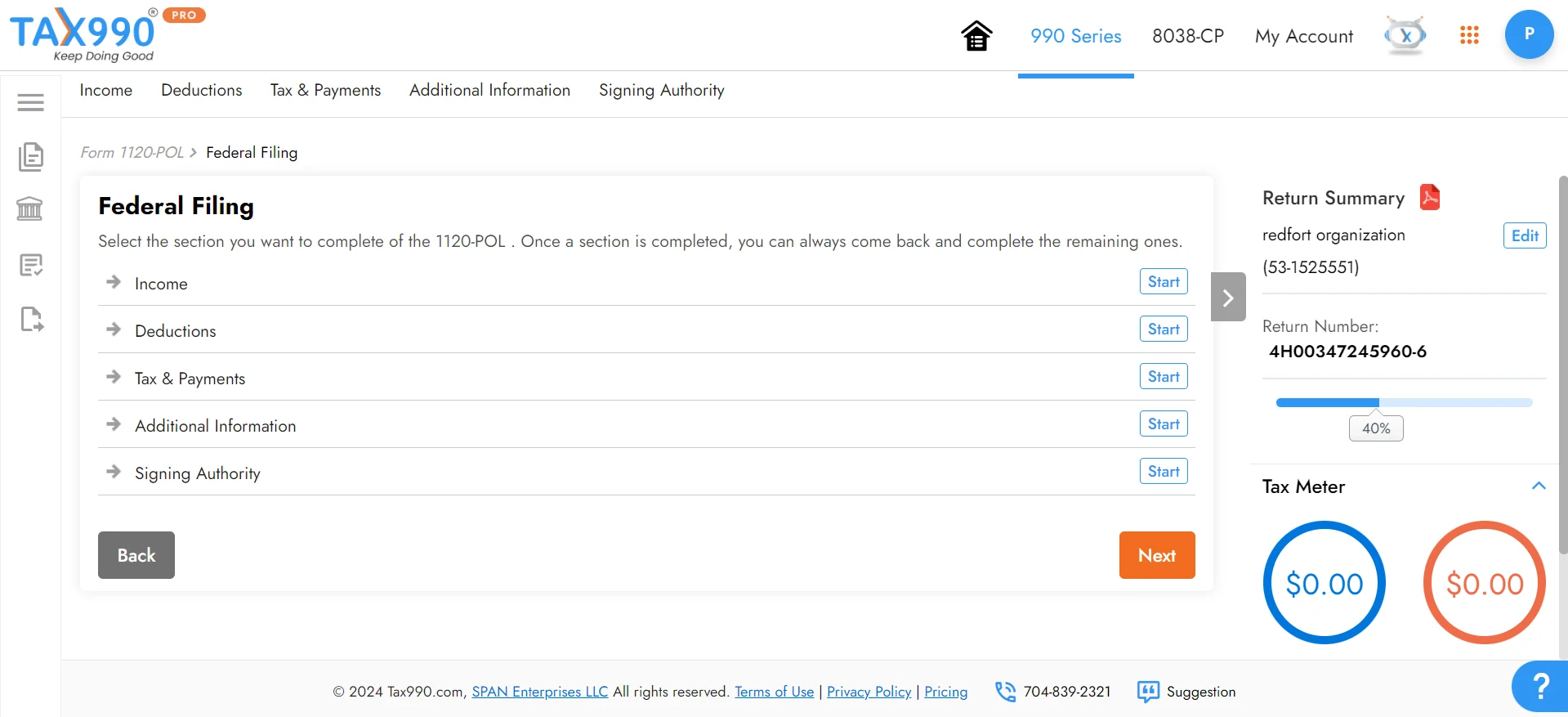

Provide all the required information for your Form 1120-POL using our interview-style filing method.

-

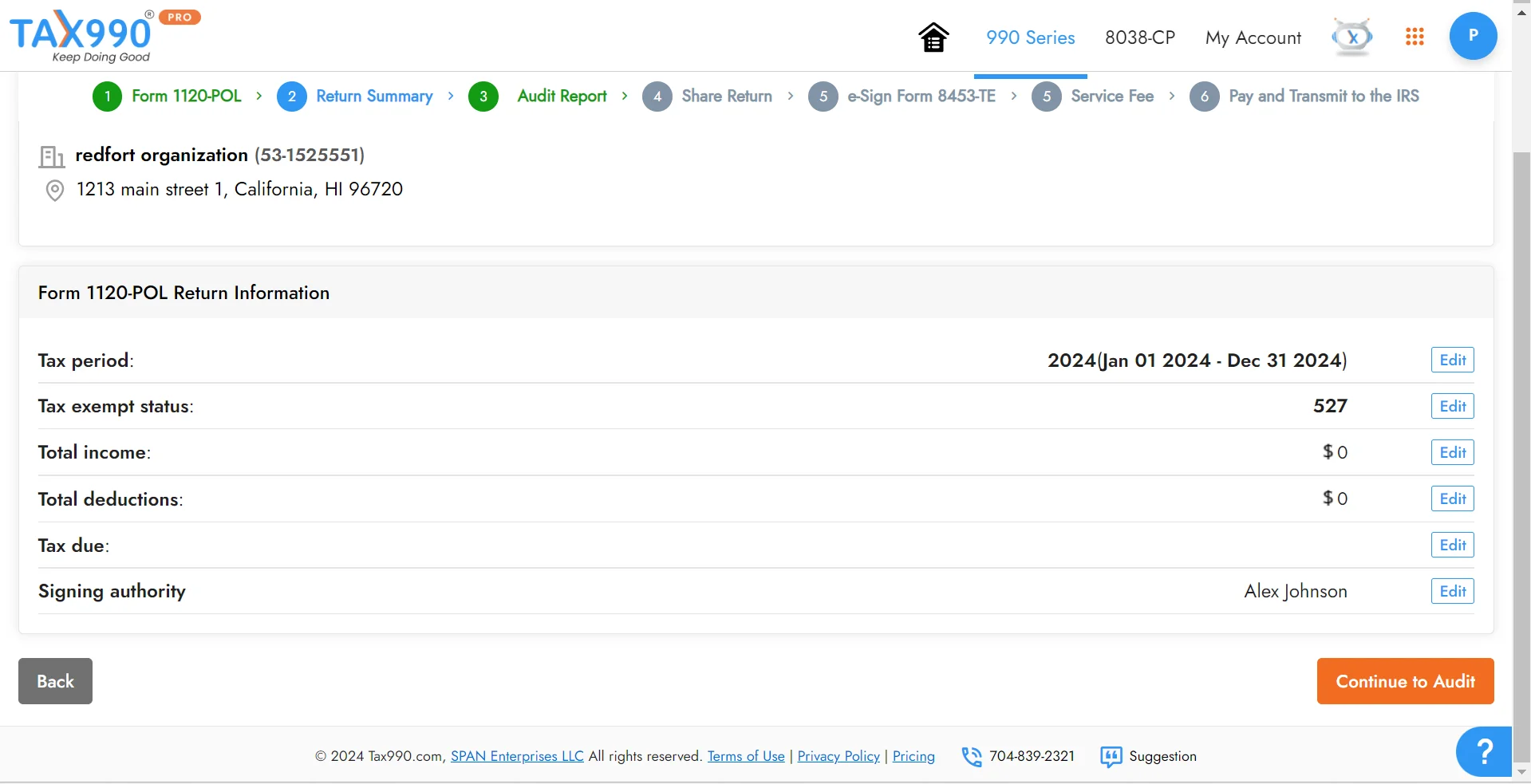

Review your form summary for any errors and share your form with your organization’s authorized members for review and approval.

-

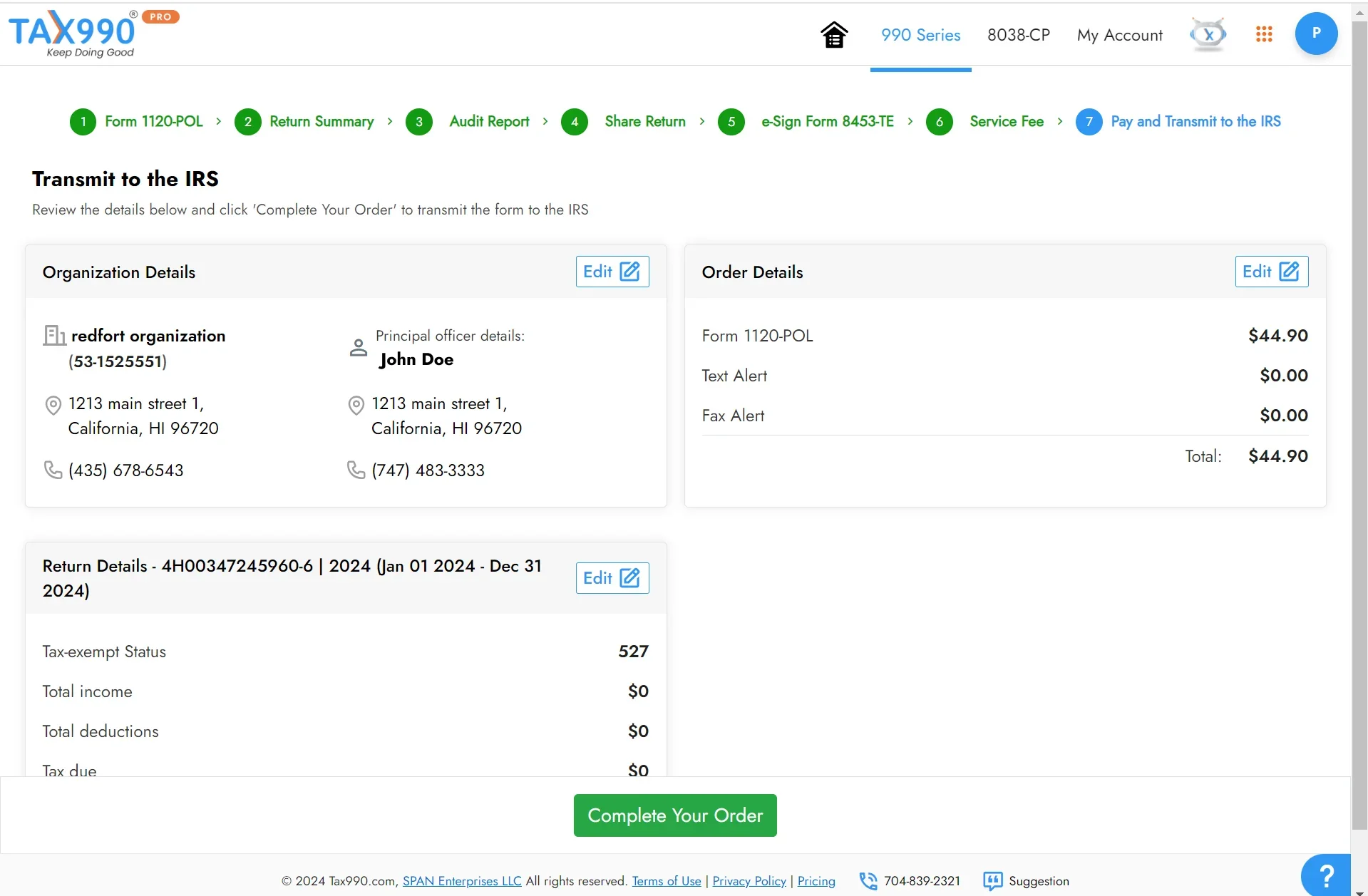

Once you have reviewed your form, transmit it to the IRS. We will keep you updated on the IRS status of your form via email or text.

Ready to E-file Form 1120-POL?

Fees to File Form 1120-POL Online

- Built-in error check system

- Invite users to manage filing

- Re-transmit rejected returns for Free

- Free First Amendment for original return filed with us

Ready to e-file Form 1120-POL?

See what our clients love about Tax 990

Join Thousands of Nonprofits that Trust Tax 990

Frequently Asked Questions about Tax Form 1120-POL

What is IRS Form 1120-POL?

Form 1120-POL is an annual return filed by political organizations to report their political organization's taxable income such as income, deductions,

taxes due, or overpayment.

Who must file Form 1120-POL?

- Political organizations that have any political organization taxable income (whether or not it is tax exempt)

- The tax-exempt organizations that are treated as having political organization taxable income under section 527(f)(1)

When is the due date to file Form 1120-POL?

Form 1120-POL must be filed on or before the 15th day of the 4th month after the organization’s accounting period ends.

For the organizations operating under the calendar year, the deadline will be April 15th (Unless it falls on a Saturday, Sunday, or federal holiday).

What are the 990 filing requirements for Political organizations that file Form 1120-POL?

An organization that files Form 1120-POL may also be required to file the following tax returns based on their type and requirements.

An exempt political organization must also file one of these forms if its annual gross receipts are $25,000 or more should file the following 990 forms.

- Form 990 - Return of Organization Exempt From Income Tax

- Form 990-EZ - Short Form Return of Organization Exempt From Income Tax

What are the returns that may be required to file along with your Form 1120-POL?

-

Form 8871 - Political Organization Notice of Section 527 Status

In general, being tax-exempt the political organization should file Form 8871 within 24 hours of the established date and before 30 days kind of material change in the organization should also report.

-

Form 8872 - Political Organization Report of Contributions and Expenditures

The political organization should report the contributions and expenditures that happened during the calendar tax year and should file Form 8872.

-

Form 8997 - Initial and Annual Statement of Qualified Opportunity Fund (QOF) Investments

During the respective year, the organization should identify qualified investments that are held in the qualified opportunity fund and should file 8897 along with Form 1120-POL.

-

Form 8992 - U.S. Shareholder Calculation of Global Intangible Low-Taxed Income (GILTI)

Form 8992 is used to figure out about their domestic corporation’s GILTI along with 1120-POL

Can I paper file Form 1120-POL?

-

Yes, you can complete and mail your 1120-POL return to the following address:

Department of the Treasury,

Department of the Treasury,

Internal Revenue Service Center,

Ogden, UT 84201. -

If your organization’s office is located in a foreign country or a U.S. possession, mail you 1120-POL return to

Internal Revenue Service Center,

Internal Revenue Service Center,

P.O. Box 409101,

Ogden, UT 84409.

Can I get an extension to file Form 1120-POL?

Yes! You can get an automatic 6-month extension by filing Form 7004 before the original Form 1120-POL filing due date.

What are the penalties for filing Form 1120-POL late?

If you fail to file Form 1120-POL within the deadline, you are required to pay a penalty amount equal to 5% of the tax due for every delayed month, with a maximum of 25% of the tax due.

The minimum penalty for a return more than 60 days late is the tax-due amount of $450 (whichever is smaller).