Trusted By Nonprofits

Let Tax990 Revolutionize Tax Form Filing For Your Organization Too

How to File Form 8868 Electronically

-

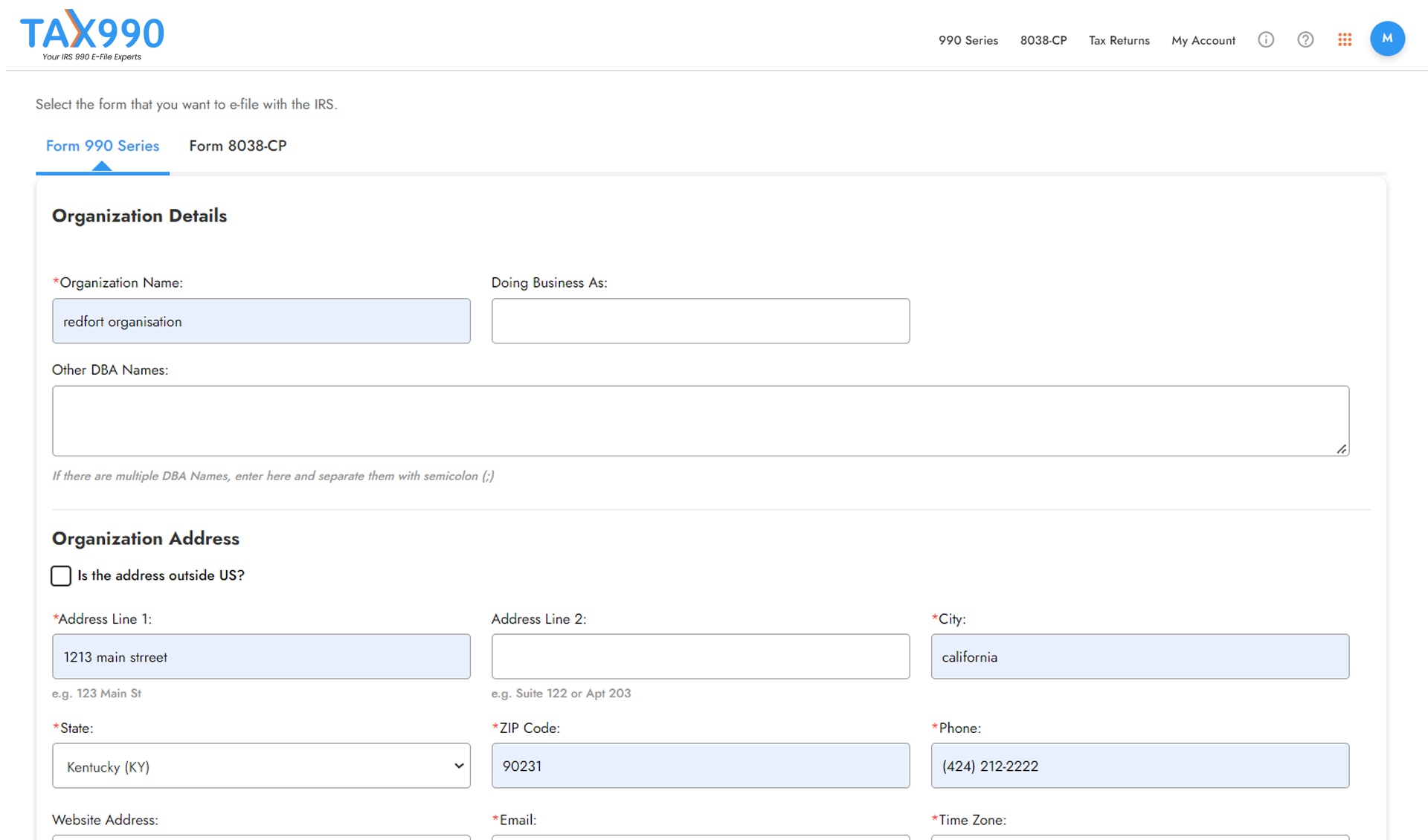

Search for your EIN to import your organization’s data from the IRS or enter your organization’s details manually.

-

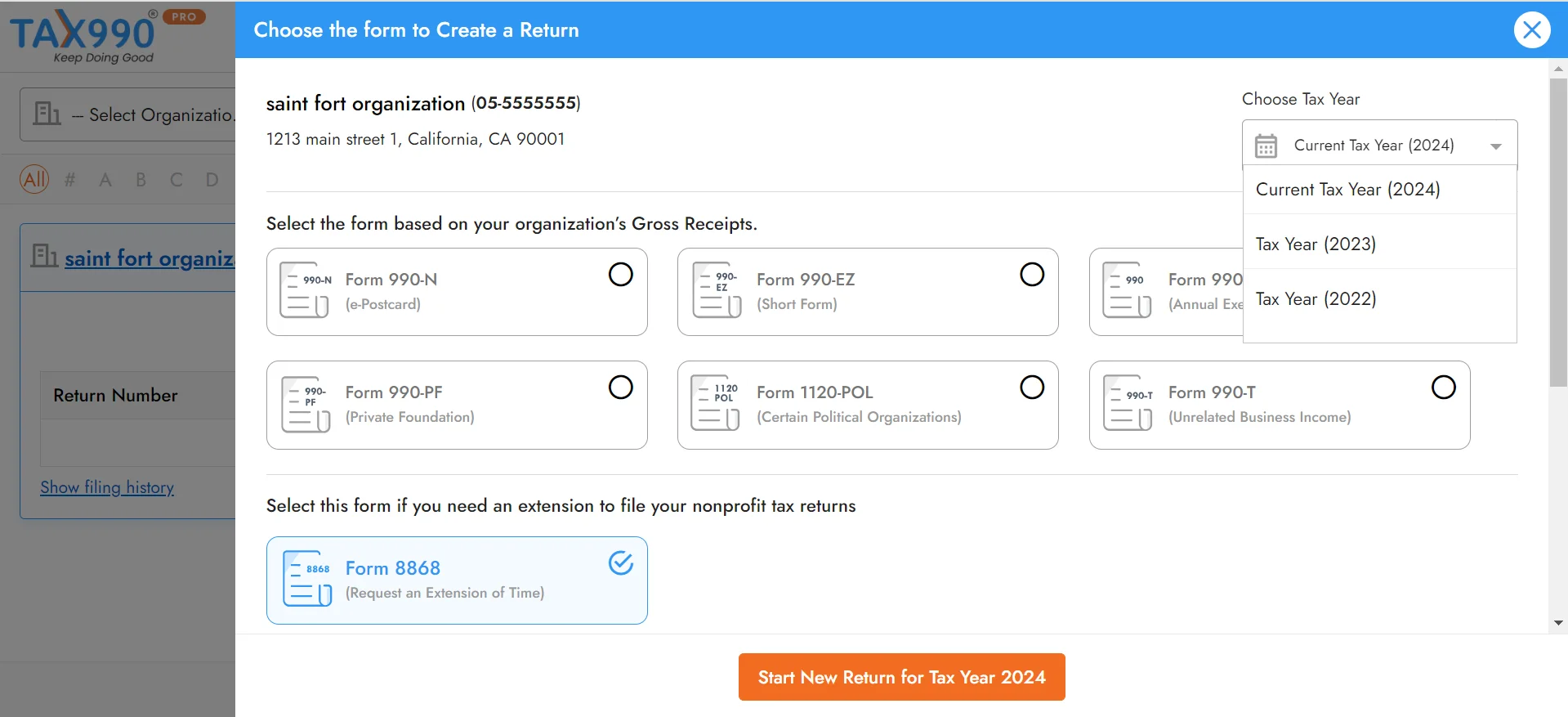

Choose the tax year for which you are required to file, select Form 8868.

-

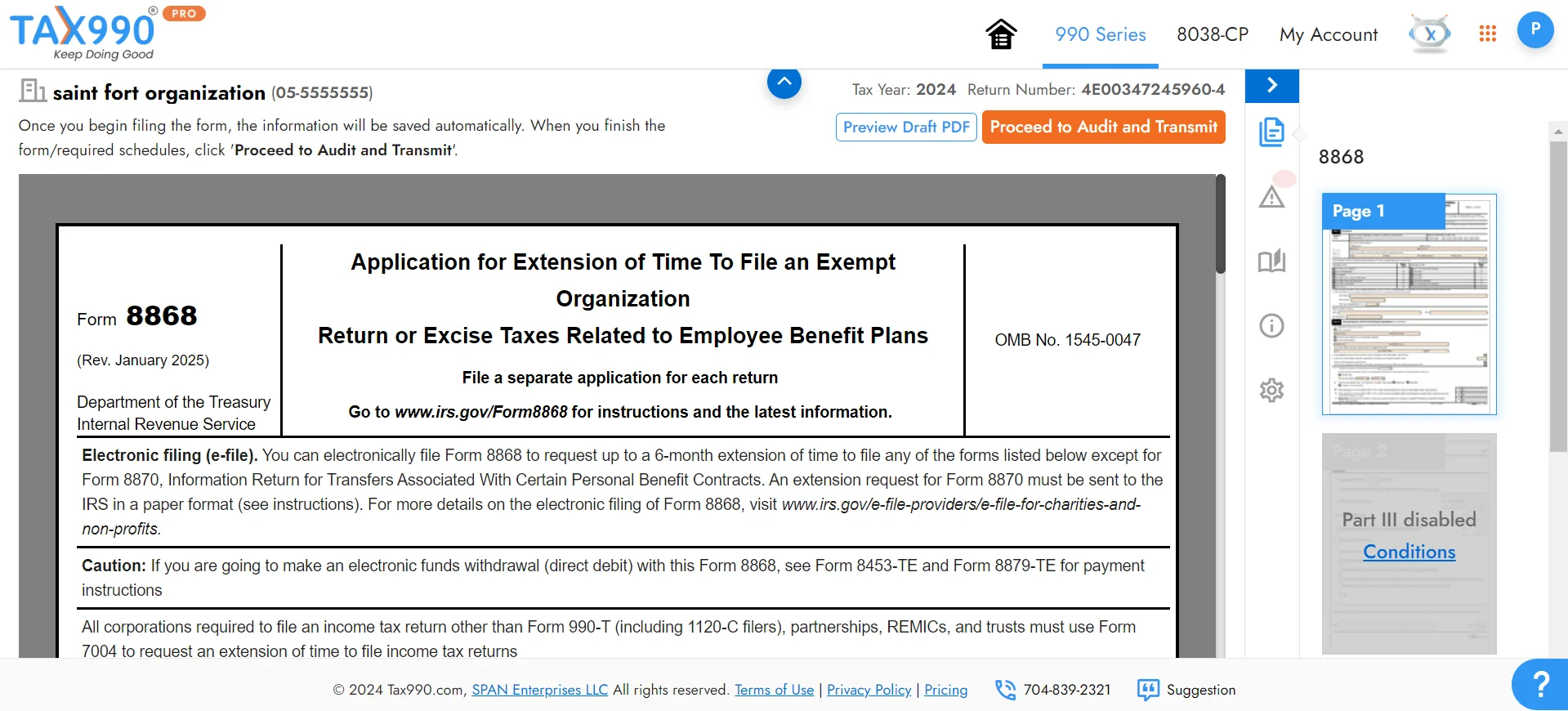

select the return for which you need to file an extension and provide the required information for your Form 8868 extension.

-

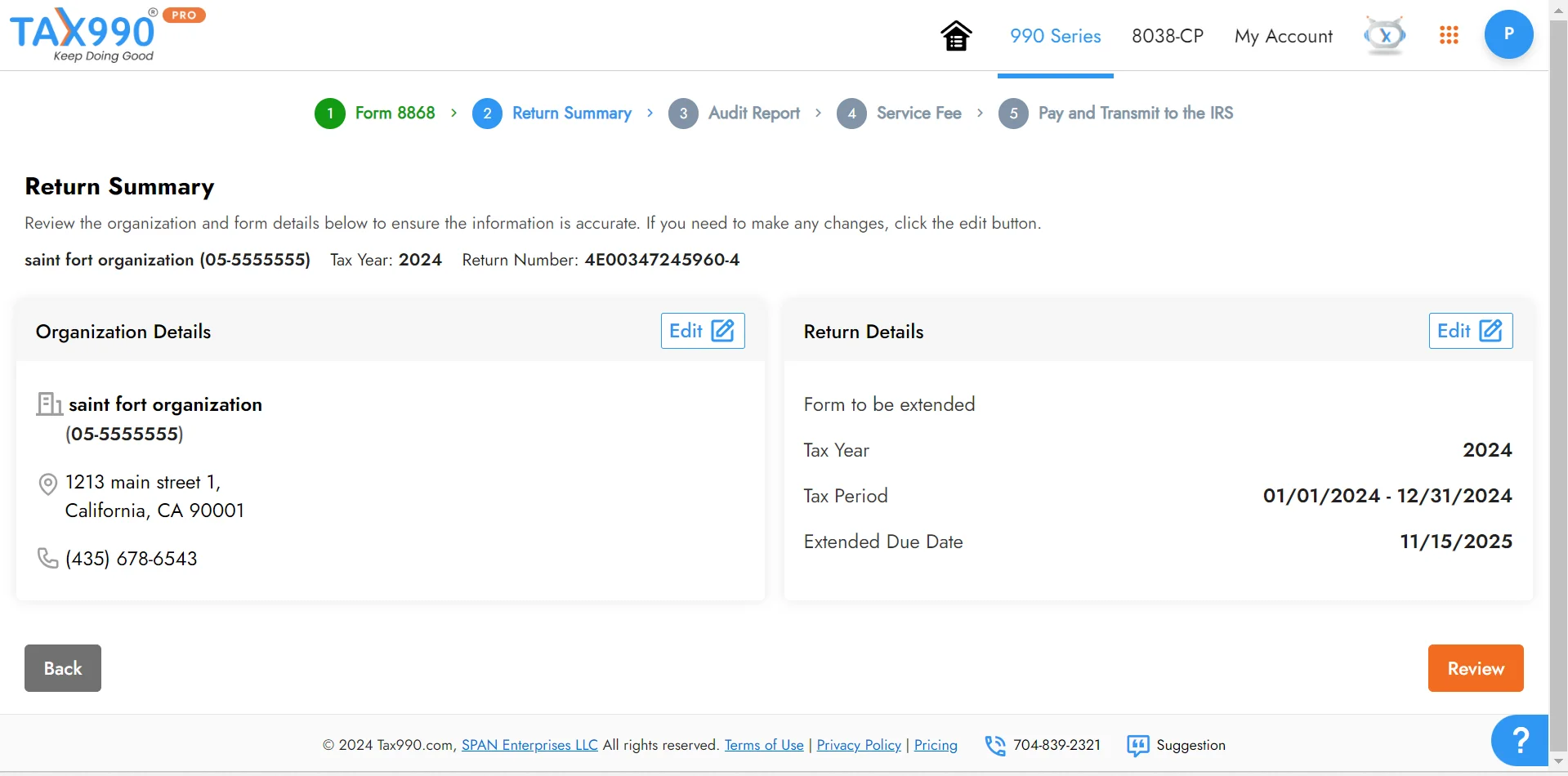

Review your form summary. You also have the option to share your form with foundation members for review and approval.

-

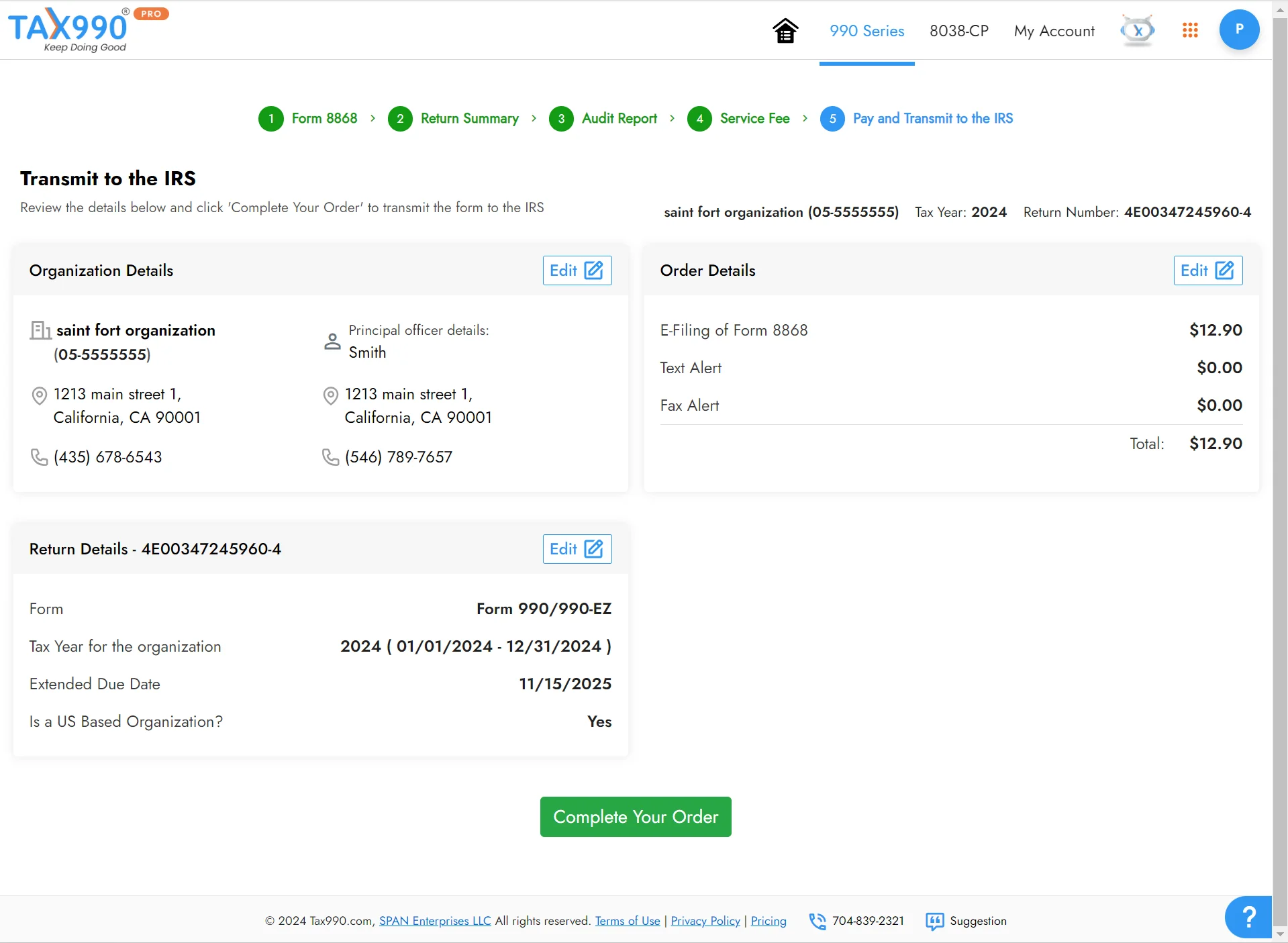

Once you have reviewed the form, you can transmit it to the IRS. The IRS will provide you with a 6-month automatic extension.

Ready to E-file Form 8868?

Information Required to E-file Form 8868 Online

Here is the list of major information that you’ll need to file Form 8868 online,

- The organization’s basic Information

- Start and end date of the organization’s accounting period

- Tax dues (if applicable)

- Organization’s books are in the care of details

- Signing authority’s details

Exclusive Features for Seamless 8868 E-Filing

Get Extension in Minutes

With Tax 990, you can file your 990 extension in just a few minutes.

File From Any Device

You can file your 8868 extension with Tax 990 on any device, such as a desktop, mobile, or tablet.

Multi-User Access

Add your organization members to assist you in form preparation or to manage filing.

Internal Audit Check

To file accurate returns, our built-in error check system audits your completed forms for errors.

Reviewers and Approvers

You can share the completed form with your organization members for review and approval.

Expert Assistance

We have a team of experts available to resolve your questions via live chat, phone, and email.

Ready to start your 8868 E-filing?

Combo Pricing for Form 8868

Maximize savings while satisfying your filing needs with Combo Pricing!

| Combo Package | Pricing |

|---|---|

| Form 8868 + 990-EZ |

|

| Form 8868 + 990-T |

|

| Form 8868 + 990-PF |

|

| Form 8868 + 990 |

|

Ready to File 990 Extension

Fees to File Form 8868 Electronically

- Instant IRS approval

- File from any device

- Ensures complete data protection

- Live chat, phone, and email support

- Retransmit rejected returns for Free

Ready to start filing your Form 8868?

See what our clients love about Tax 990

Join Thousands of Nonprofits that Trust Tax 990

Frequently Asked Questions about Tax Form 8868

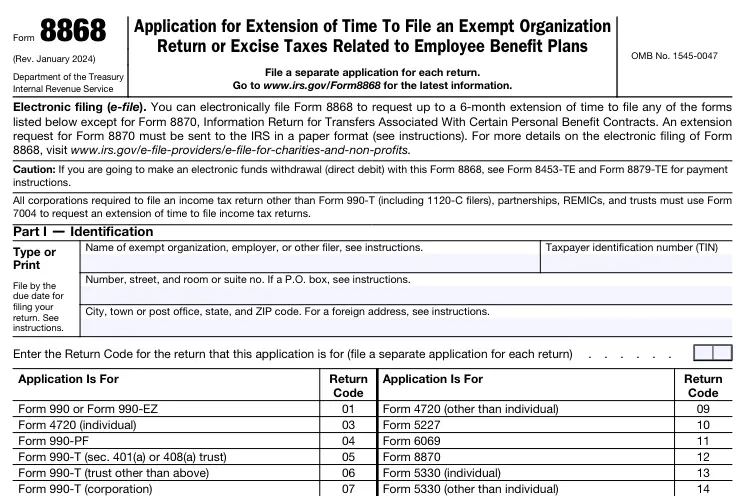

What is Form 8868?

Form 8868 is a tax extension form filed by exempt organizations to get an automatic 6-month extension to file their annual tax returns.

For what returns the extension Form 8868 is applicable?

Form 8868 can be used to extend the deadline for Forms 990, 990-EZ, 990-PF, 990-T, 4720, 1041-A, 5227, 5330, 6069, and 8870.

Do I need to provide any explanation for requesting an extension?

No! This extension is automatic, which means you aren’t required to provide the IRS with a reason for requesting more time to

file your nonprofit tax returns.

When is the due date to file Form 990 extension?

The due date to file 990 extension (Form 8868) is actually the same as the due date of the original nonprofit tax forms for which the extension is

being requested.

For example, If you need to get an extension for Form 990, then the deadline is 15th day of the 5th month after the organization’s accounting

period ends.

So, for calendar filers, the deadline to file Form 8868 is May 15.

Can I paper file Form 8868?

Yes! Form 8868 can be filed either electronically or on paper. However, if you are requesting an extension for Form 8870, you must paper

file Form 8868.

Where to Mail Form 8868?

You can complete and mail your 8868 return to the following address.

Internal Revenue Service Center,

Ogden, UT 84201-0045.

How to pay tax dues when filing Form 8868 electronically?

You can choose one of the following options to pay your tax dues when filing Form 8868 electronically.

- EFTPS - Electronic Federal Tax Payment System

- EFW - Electronic Funds Withdrawal