IRS Form 990 for Nonprofits - Key Takeaways

What is Form 990?

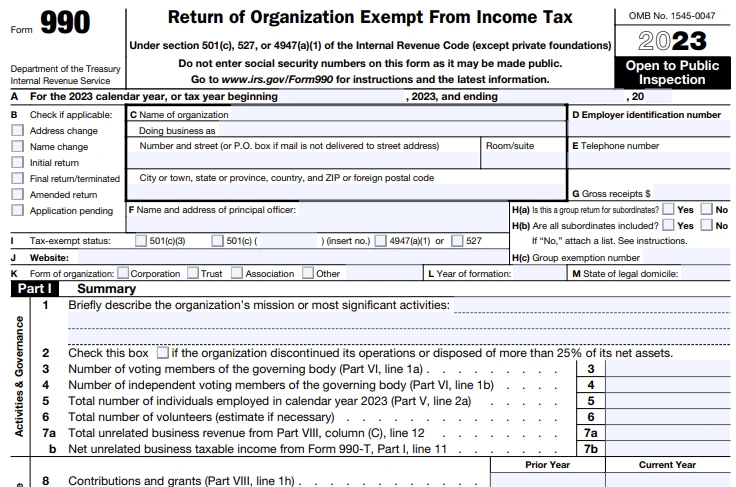

Form 990 is an annual return filed by the tax-exempt & nonprofits to report their financial information, activities, and other information for the respective tax years.

Who must file Form 990?

Tax-exempt organizations whose gross receipts $200,000 or more (or) assets of $500,000 or more for the tax year.

When is Form 990 Deadline?

The deadline is the 15th day of the 5th month after the organization’s accounting period ends.

Tax990 Enables Seamless 990 E-Filing with Exclusive Features

Tired of complicated tax filing? Tax990 is here to simplify the process, making your Form 990 filing easy and stress-free!

Form Preparation Options

Choose between our Direct-Form entry and Interview-Style filing methods to prepare your forms with complete ease and convenience.

Internal Audit Check

Our built-in error check system ensures you can catch and fix any IRS errors in your 990 return before submission.

Auto-generate 990 Schedules

Based on the data you provide on the 990 Form, our system automatically adds the required Schedules at no extra cost.

Live Customer Support

Our support team is here to help! Reach out to us via live chat, phone, or email.

Copy Data Option

You can now copy data from the previous year’s 990 returns, even if they were filed elsewhere.

Free Retransmission

If your Form 990 is rejected by the IRS, you can edit and resubmit it at no additional cost.

Our intuitive interface walks you through every step of the 990 filing process, making it easy to stay compliant

without any bother.

Exclusive PRO Features for Tax Professionals to File Form 990!

Easily manage multiple clients with Tax990. Organize unlimited organizations and their tax filings—all from a single account.

Staff Management

Invite your team members and assign them tasks to assist with preparing and submitting 990 filings for the clients.

Client Management

Easily prepare and manage 990 filings for a large number of clients with multiple EINs and also ensure clients review their returns through a secure portal before submission.

E-Signing Options

Tax990 offers easy e-sign options for Form 8453-TE and Form 8879-TE, making your filing process even smoother.

Flexible Pricing

Our volume-based pricing packages allow you to save more on your filings while ensuring tax compliance for your clients.

Ready to file 990 for your clients?

How to File Form 990 Electronically?

-

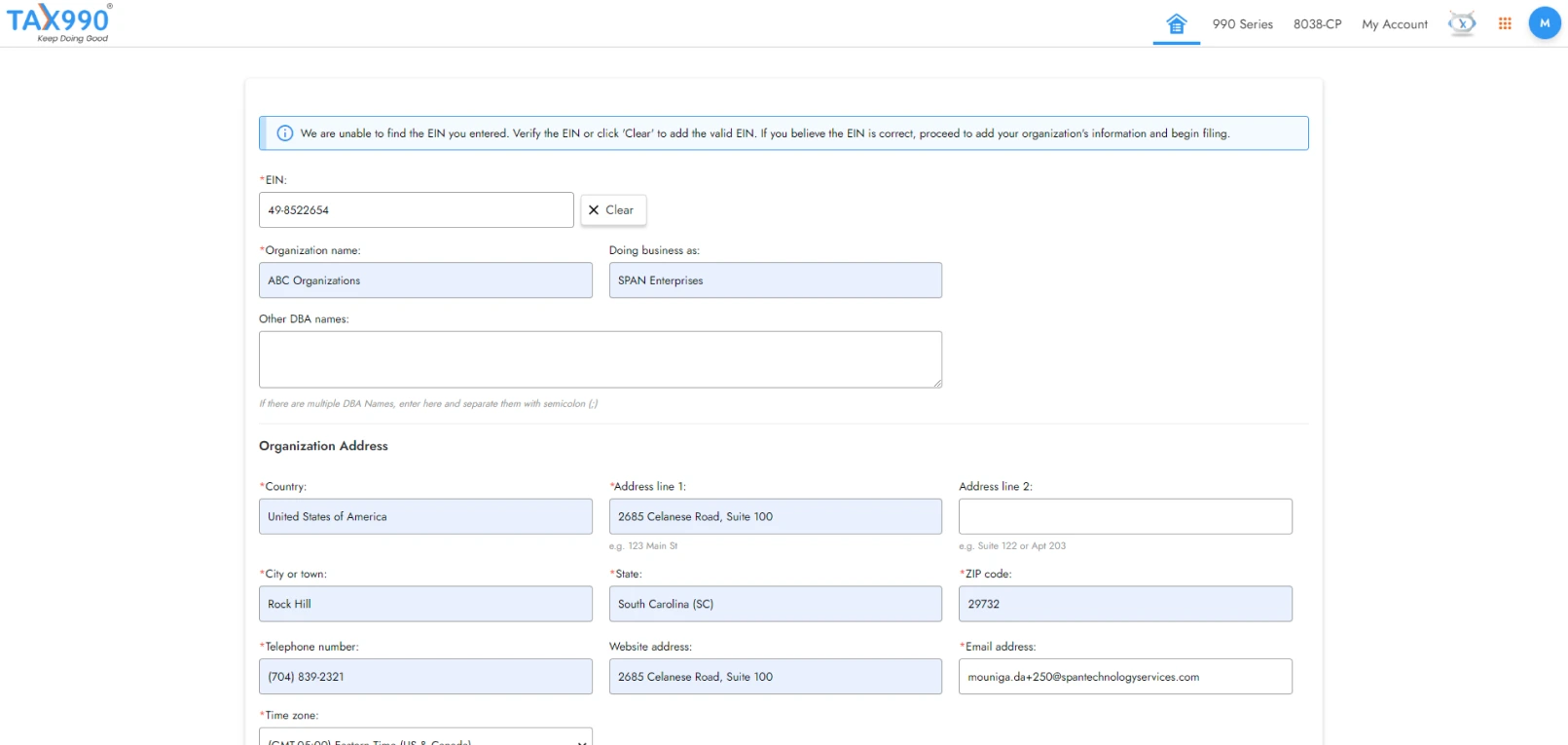

Search for your EIN to automatically import your organization’s data from the IRS or enter manually.

-

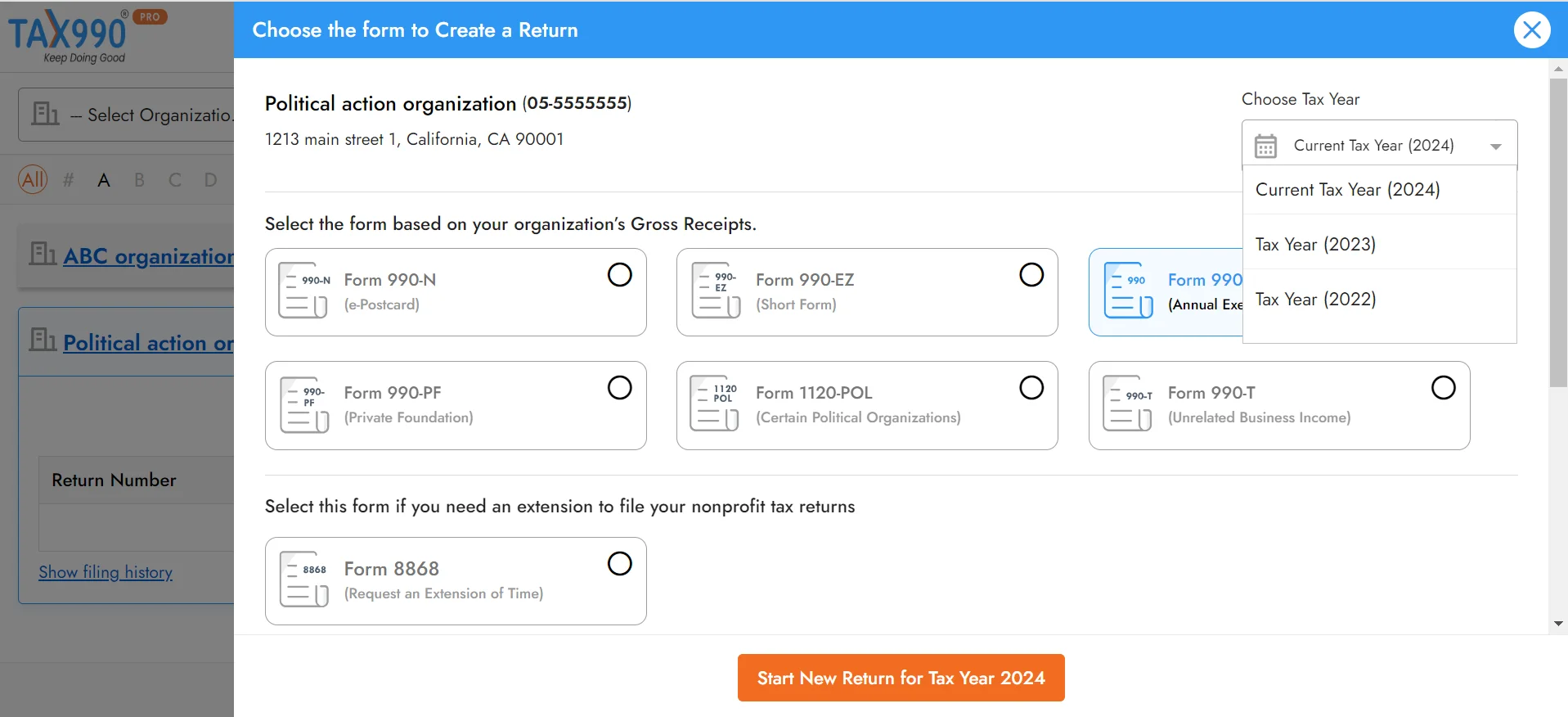

Tax 990 supports filing for the current and previous tax years. Select the tax year for which you are required to file, select Form 990, and proceed.

-

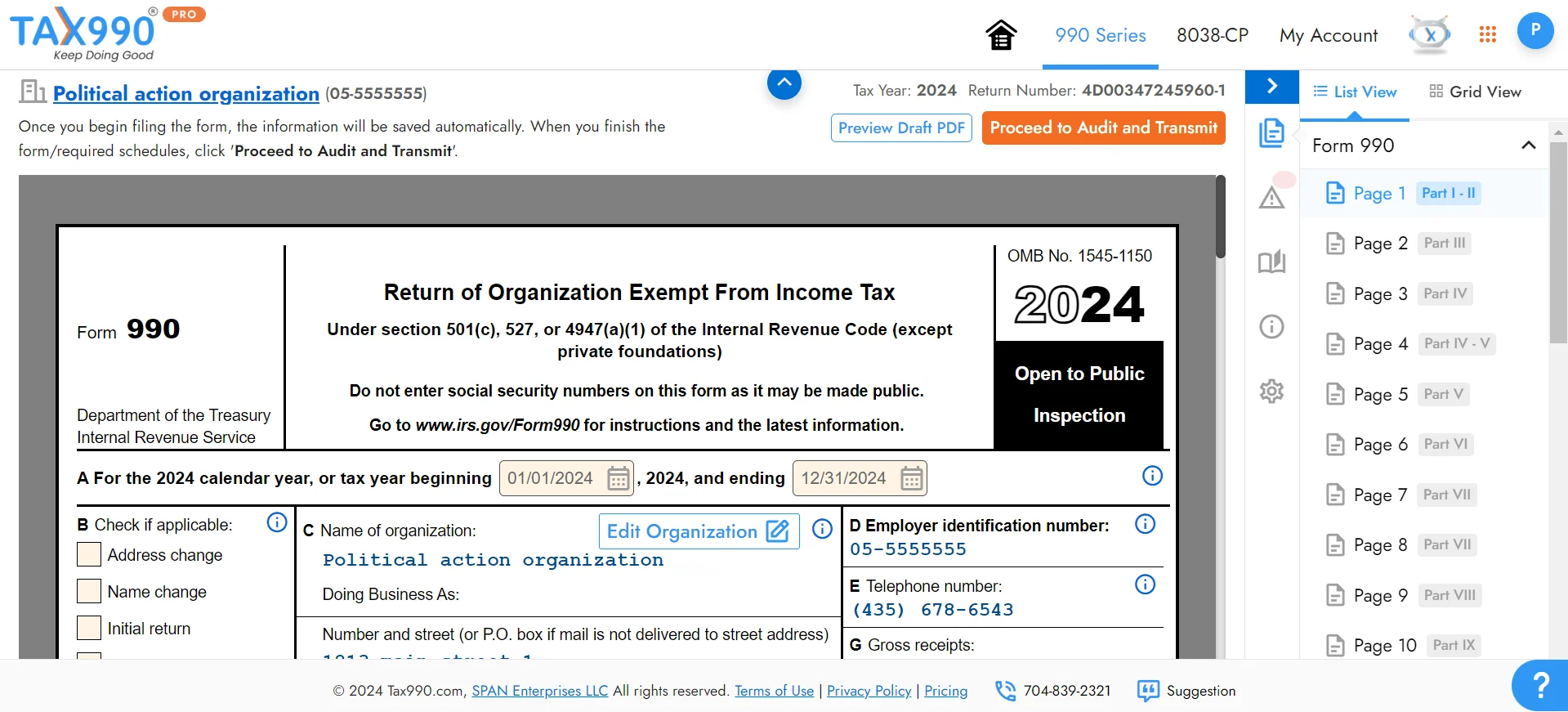

Choose from Form-based or Interview-style, depending on how you would like to provide the form information.

-

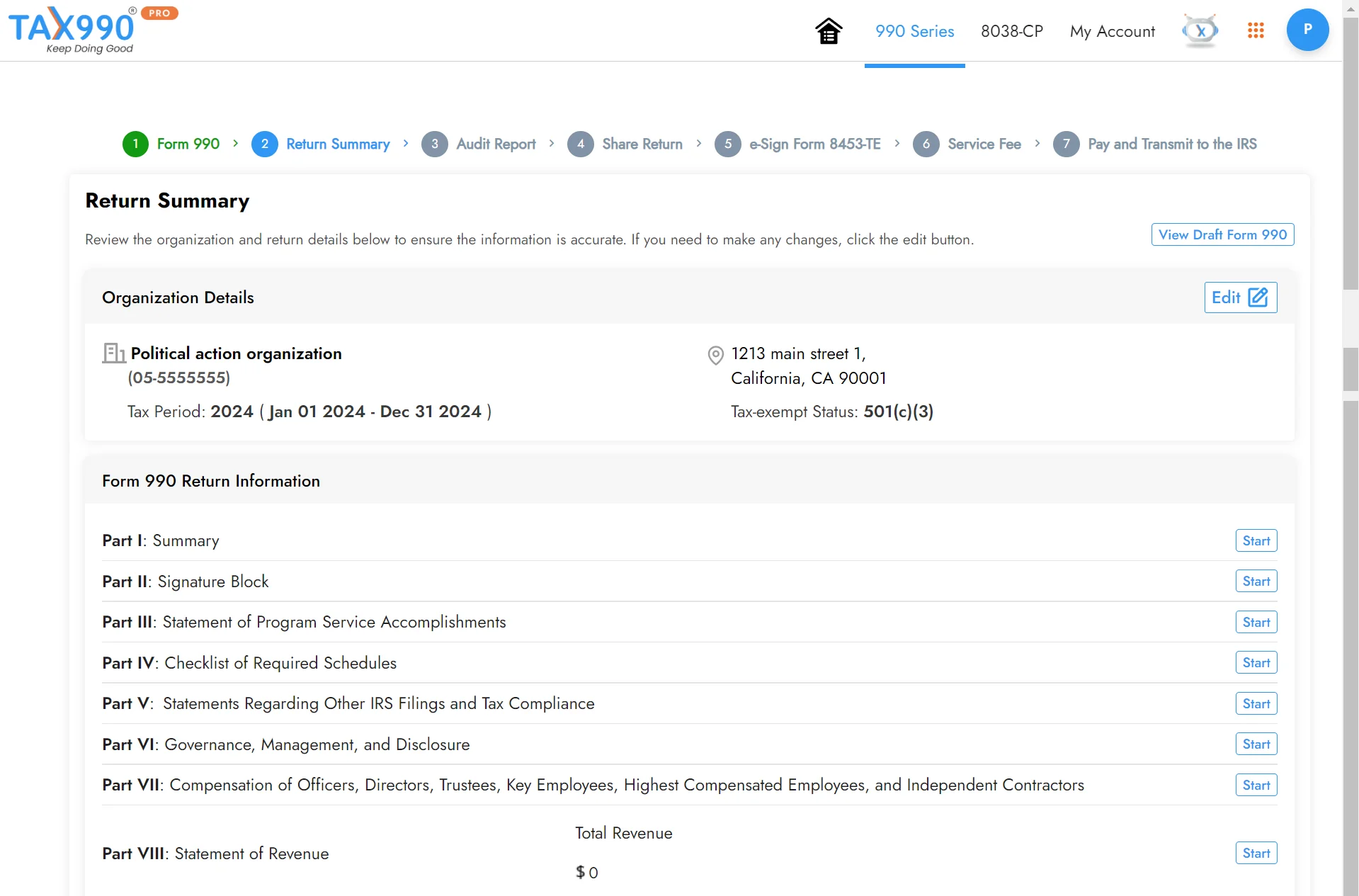

Review your form summary and make any necessary changes. You can also share your form with team members for review and approval.

-

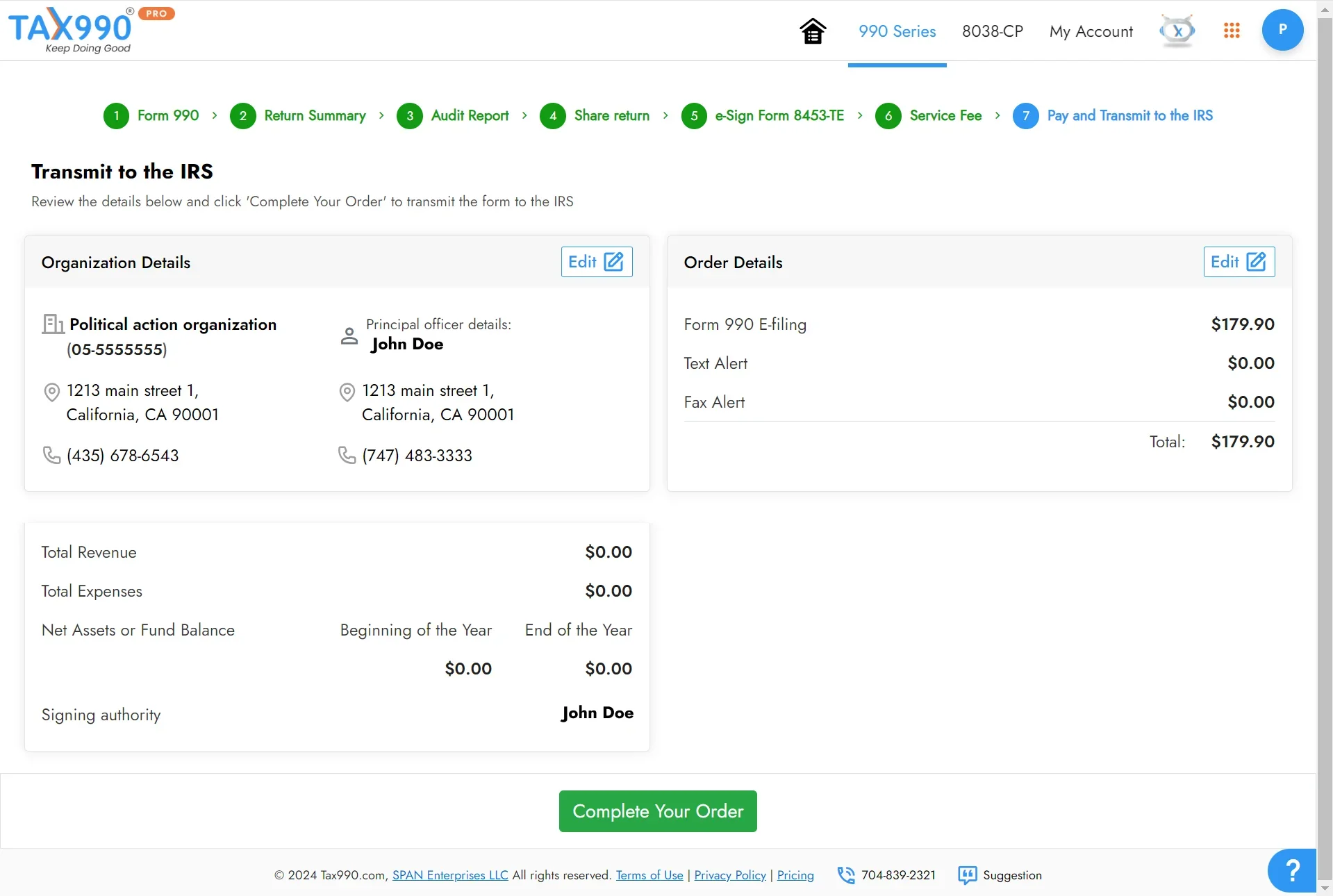

After you review your form, you can pay and transmit it to the IRS. Our system will provide status updates for your form via email or text.

File Form 990 Electronically with Tax990!

Information Required to E-file Form 990 Online

Here is the list of key information you’ll need to file Form 990 online,

- The organization’s basic Information

- Financial information such as revenue, expenses, assets, and liabilities

- Program service accomplishments

- Other IRS filings and tax compliance requirements

- Key personnel, governing body and management details

Learn more about instructions on Form 990

Trusted by Nonprofits Everywhere

Tax990 Revolutionizes the Tax Filing Process for Nonprofits like Yours!

Hear From Our Happy Clients

Fees to File Form 990 Online with Tax990

| Forms | Pricing per Form |

|---|---|

| Form 990-N | $19.90 |

| Form 990-EZ | $99.90 |

| Form 990 | $199.90 |

| Form 990-PF | $169.90 |

| Form 990-T | $149.90 |

Maximize Savings with Combo Pricing! View Pricing

Frequently Asked Questions about Form 990 Filing

What is IRS Form 990?

Form 990 is an annual information return that must be filed by nonprofit organizations, tax-exempt entities, charitable trusts, and section 527 political organizations. It is used to report essential financial data, operational activities, and other information mandated by section 6033 to the IRS.

This form plays a vital role in ensuring organizations remain compliant with IRS regulations and provides transparency to potential donors, offering them insight into the organization's financial health and activities.

Who must file Form 990?

Organizations with gross receipts of $200,000 or more (or) assets of $500,000 or more are required to file Form 990.

When is the deadline to file Form 990?

Form 990 is due by the 15th day of the 5th month after the end of the accounting period. For organizations following the calendar tax year, the deadline to file Form 990 is May 15th.

Operating on a Fiscal Tax Year? Find your 990 deadline using our due date calculator.

How many parts are there in Form 990?

Here’s the breakdown of Form 990:

- Part I - Summary

- Part II - Signature Block

- Part III - Statement of Program Service Accomplishments

- Part IV - Checklist of Required Schedules

- Part V - Statements Regarding Other IRS Filings and Tax Compliance

- Part VI - Governance, Management, and Disclosure

- Part VII - Compensation of Officers, Directors, Trustees, Key Employees, Highest Compensated Employees, and Independent Contractors

- Part VIII - Statement of Revenue

- Part IX - Statement of Functional Expenses

- Part X - Balance Sheet

- Part XI - Reconciliation of Net Assets

- Part XII - Financial Statements and Reporting

Check out our step-by-step instructions on how to complete Form 990.

What are the additional filing requirements for Form 990?

Organizations filing Form 990 may be required to attach certain schedules for reporting additional information, depending on the details they report.

From the 16 Schedules available for Form 990, organizations should attach any and all applicable schedules based on their requirements.

Should Form 990 be filed electronically?

Yes! As per the Taxpayer Act of 2019, the IRS requires organizations to file Form 990 electronically for a tax year ending on or after July 31, 2020.

Get Started with Tax990 and file your Form 990 electronically with the IRS. Supports current (2024) and prior year filings (2023, 2022).

Can I get an extension to file Form 990?

Yes! If your organization requires additional time to file Form 990, you can submit Form 8868 to request an extension. The IRS grants an automatic 6-month extension if Form 8868 is filed on or before the original due date.

For organizations following a calendar tax year, filing for an extension moves the 990 deadline to November 15.

What are the penalties for filing Form 990 late?

If you do not file Form 990 by the deadline, your organization will incur late filing penalties imposed by the IRS. These penalties range from $20 to $120 per day, depending on your organization’s gross receipts, and they accrue for each day the form is late.

For more information about 990 penalties, click here to learn more.

How do I amend a previously filed 990 return, and what information can I amend?

You have the ability to amend any details on your original Form 990, with the exception of the organization’s EIN. However, amendments can only be made after the IRS has accepted your initial filing. .

If your original Form 990 was submitted through Tax 990, all field values from that form will automatically populate the amended form when you select the "Amend this Return" option. To make changes, simply access the relevant section, click ‘edit’, revise the necessary information, and submit the updated form to the IRS.

If you originally filed your Form 990 with a different provider, you can still use Tax990 to file amendments. You will need to enter all required information into the fields manually.

Do I need to file Form 990 if my tax-exempt status was revoked?

Organizations that have not submitted the required Form 990 series returns for three consecutive years and have consequently lost their tax-exempt status must apply for reinstatement. Once your reinstatement application has been processed, you can submit your Form 990 to the IRS, indicating that your reinstatement application is currently pending.

What is the difference between Form 990 and Form 990-PF?

Form 990 must be filed by tax-exempt organizations with gross receipts of $200,000 or more or total assets of $500,000 or more. On the other hand, Form 990-PF is specifically designated for private foundations.