IRS Authorized Provider

SOC 2 Certified

FTB Authorized Provider

10 Years of Excellence

24/7 Customer Support

.webp)

What is Form 990-N (e-postcard)?

Form 990-N, also known as e-postcard, is the shortest of all the IRS 990 Forms and is used by small tax-exempt and nonprofit organizations with gross receipts of $50,000 or less to comply with their annual tax filing requirements.

Ready to start your 990-N tax form filing?

Who can File the 990-N Tax Form?

- Tax-exempt organizations whose gross receipts are generally $50,000 or less can file Form 990-N. However, there are certain exceptions that the organizations must be aware of.

- Also, it’s important to note that nonprofits eligible to file 990-N can voluntarily choose to file Form 990 or 990-EZ.

Start your Form 990-N filing Today!

When is the Due Date to File Form 990-N?

- Form 990-N is due every year by the 15th day of the 5th month after the end of the organization's tax year.

- For organizations following the calendar tax year, the deadline typically falls on May 15th. If this deadline falls on a weekend or federal holiday, 990-N must be filed by the next business day.

File Form 990-N (e-Postcard) Now!

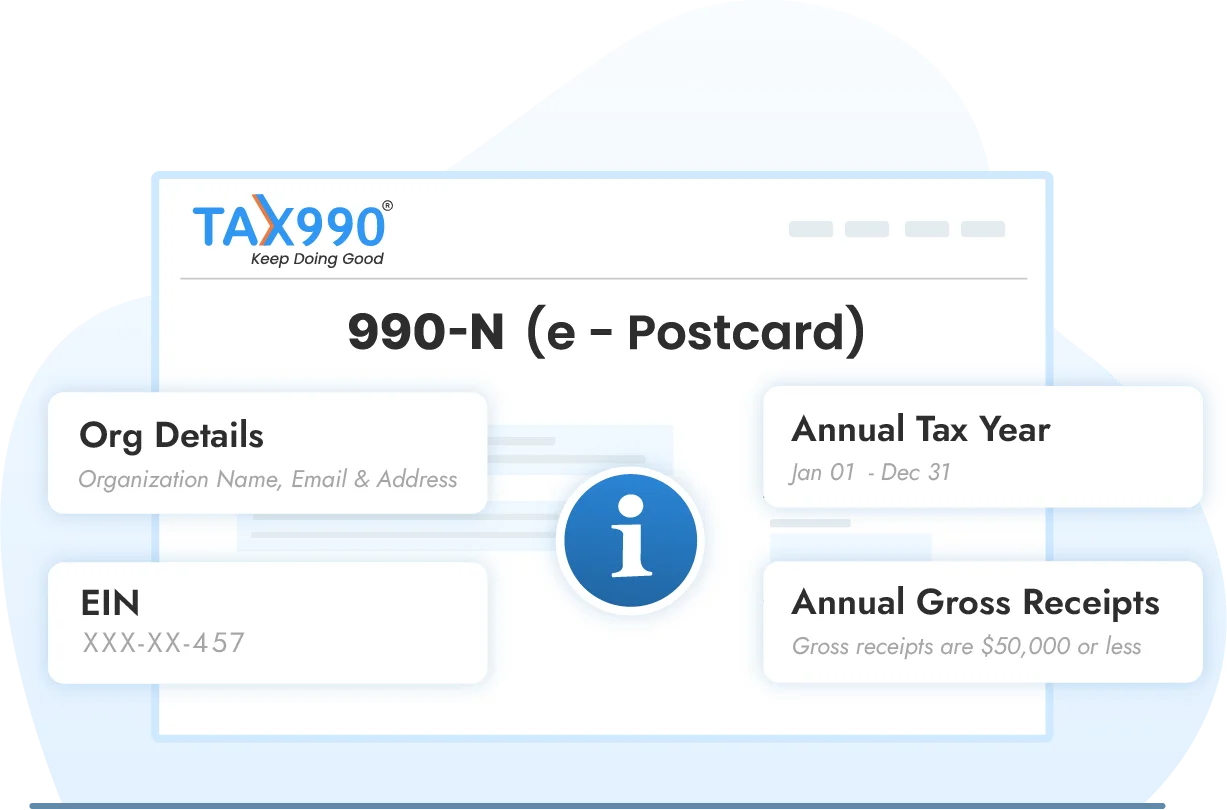

What Information is Required to Complete the 990-N Form?

The organization will need the following information to e-file Form 990-N

(e-Postcard).

- The organization's legal name, other names, and mailing address

- Employer identification number (EIN)

- Organization's annual tax year (calendar or fiscal year)

- Name and address of a principal officer

- Organization's website address (if the organization has one)

- Confirmation that the organization's annual gross receipts are

$50,000 or less.

File 990-N tax form Now!

Trusted by Nonprofits Everywhere

Tax990 Revolutionizes the Tax Filing Process for Nonprofits like Yours!

Hear From Our Happy Clients

How to File Form 990-N Postcard?

Tax990 supports the e-filing of 990-N for both the current and prior tax years. All it takes is 3 simple steps to transmit your e-postcard to the IRS.

Search Organization’s EIN

Search for your organization’s EIN and our system will automatically import your organization’s basic information from the IRS database.

Choose Tax Year

Tax 990 supports filing Form 990-N for the current and 2 prior tax years. Choose the tax year for which you need to file Form 990-N

and proceed.

Review & Transmit to the IRS

Review the details and transmit your e-Postcard to the IRS. Our system will notify you of your filing status via email or text.

Pricing to File e-Postcard Form 990-N

- 3-Step Filing

- File from any device

- Instant IRS status updates

- Supports prior years' filing

- Retransmit rejected returns for free

Frequently Asked Questions About Form 990-N Postcard

Can I file Form 990 or Form 990-EZ instead of the e-postcard?

Yes, the organizations that are eligible to file 990-N can voluntarily opt for filing 990 or 990-EZ and fulfill their reporting requirements. Typically, this is recommended if you prefer to strengthen your organization’s transparency and reputation among the public.

Which organizations are not eligible to file Form 990-N?

The following organizations are not eligible to file Form 990-N, even if their gross receipts are $50,000 or less.

- Organizations categorized as Private foundations

- Section 509(a)(3) supporting organizations

- Religious organizations (churches, mosques, and synagogues)

- Other organizations such as,

- Section 527 (political) organizations

- Section 501(c)(1) – U.S. government instrumentalities

- Section 501(c)(20) – Group legal services plans

- Section 501(c)(23) – Pre-1880 Armed Forces organizations

- Section 501(c)(24) –ERISA sec. 4049 trusts

- Section 501(d) – Religious and apostolic organizations

- Section 529 – Qualified tuition programs

- Section 4947(a)(2) – Split-interest trusts

- Section 4947(a)(1) – Charitable trusts treated as private foundations

What is the difference between Form 990 EZ and Form 990-N?

Form 990-EZ is used by organizations with gross receipts less than $200,000 and total assets less than $500,000. Generally, it requires more information than

Form 990-N.

Form 990-N, the e-Postcard, is a simplified electronic form for small organizations with gross receipts normally $50,000 or less.

Should churches file Form 990-N?

No, the churches are not required to file Form 990-N as the religious organizations are exempt from filing returns. However, the churches can voluntarily file an e-postcard or other 990 forms to enhance public integrity. For more information, click here.

What should I do if my 990-N is rejected?

If Form 990-N is rejected, you can review the rejection notice from the IRS to identify the reason for rejection. Then you can then correct the errors and retransmit the form. With Tax990, you can retransmit any rejected returns at no extra cost.

Can a supporting organization file a 990-N?

Generally, most of the section 509(a)(3) supporting organizations cannot file Form 990-N. They usually need to file either Form 990 or 990-EZ.

Is Form 8879-TE required for 990-N?

No, Form 8879-TE is not required for Form 990-N.

Can I request an extension to file 990-N (e-Postcard)?

No, unlike other 990 forms, the 990-N deadline cannot be extended. You can still file your 990-N return if you have missed the deadline, as the IRS does not incur any penalties for 990-N filers.

Can I amend Form 990-N?

No, you cannot amend the From 990-N return. Instead, you can file a corrected return for the next year.

What happens if I fail to file the 990-N (e-postcard) for three consecutive years?

If you fail to file your 990-N (e-postcard) for three consecutive years, the IRS will automatically revoke your organization’s tax-exempt status.