The Tax990 Commitment

Accepted, Every Time–Nonprofit Tax Filing Made Simple

At Tax990, we’ll do whatever it takes to get your form approved.

Retransmit Rejected Returns

If your return is rejected due to any errors, you can update and retransmit the form easily, at no extra cost.

No Cost Amendments

If you discover mistakes after submission, you can file amendments without extra charges.

Money-Back Guarantee

If you’re unable to get your form accepted, or it turns out to be a duplicate, we’ll refund your money—no questions asked.

A Solution Designed for Easier CA Form 199 E-Filing

Filing Form CA Form 199 is straightforward with our smart tools. We guide you through each section so you can file accurately, with less effort.

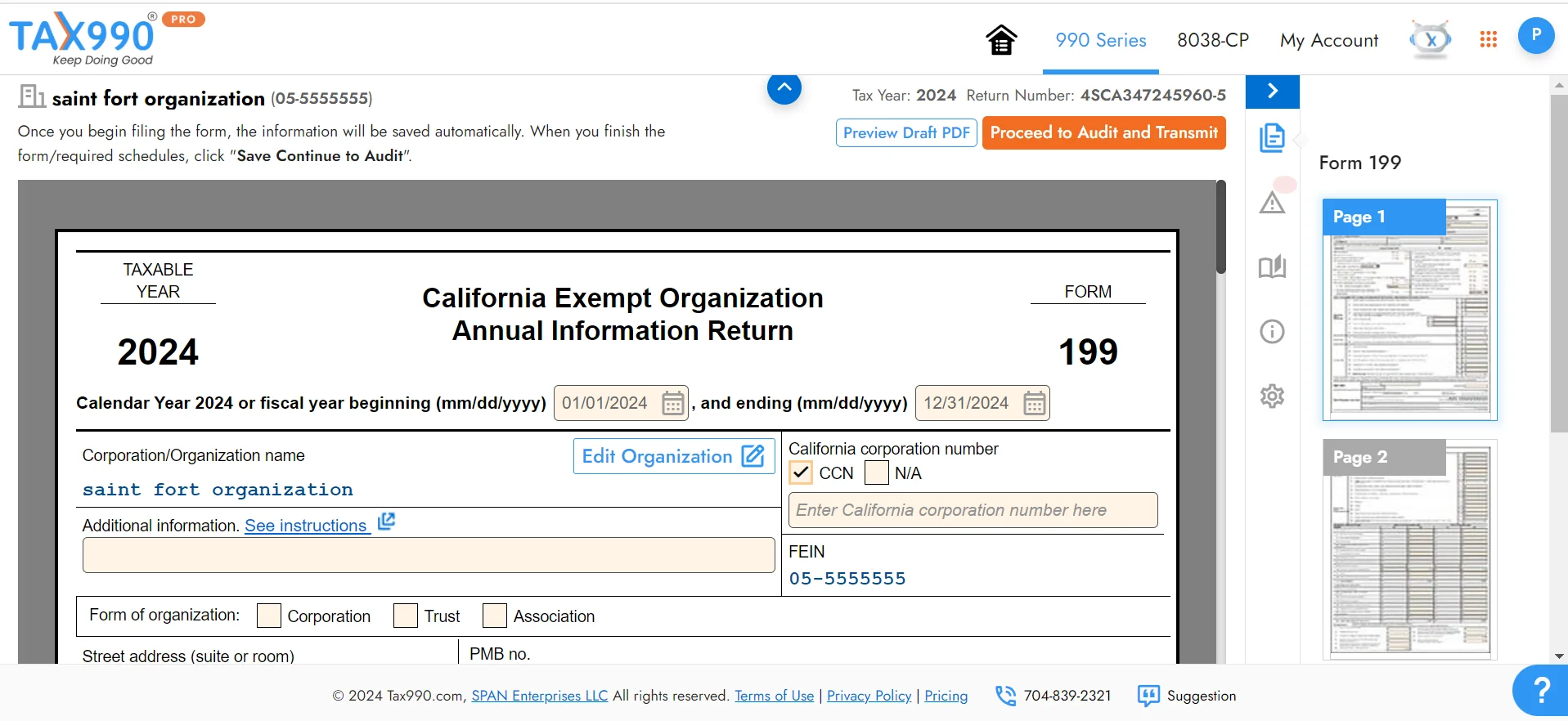

Includes Schedules M-1 and L

Tax 990 automatically includes CA 199 Schedule M-1 and L, based on the data you provide.

Copy or Upload Federal 990 Data

Copy data from your approved federal 990 return to Form 199 or upload your completed 990 form.

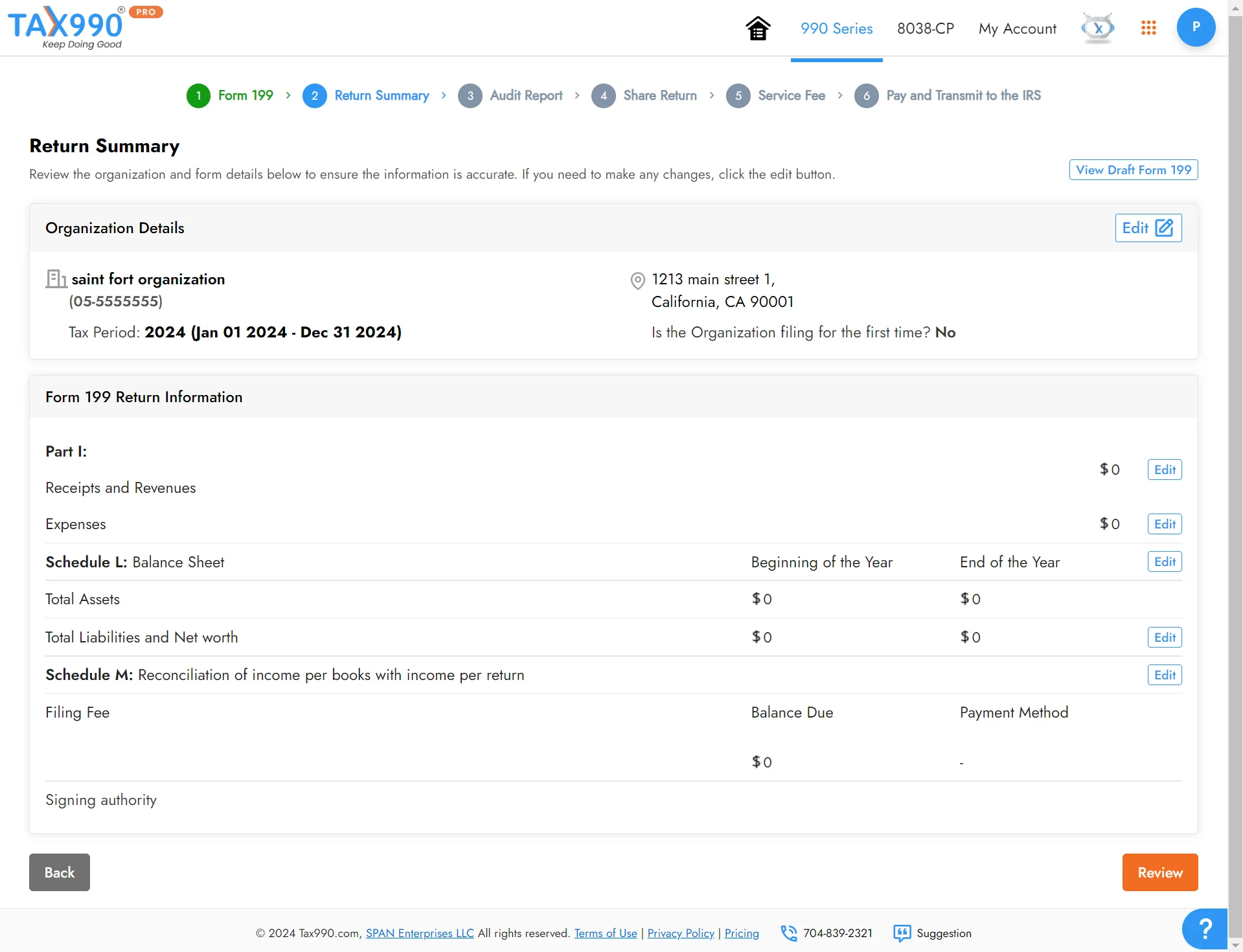

Reviewers and Approvers

The completed form can be shared with your organization members for review and approval.

Internal Audit Check

Our system checks your return for common errors and ensures its accuracy before submission.

Smart AI Assistance

Our AI chatbot is available 24/7 to guide you through questions or next steps in filling out

your form.

World-Class Customer Support

Need expert help? Connect with our dedicated support team via chat, phone, or email anytime.

Our intuitive features make online filing of Form CA Form 199 easier than ever.

What You’ll Need to File Form CA Form 199 Online

Here is all the information you’ll need to file CA Form 199 Online:

- The organization’s basic information

- The exempt status of the organization

- Details about the organization’s activities

- Financial information such as revenues and expenses

- Filing fee details

How to File CA Form 199 Electronically with Tax990?

Create your free account and follow these simple steps to e-file your Form CA Form 199 effortlessly!

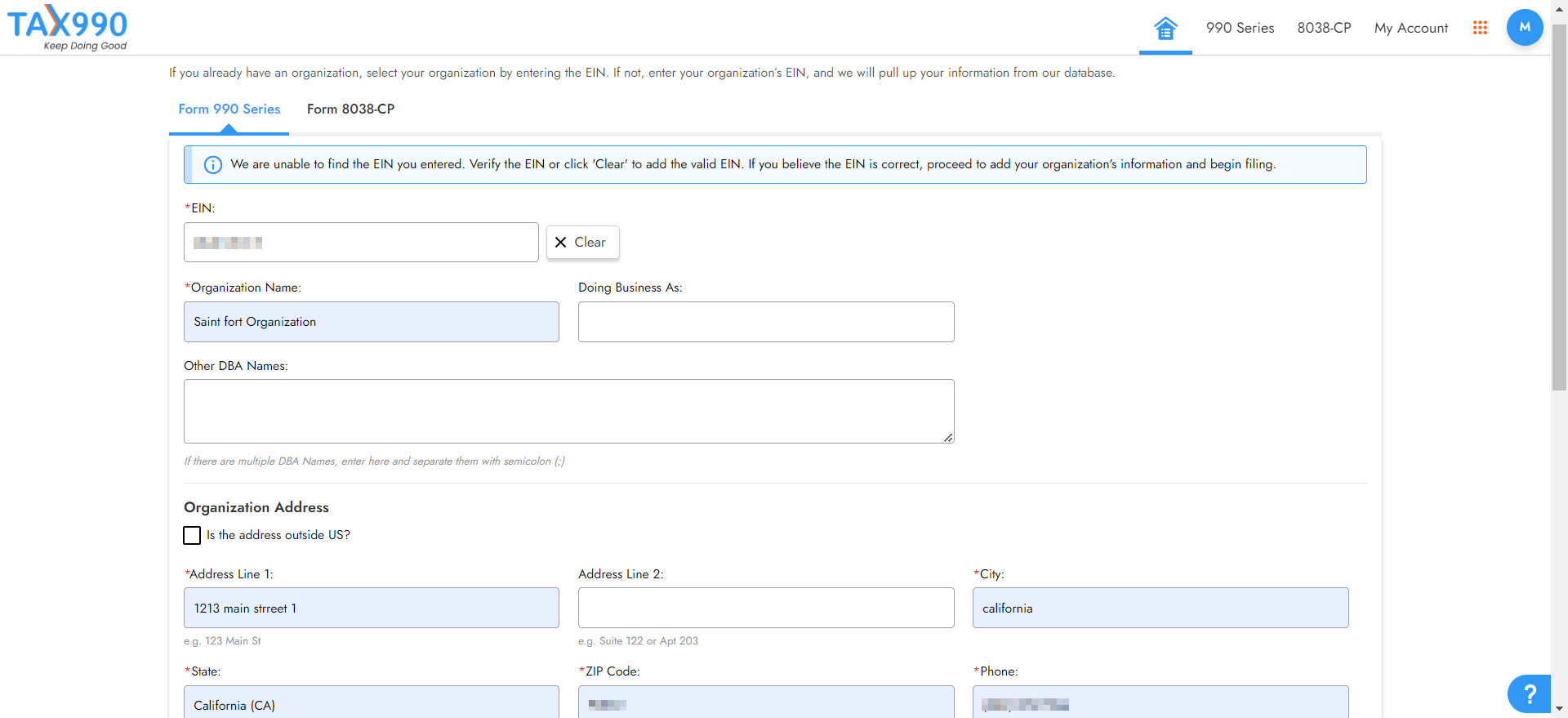

Add Organization Details

Search for your EIN, and our system will import your organization’s details from the IRS. You can also provide those details manually.

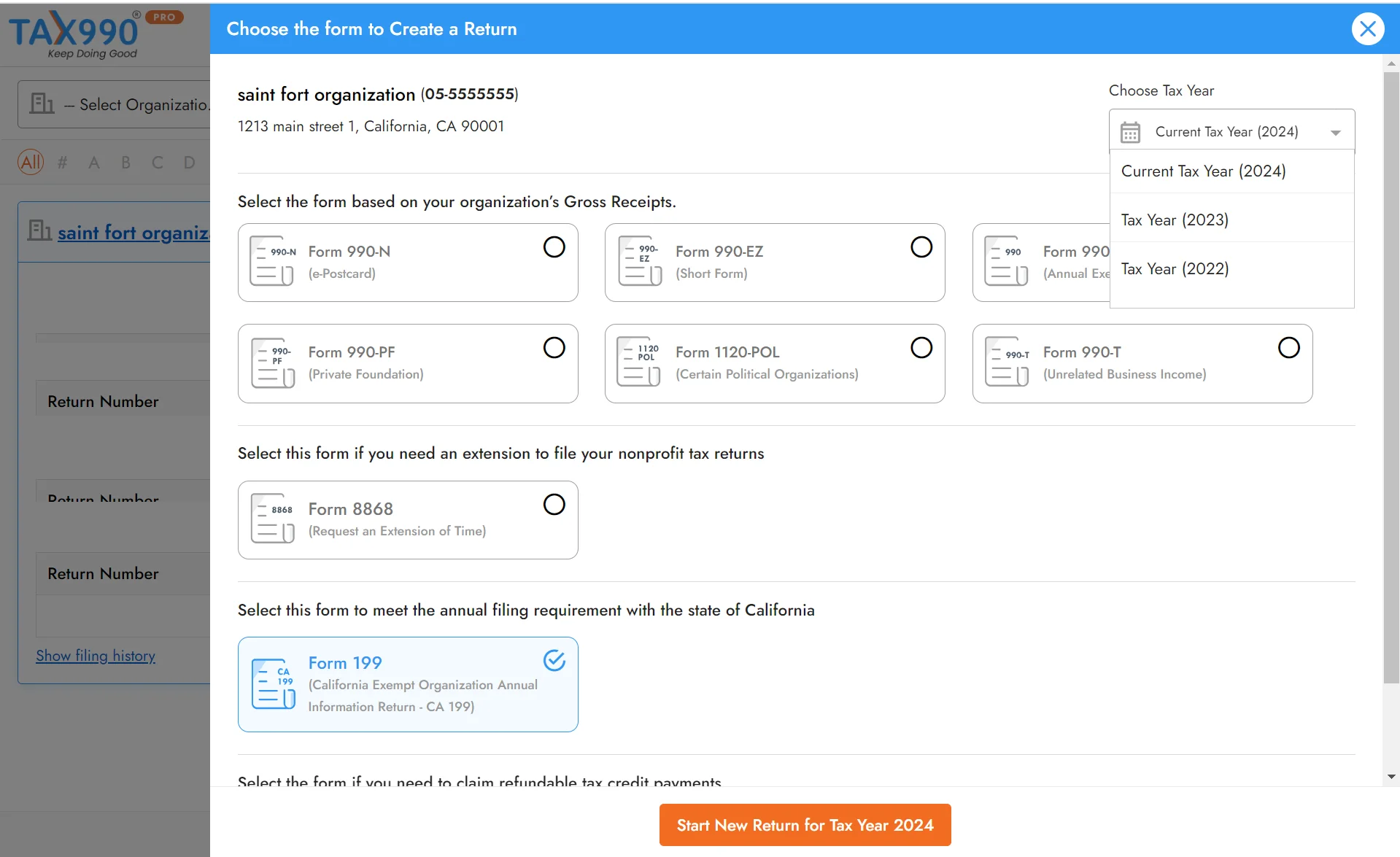

Choose Tax Year and Form

Tax 990 supports current and previous tax years’ filing. Choose the tax year for which you are required to file, select CA Form 199, and proceed.

Enter Form CA Form 199 Data

You can either copy data from your federal 990 return to your CA 199 or enter the data manually with our Form-based filing option.

Review your Form Summary

After providing the required data, review the form summary and share it with your organization members for review and approval.

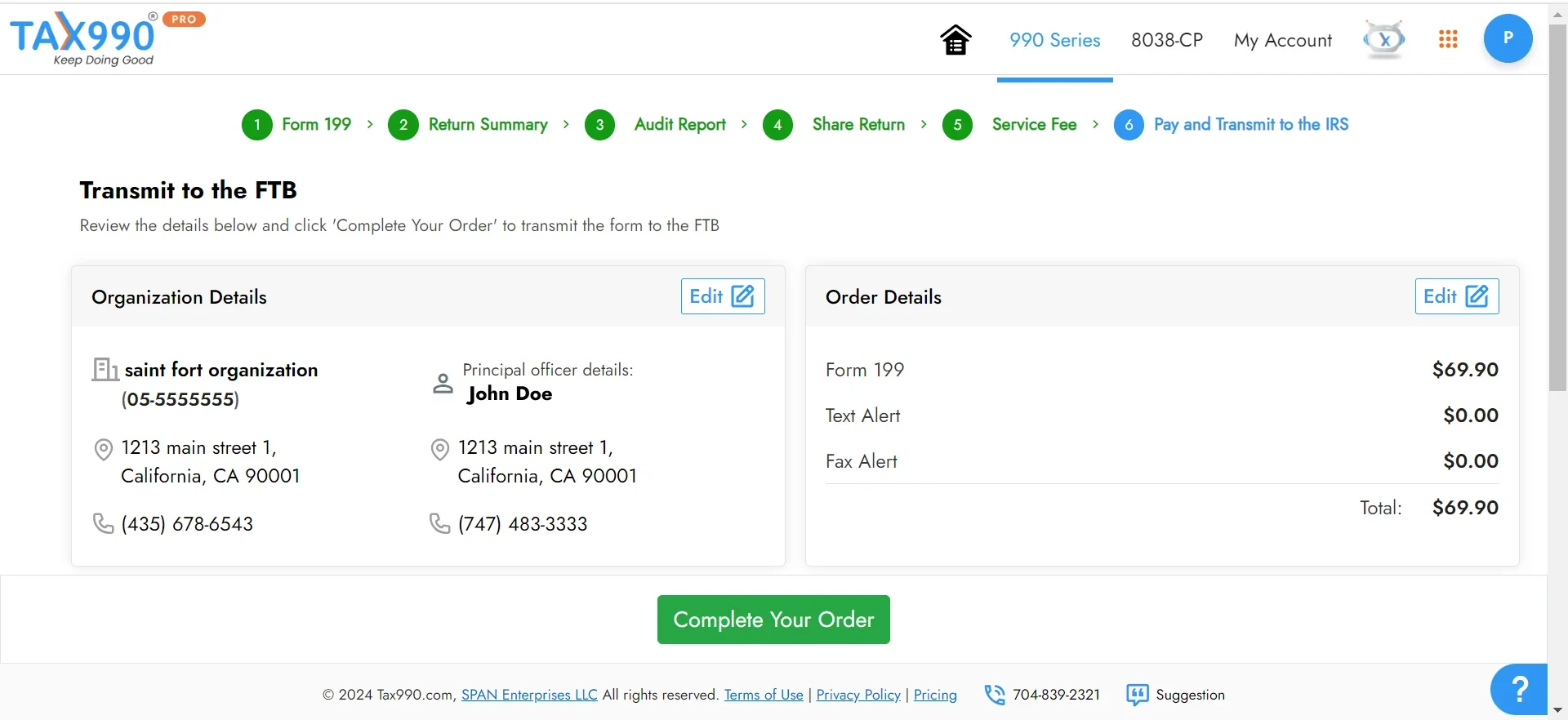

Transmit your Return to the FTB

Transmit your return and get Once you have reviewed the form, you can transmit it to the FTB. Our system keeps you updated about the status of your form via email and text.

Ready to file CA Form 199 online?

Fees to File Form CA Form 199 Online with Tax990

$79.90/ Form

- Retransmit Rejected Returns

- No Cost Corrections

- Guaranteed approval or money-back

File easily and get back to what matters most!

Frequently Asked Questions

What is CA Form 199?

Form 199 is an annual information return filed by tax-exempt organizations and certain other nonprofits to report their financial information and activities to the Franchise Tax Board (FTB) as part of their tax filing requirements.

Who must file CA Form 199?

CA Form 199 is filed by:

- Organizations with normal gross receipts of more than $50,000

- Private foundations (regardless of gross receipts)

- Nonexempt charitable trusts described in IRC Section 4947(a)(1) (regardless of gross receipts)

Note: Usually, organizations with gross receipts less than or equal to $50,000 may file FTB 199N. However, they can also choose to file CA Form 199 voluntarily.

When is the due date to file Form 199?

CA Form 199 must be filed on or before the 15th day of the 5th month after the organization’s accounting period ends. If the organization follows a calendar tax year, the deadline for filing CA Form 199 is May 15.

Can I paper-file CA Form 199?

Yes, you can complete and mail your California Form 199 to one of the following addresses.

-

If Payment is Included with the form,

Franchise Tax Board

Franchise Tax Board

PO Box 942857

Sacramento, CA 94257-0501 -

If Payment is not Included with the form,

Franchise Tax Board

Franchise Tax Board

PO Box 942857

Sacramento, CA 94257-0500

Is there an extension available for Form 199?

Yes! Organizations that are in good standing and not under suspension can get an additional six months to file Form 199 with the state of California without filing a written request for an extension.

What are the penalties for filing Form 199 late?

The organizations that fail to file their California Form 199 on or before the deadline will be subjected to penalties from the FTB. The penalty amount is $5/month or part of the month if the return is late. The maximum penalty is $40.

Can Form 199 be amended?

Yes! Tax 990 supports the amendment of CA Form 199. You can make changes to the previously filed returns and transmit the amended return to the FTB.

What are all the supporting forms for CA Form 199 that Tax990 Supports?

Tax 990 Includes supporting forms 3885 & 3885F.

What is a no-cost amendment?

At Tax990, we know that mistakes can occasionally happen when filing your 990. That’s why, as part of the Tax990 Commitment to accuracy, transparency, and peace of mind, we offer No-Cost Amendments.

If you filed your original Form 990 with us and later discover an error after the IRS has accepted it, you can file a corrected return without paying any additional fees—up to 3 times.