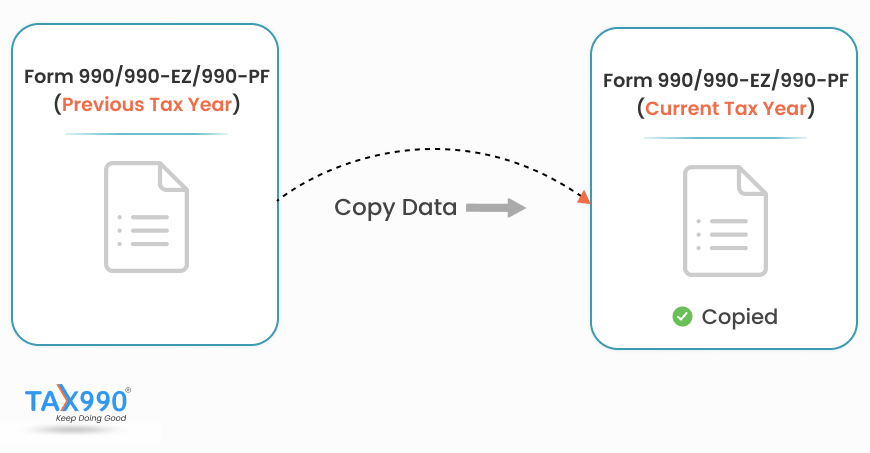

Make 990 Filing Easier with the Copy Data Feature

Filing your 990 returns can be tedious, with extensive data entry and manual work. Tax990 makes it easier by allowing you to copy data from prior-year returns, reducing effort and saving time.

- Copy last year’s Form 990, 990-EZ & 990-PF data—even if filed elsewhere.

- In addition, if you are required to file California Form 199, you can seamlessly transfer federal Form 990 data to CA Form 199 in just a few clicks.

Skip the manual entry—use the Copy Data feature and file faster!

Get Started Now

Information You can Copy from Prior Year 990 Returns

Some data is automatically copied by our system, and you can select and transfer the rest as required.

Copying Data From Federal 990 Form to CA 199

Tax990 provides you with the option to copy certain data from your accepted federal 990 form (filed with us) onto your California Form 199.

The information you can

copy includes:

- Basic Organization Details

- Item A - First return

- Item C - IRC Section 4947(a)(1) trust

- Item E - Accounting Method

- Part I

- Receipts and Revenues (Lines 2,3,5,6)

- Part II

- Receipts from Other Sources (Lines 1 - 7)

- Expenses and Disbursements (Line 9 - 17)

- Schedule L (Balance Sheet)

- Assets and Liabilities (Column B and D)

Frequently Asked Questions

Yes. You can copy from a prior year's return filed using a different filing method, and the combinations for Form 990, Form 990-EZ, and Form 990-PF are listed below.

- Interview to Form-based filing method

- Form to Form-based filing method

- Interview to Interview-based filing method

Please note that all other forms cannot be copied using a different filing method.

Yes! Currently, the option of copying information from a prior year’s return filed with a different service provider is available for

Form 990, 990-EZ & 990-PF.