IRS Form 990-N for Nonprofits - Key Takeaways

What is Form 990-N?

Form 990-N is an annual return filed by small tax-exempt organizations to meet their tax filing requirements.

Who must file Form 990-N?

Tax-exempt organizations whose gross receipts are $50,000 or less for the tax year should file Form 990-N.

When is Form 990-N Due?

The due date for filing Form 990-N is the 15th day of the 5th month after the organization’s accounting period ends.

Tax990 Enables Seamless 990-N E-Filing with Exclusive Features

3-Step Filing

You can complete and e-file your e-postcard in just 3 simple steps with Tax 990.

File From Any Device

E-file Form 990-N from any device including desktop, mobile, or tablet.

View Filing History

Tax 990 provides you with the option to view and access the filing history of your organization.

Get Real-Time Updates

Receive instant email and text notifications regarding the IRS status of your Form 990-N.

Re-transmit Rejected Returns

If the IRS rejects your Form 990-N for any reason, you can retransmit it for free.

Expert Assistance

Our team of experts is available to answer your questions via live chat, phone, and email.

Ready to start your 990-N E-filing?

Exclusive PRO Features for Tax Professionals to File 990 N!

Staff Management

Invite your team members to handle the preparation and submission of the 990 filings for our clients. You have the option to assign this task to them.

Client Management

Prepare and manage 990 filings for a large number of clients (many EINs), and ensure that clients check the returns through a secure portal before they are sent out.

E-Signing Options

We accept Form 8453-TE for Paid Preparers and Form 8879-TE for Electronic Return Originators (ERO).

Ready to file 990-N for your clients?

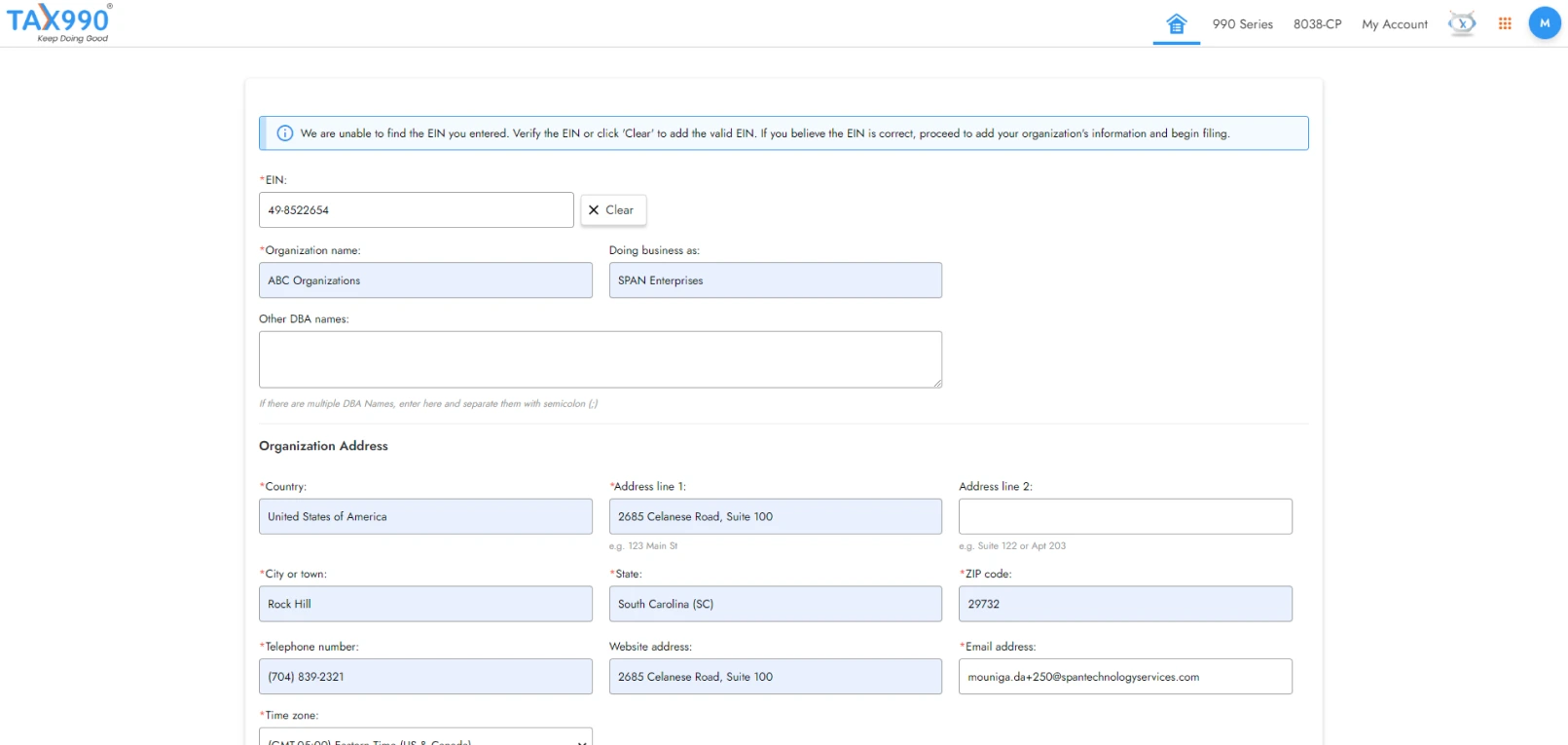

How to file Form 990-N Electronically?

-

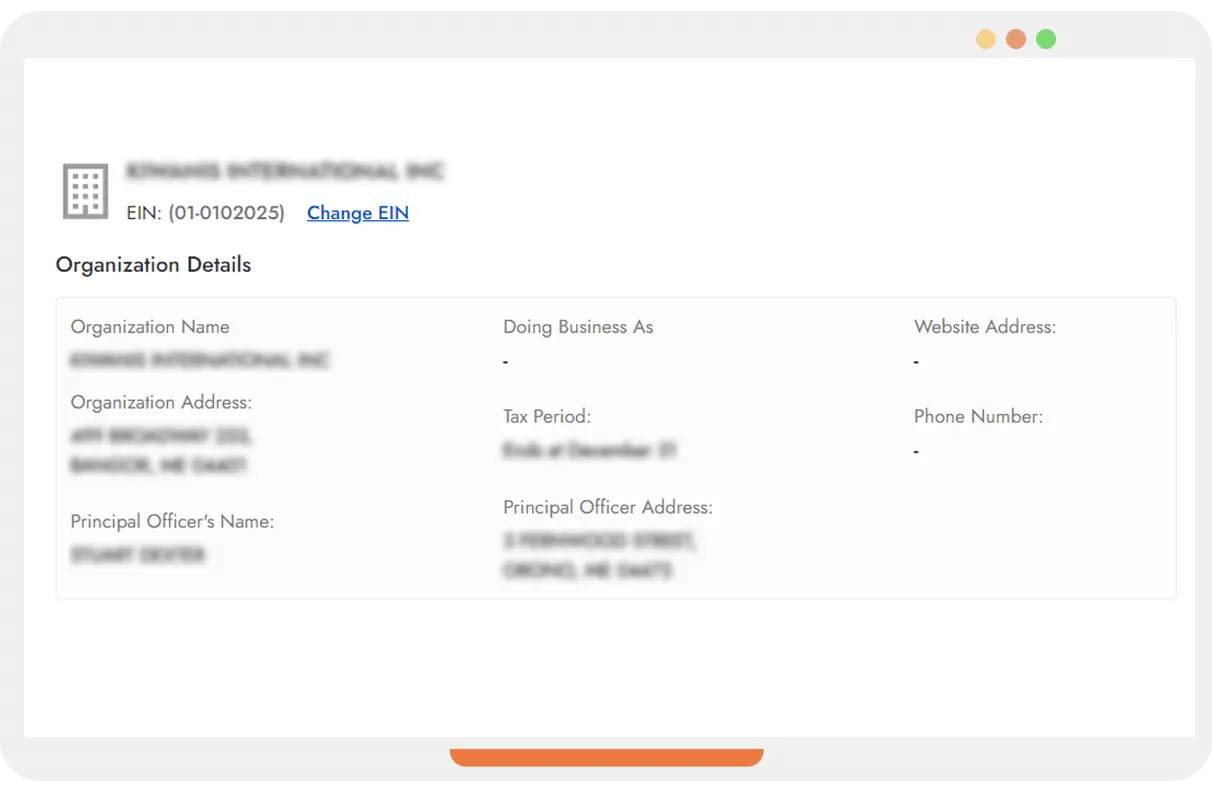

Just search for your EIN, and our system will automatically import your organization’s data from the IRS.

-

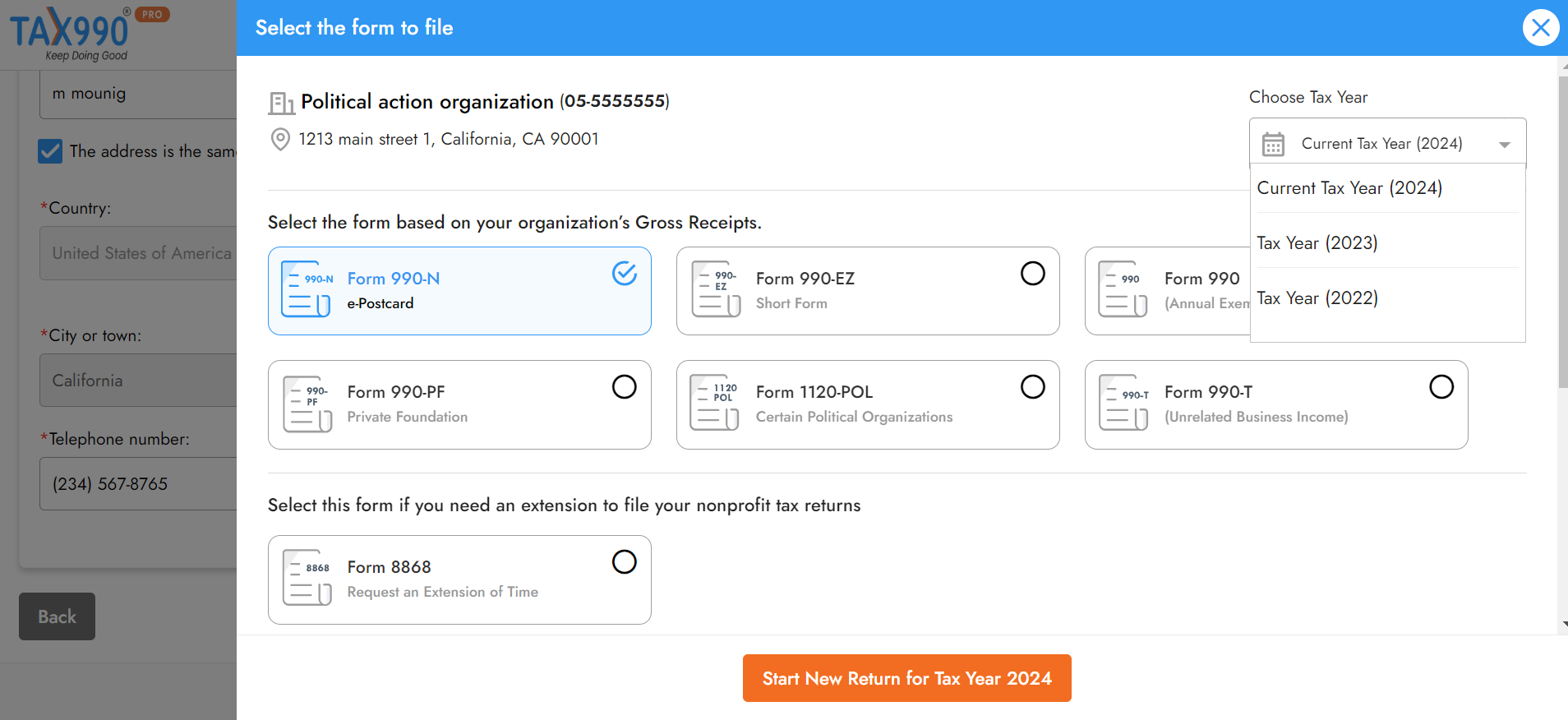

Tax 990 supports 990-N filing for the current and previous tax years. Choose the applicable tax year, select Form 990-N, and proceed.

-

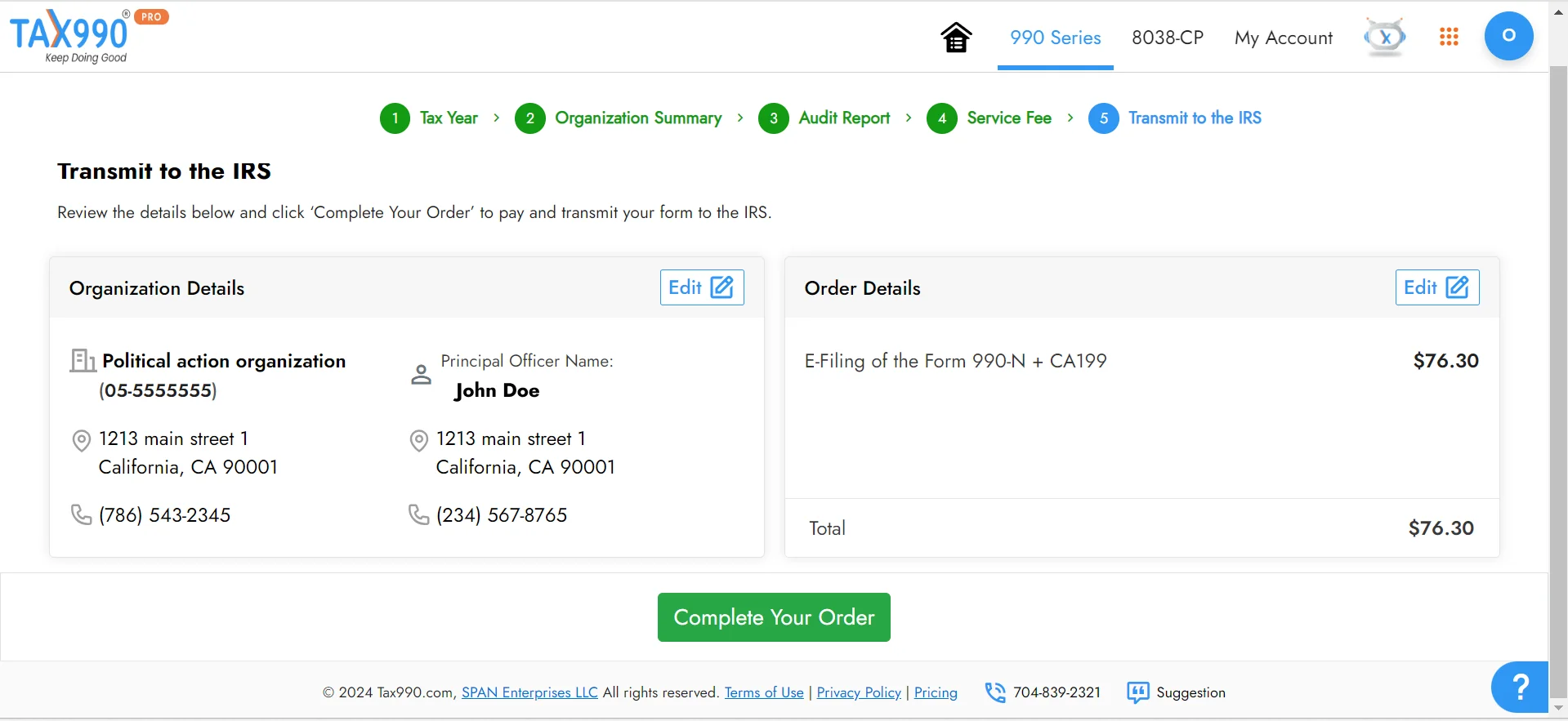

Once you have reviewed your form, you can transmit it to the IRS. Our system will update you on your form status via email or text.

File Form 990-N Electronically with Tax990 Securely!

Information Required to E-file Form 990-N Online

Here is the list of major information that you’ll need to file Form 990-N online,

- Organization’s EIN

- Organization’s accounting period

- Legal name and mailing address

- Other names of the organization

- Principal officer details

- Organization’s website address (if applicable)

- Confirmation that the organization's annual gross receipts are

$50,000 or less - Statement of termination (if applicable)

Trusted by Nonprofits Everywhere

Tax990 Revolutionizes the Tax Filing Process for Nonprofits like Yours!

Hear From Our Happy Clients

See what our clients love about Tax 990

Join Thousands of Nonprofits that Trust Tax 990

Fees to File Form 990-N Online

- 3-Step Filing

- File from any device

- Instant IRS status updates

- Supports prior years' filing

- Retransmit rejected returns for free

Ready to file your Form 990-N?

Frequently Asked Questions about Tax Form 990N

What is IRS Form 990-N?

Form 990-N (Electronic Notice) is an annual return filed by small tax-exempt organizations with gross receipts less than or equal to $50,000. Form 990-N is also known as an e-postcard.

Who must file Form 990-N?

Generally, Form 990-N is filed by tax-exempt organizations with gross receipts of $50,000 or less.

Note: Organizations that are eligible to file Form 990-N can also file Form 990 or 990-EZ voluntarily.

When is the deadline to file Form 990-N?

The due date to file Form 990-N is the 15th day of the 5th month after the organization’s accounting period ends.

Therefore, if your organization follows a calendar tax year, the deadline to file Form 990-N is May 15.

Does your organization follow a fiscal tax year? Find your 990-N due date.

Are there any additional filing requirements for Form 990-N?

No! Unlike the other 990 forms, such as Form 990, 990-EZ, or 990-PF, the organizations that file Form 990-N aren’t required to include

any Schedules.

Can I get an extension for Form 990-N?

No, the Form 990-N deadline cannot be extended (unlike other 990 forms).

Is there any penalty for filing Form 990-N late?

There is no penalty for filing Form 990-N late. However, if the organization fails to file 990-N for three consecutive years, the IRS will revoke the tax-exempt status of the organization.

Can Form 990-N be amended?

No! You cannot file an amended return for Form 990-N. However, Tax 990 provides you with the option to retransmit the 990-N returns rejected due to IRS

errors for Free.

What is the difference between Form 990-N, Form 990, and Form 990-EZ?

Form 990-N:

Form 990-N is an e-postcard that can be filed by small tax-exempt organizations with gross receipts of $50,000 or less. Unlike Form 990, this form doesn’t require detailed information.

Form 990:

Form 990 is filed by certain nonprofits that have gross receipts of $200,000 or more (or) total assets of $500,000 or more to report their activities, financial information, and certain other details to the IRS.

Form 990-EZ:

Tax-exempt organizations that have gross receipts of less than $200,000 and total assets are less than $500,000 should file form 990-EZ to report their financial activities, Program service accomplishments, revenue, expenses, assets, liabilities, and certain other details to the IRS.

What is the difference between Form 990-N and Form 990-PF?

Form 990-PF is filed by Private Foundations to report their foundation's activities and financial information to the IRS, whereas 990-N Tax Form is filed by small tax-exempt organizations that have gross receipts of less than or equal to $ 50,000 for the corresponding tax year to sustain the tax-exempt status.

Can I file Form 990-EZ/990 instead of Form 990-N?

Yes! The small exempt organization that is eligible to file Form 990-N may choose to file Form 990-EZ or even Form 990 voluntarily to satisfy its annual

reporting requirements.

What does the term Principal Officer mean in Form 990-N?

- The term "principal officer" refers to an individual within the organization who holds a key leadership position.

- This person is usually responsible for the organization's activities, implementing power, decision-making power, and overall management.