IRS Authorized Provider

SOC 2 Certified

FTB Authorized Provider

10 Years of Excellence

24/7 Customer Support

IRS Authorized Provider

SOC 2 Certified

FTB

10 Years of Excellence

24/7 Customer Support

Steps to File Form 990 with Tax990

-

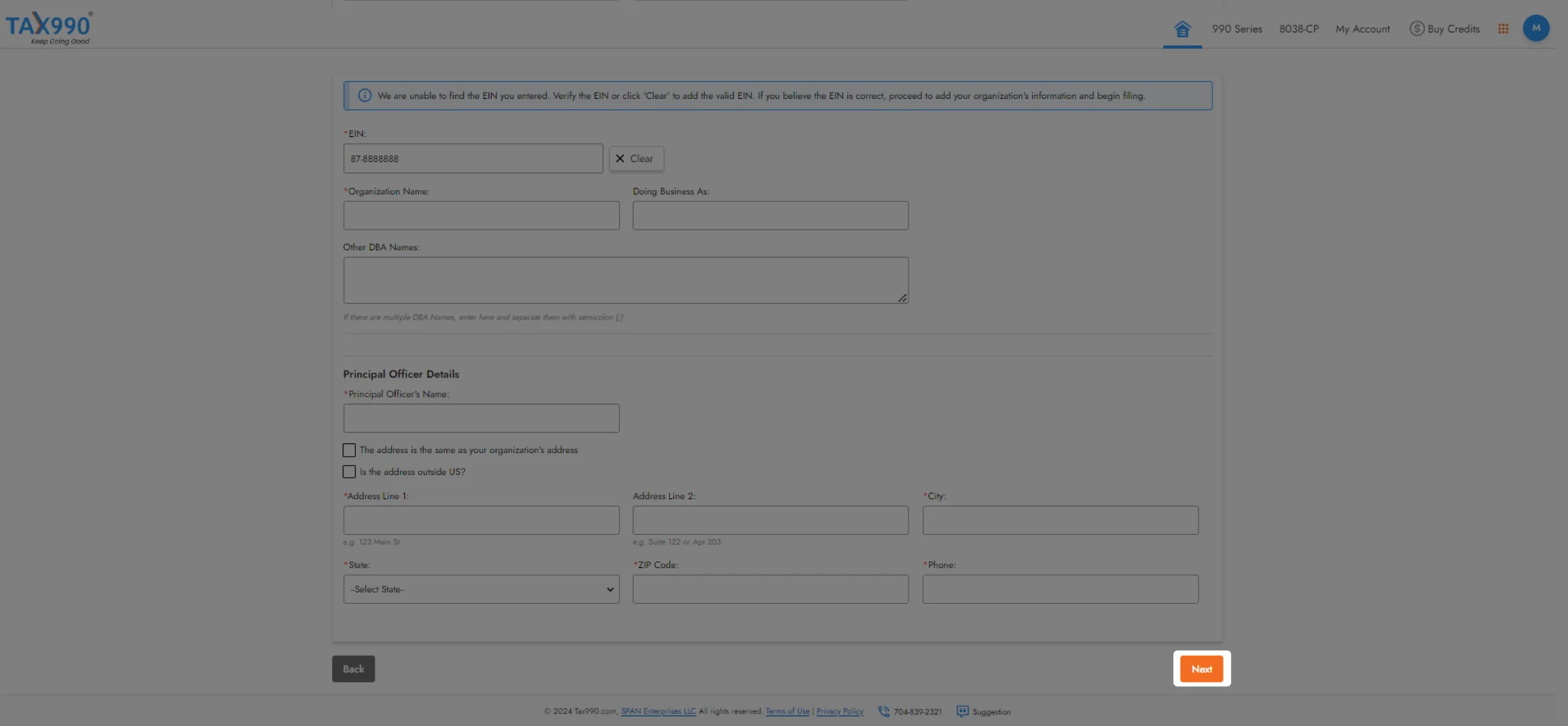

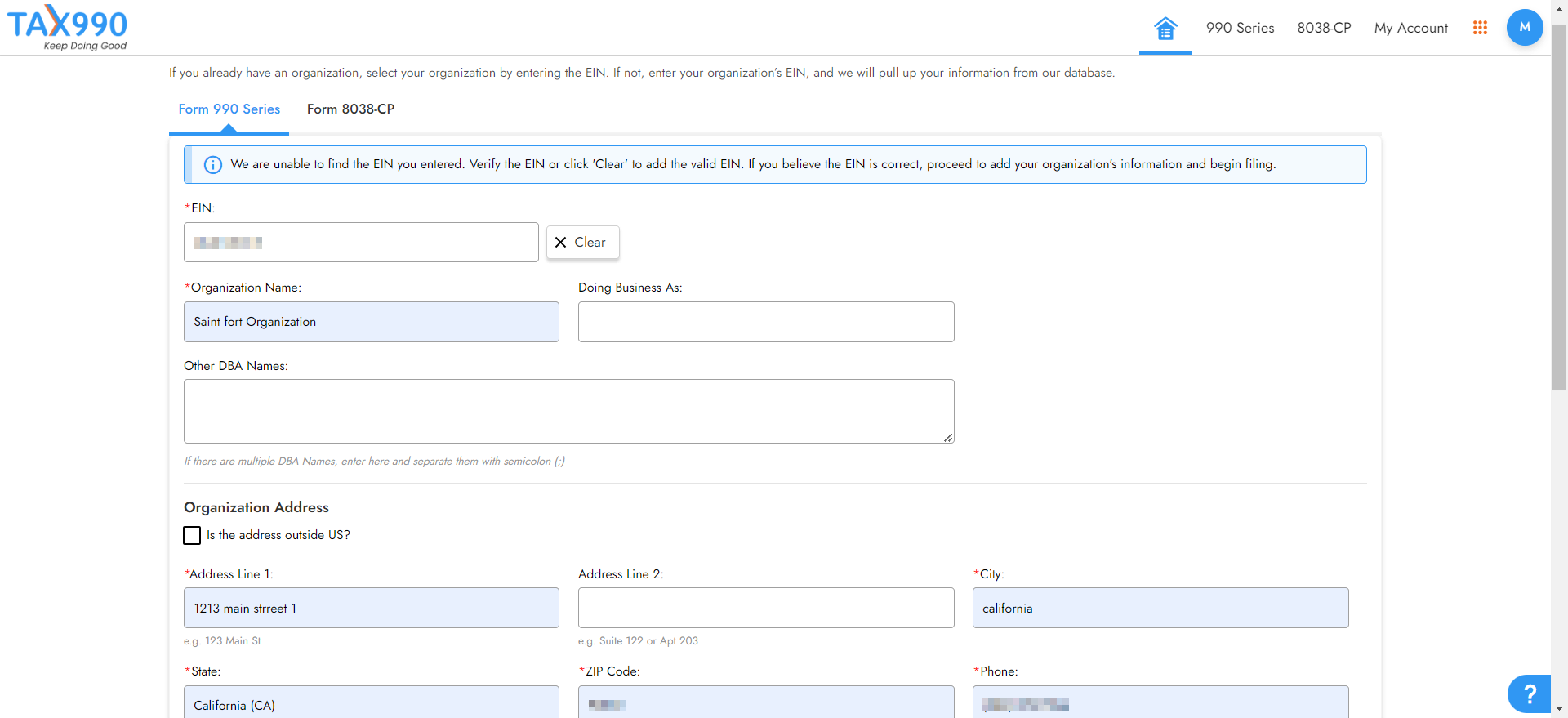

Search for your EIN to import your organization’s data automatically from the IRS. You can also enter your organization’s details manually.

-

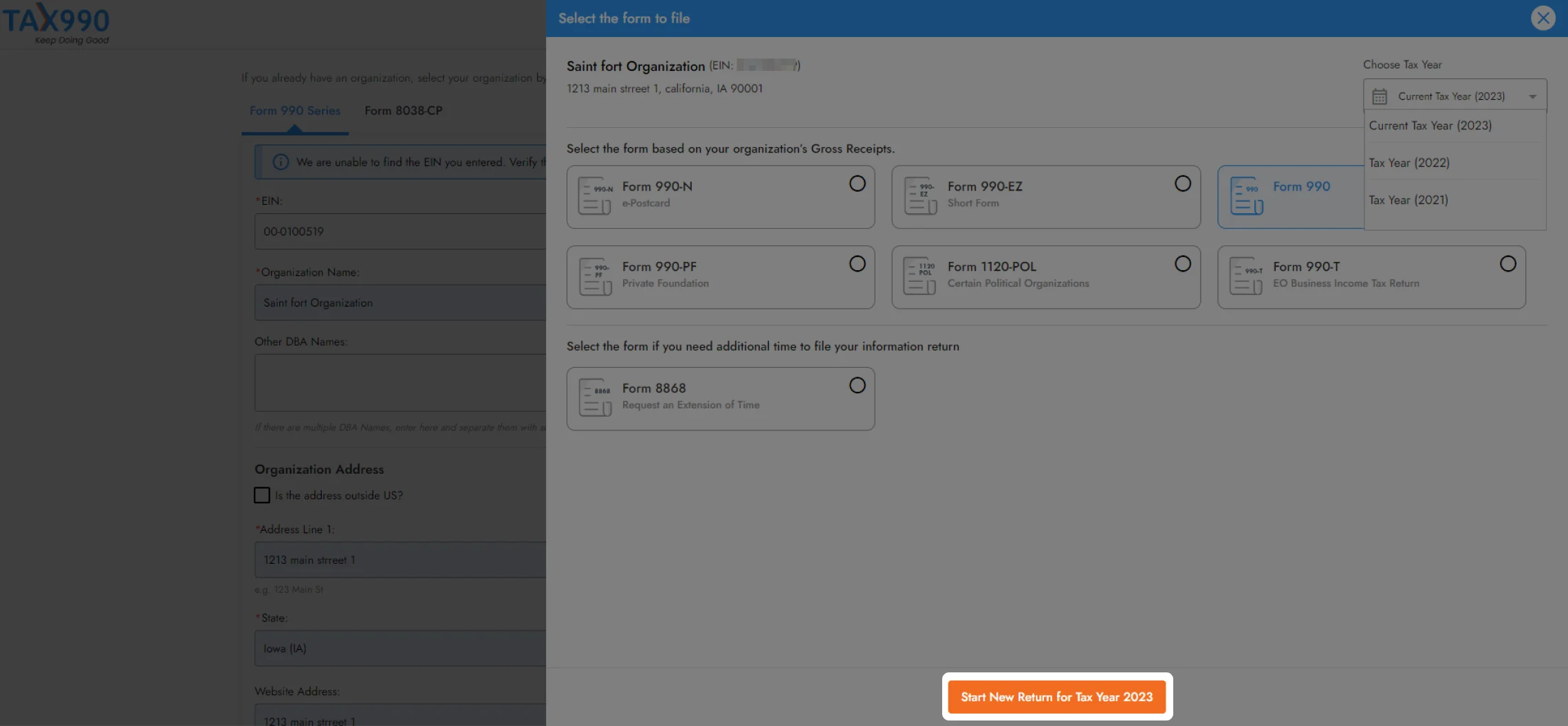

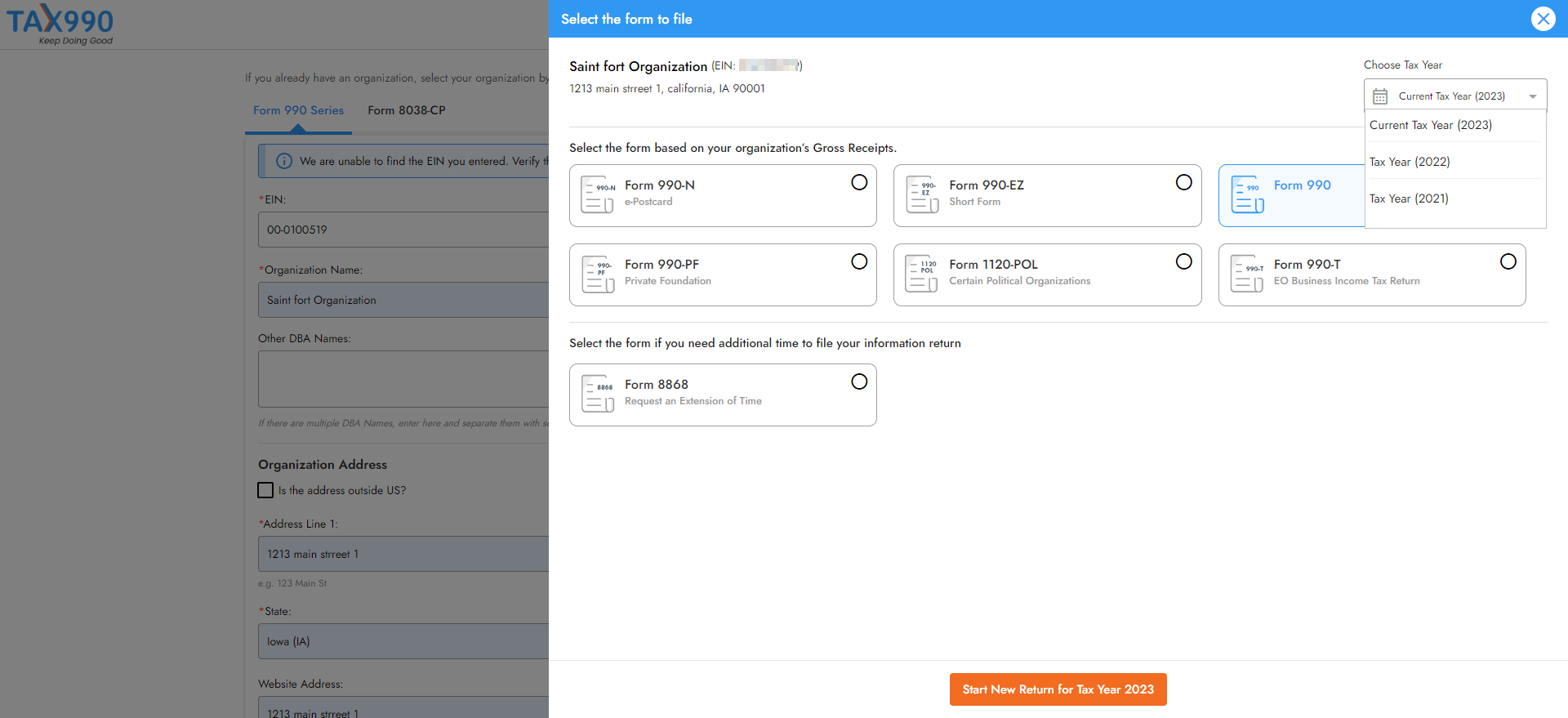

Tax 990 supports filing for the current and previous tax years. Select the tax year for which you are required to file, select Form 990-PF, and proceed.

-

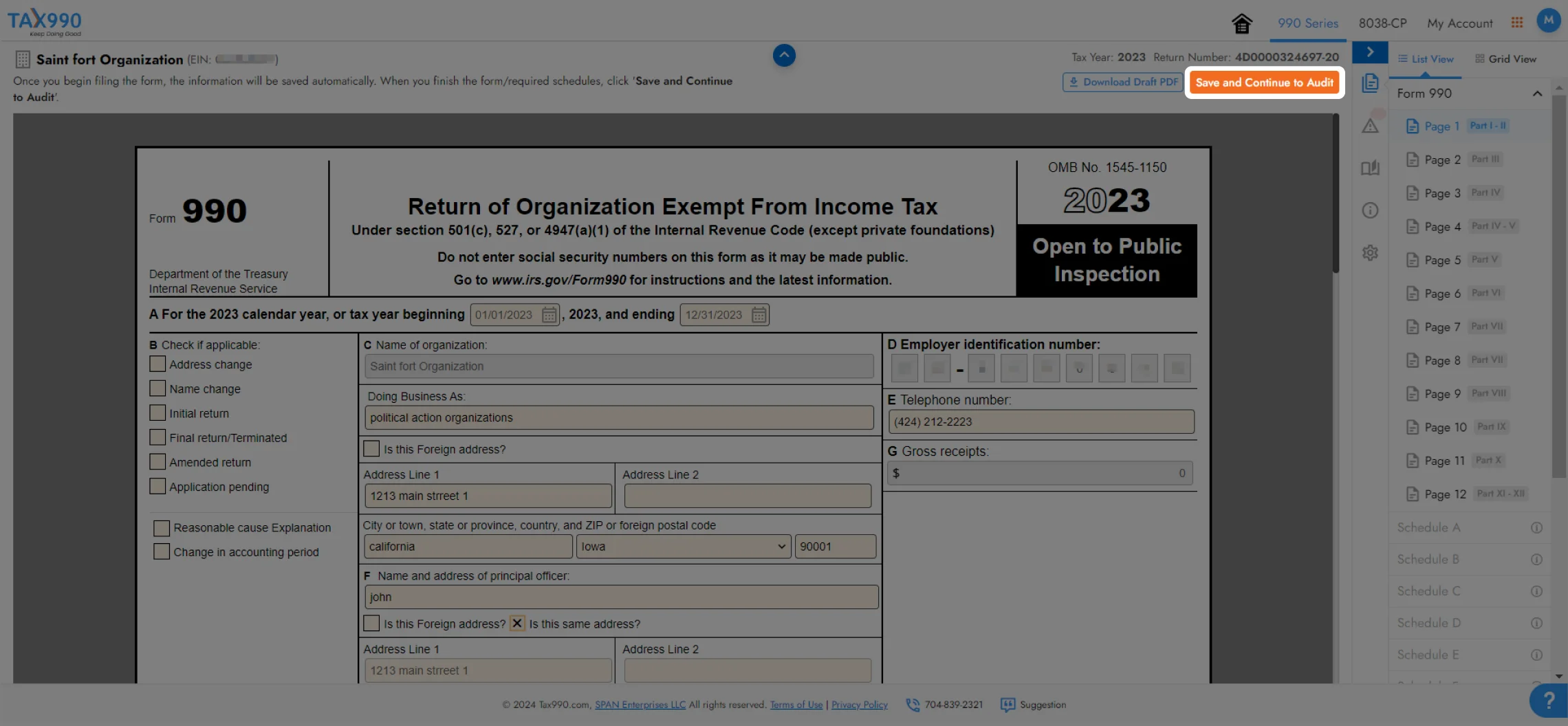

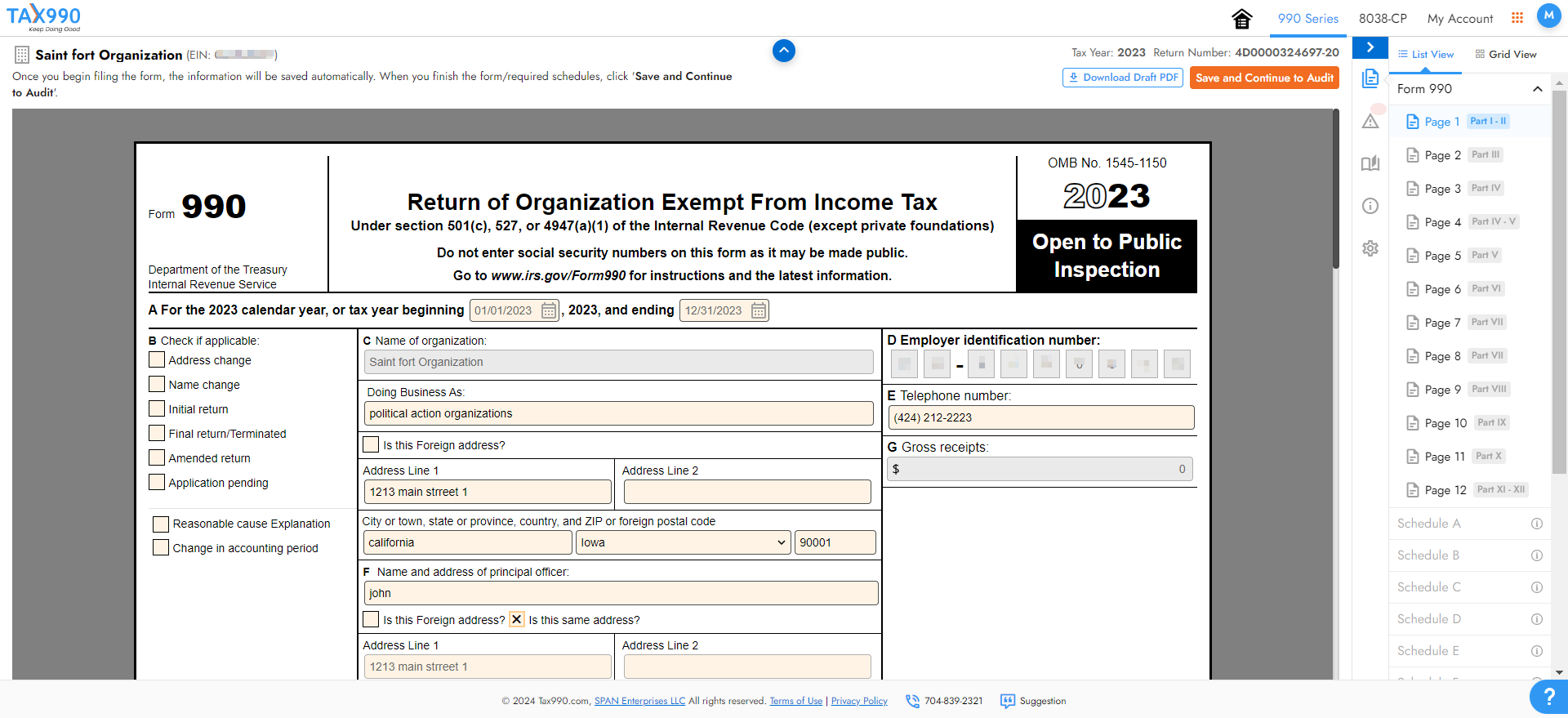

We offer Form-based and Interview-Style filing options. Choose one at your convenience and provide the required form information.

-

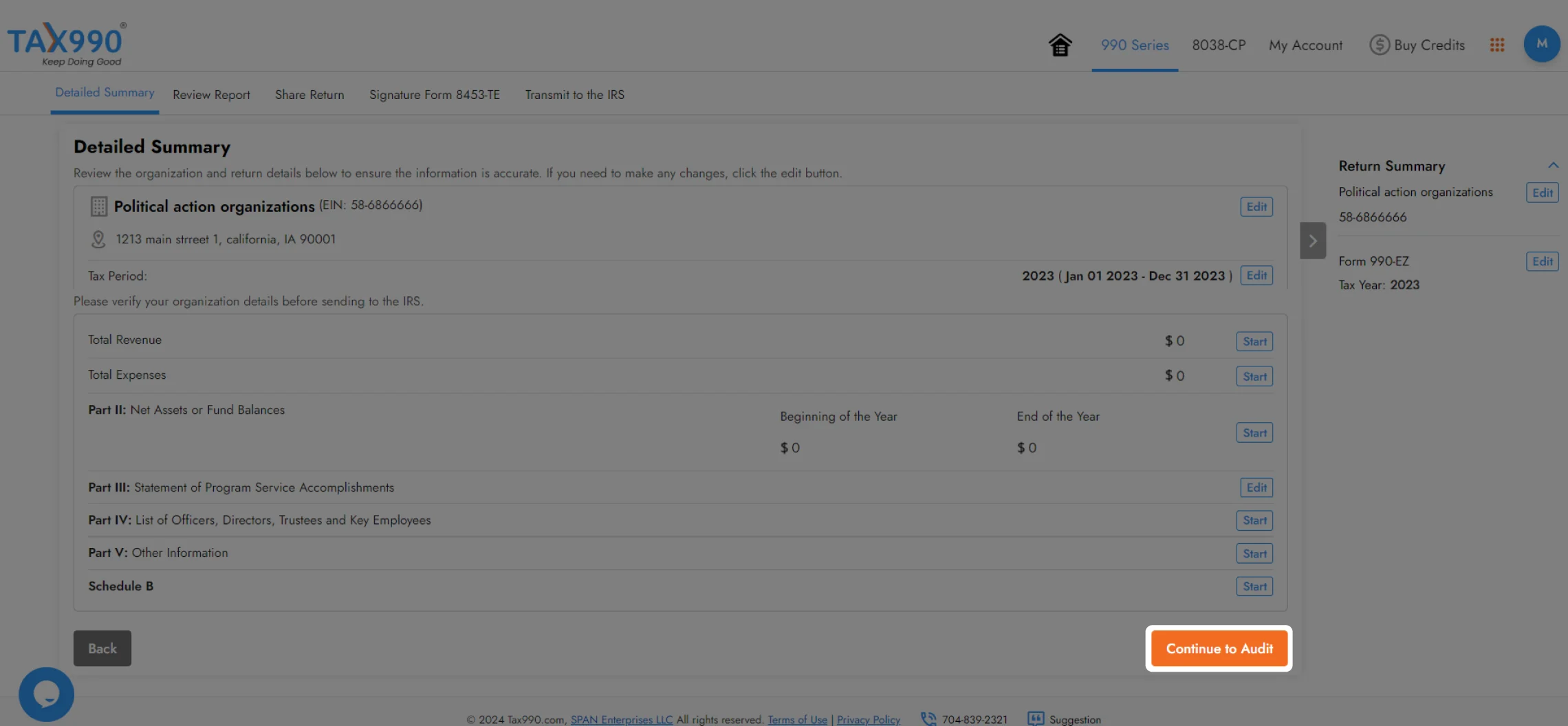

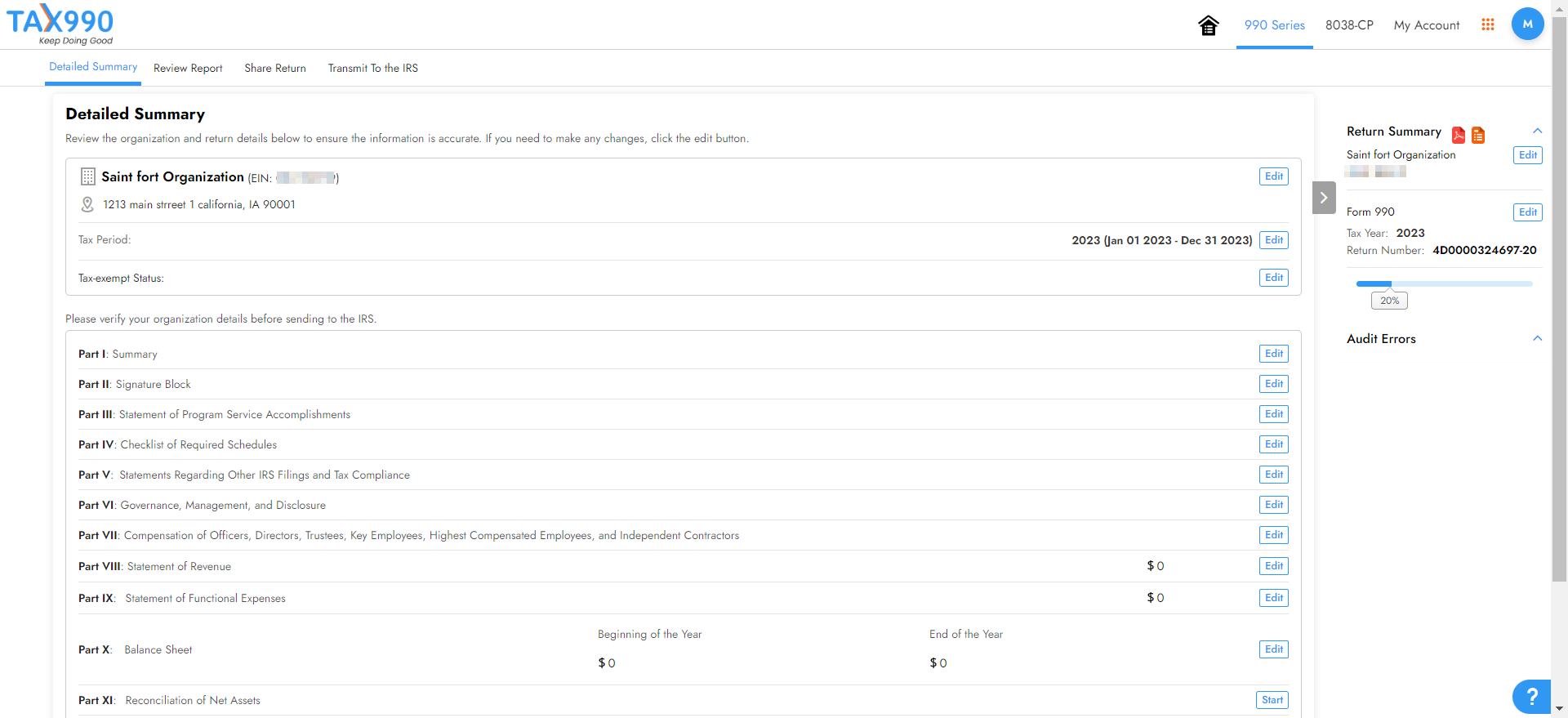

Review your form summary and make any necessary changes. You can also share your form with team members for review and approval.

-

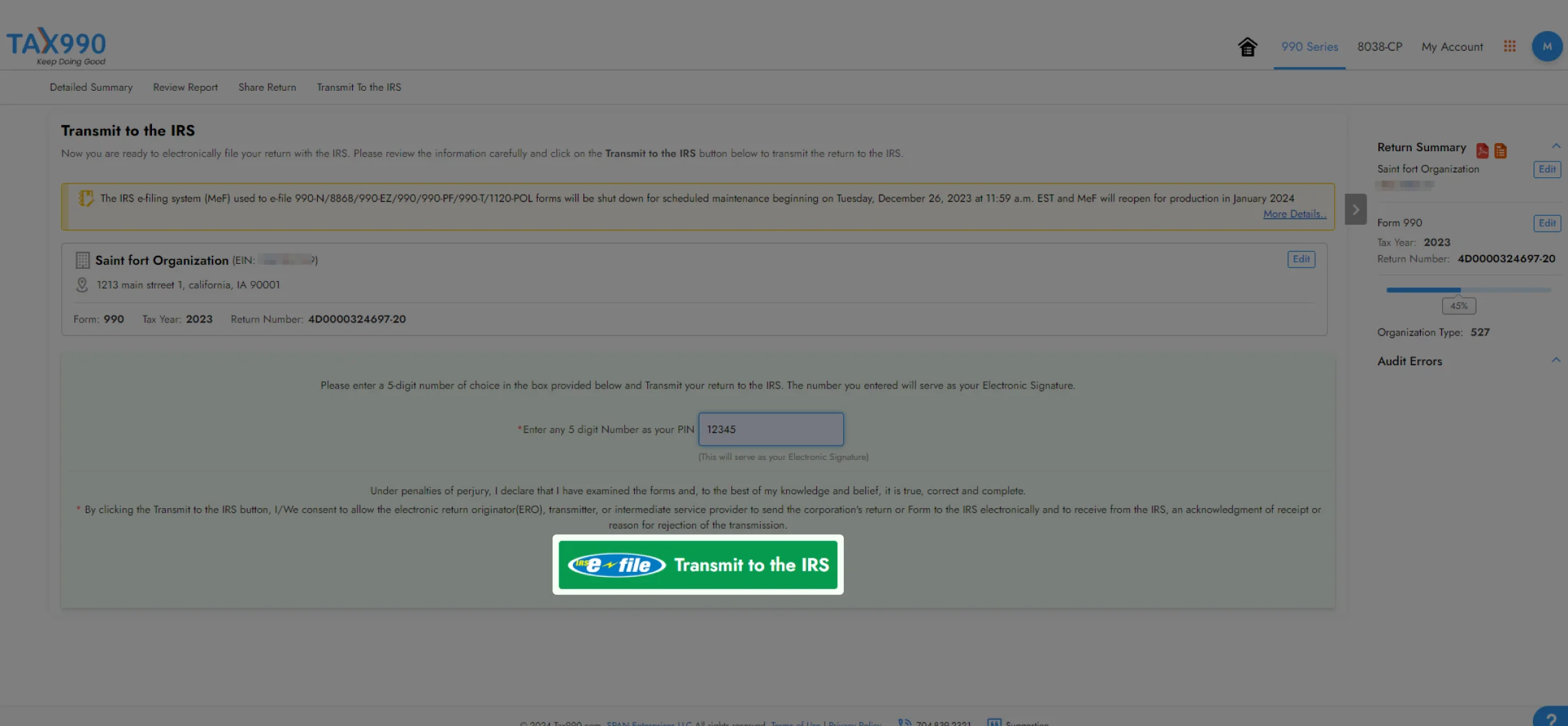

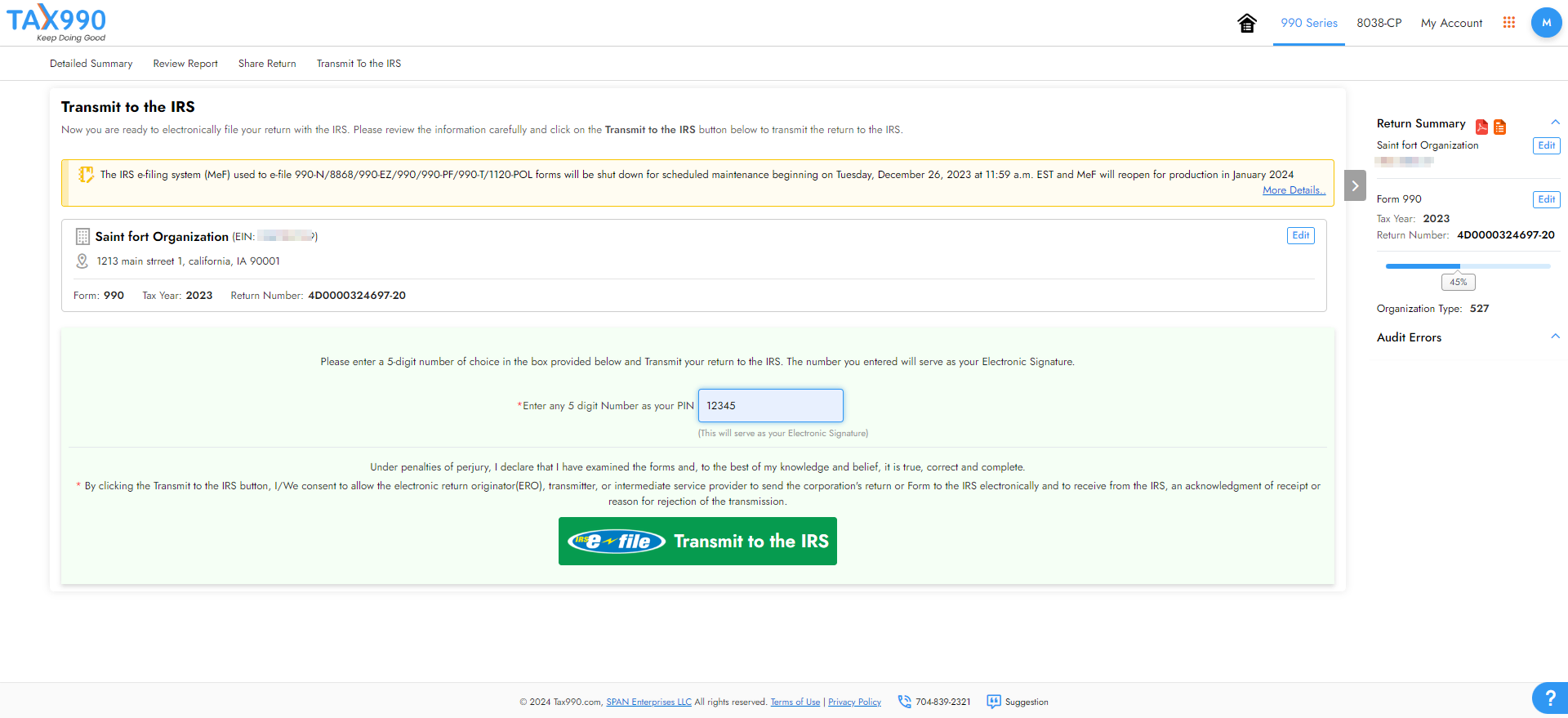

After you review your form, you can pay and transmit it to the IRS. Our system will provide status updates for your form via email or text.

File Form 990 Electronically with Tax990!

Exclusive Features for Filing Form 990 for Nonprofits

Easy and Secure

Our cloud-based software comprises an intuitive interface, enabling easy navigation and a seamless filing experience.

Interview-Style Filing

If you’re a first-time filer, choose our interview-style filing to answer a series of questions and let us generate your 990 accordingly.

Direct-Form Entry

If you’re familiar with 990 filing, choose our form-based option to enter the data directly into the digitalized form on your own and submit it to the IRS.

Free 990 Schedules

Our system autogenerates the Schedules your organization needs for free based on the information you provide.

Internal Audit Check

To ensure accurate returns, our built-in error check system audits your forms for any IRS errors.

Free Retransmission

If the IRS rejects your 990 return for any errors, you can fix them and retransmit it for free

Amend Returns

Even if the original return wasn’t filed with Tax990, you can file an amended return with us.

AI-Powered Knowledge Base

Get tailored assistance from our AI chatbot and explore our knowledge base to find answers to queries you may have during the filing.

Real-Time Support

Our dedicated support team has always gotten back to you via live chat, phone, and email to assist with your queries, if any.

Exclusive PRO Features for Tax Professionals!

Staff Management

Invite your team members and grant them access to manage 990 filings for your clients on your behalf. You can even assign them roles for a streamlined workflow.

Client Management

Prepare 990 filings for unlimited clients in one single account. Share the completed returns with the respective clients via a secure portal.

Seamless E-signing

Our system automatically generates 8453-EMP or 8879-EMP based on the type of filer you are, enabling a simplified authorization process.

Flexible Pricing

Our volume-based pricing packages allow you to save more on your filings while ensuring tax compliance for your clients.

Bulk Upload Templates

Use our standard Excel templates to upload some of the filing information in one go. This will prevent you from repetitive data entry, saving you time and effort.

Reports

Get detailed insights from the custom reports generated by our software and make informed decisions.

Ready to file 990 for your clients?

How to File Form 990 Electronically

-

Search for your EIN to import your organization’s data automatically from the IRS. You also have the option to enter your organization’s details manually.

-

Tax 990 supports filing for the current and previous tax years. Select the tax year for which you are required to file, select Form 990, and proceed.

-

We offer Form-based and Interview-Style filing options. Choose one at your convenience and provide the required

form information.

-

Review your form summary and edit if required. You also have the option to share your form with foundation members for review and approval.

-

Once reviewed, you can transmit it to the IRS. Our system keeps you updated about the IRS status of your form via email and text.

Ready to E-file Form 990?

Trusted by Nonprofits Everywhere

Tax990 Revolutionizes the Tax Filing Process for Nonprofits like Yours!

See what our clients love about Tax990

Join Thousands of Nonprofits that Trust Tax990

Form 990 E-File Pricing

| Forms | Pricing per Form | Benefits |

|---|---|---|

| Form 990-N | $19.90 |

|

| Form 990-EZ | $99.90 | |

| Form 990 | $199.90 | |

| Form 990-PF | $169.90 | |

| Form 990-T | $149.90 |

| Forms | Pricing per Form |

|---|---|

| Form 990-N | $19.90 |

| Form 990-EZ | $99.90 |

| Form 990 | $199.90 |

| Form 990-PF | $169.90 |

| Form 990-T | $149.90 |

Features

- Only pay for the returns you file

- No subscription fees or contracts

- Ensures complete protection of your data

- Access to live chat, phone, and email support