Form 990-EZ Instructions - How to Fill Out Form 990-EZ?

- Updated December 23, 2024 - 2.00 PM - Admin, Tax990

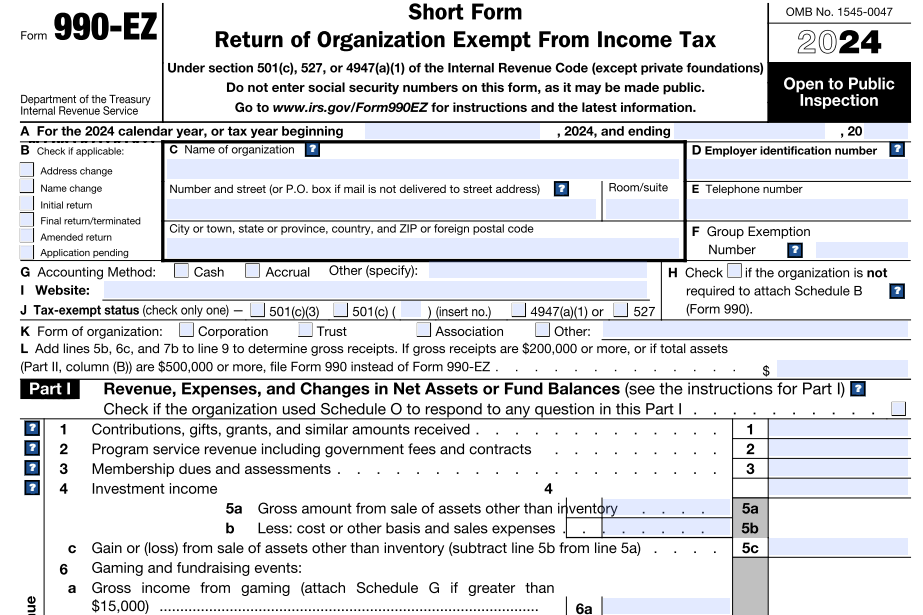

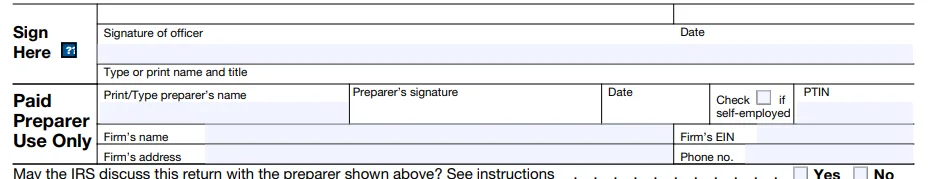

Organizations classified under IRC section 501(c), 527, or 4947(a)(1) (excluding private foundations) with gross receipts under $200,000 and total assets under $500,000 must file Form 990-EZ (Short Form Return of Organization Exempt From Income Tax).

The due date for filing Form 990-EZ is typically the 15th day of the 5th month after the end of the organization's tax period. However, for organizations operating on the calendar tax year, the deadline may vary based on the end of the organization’s tax year. In case additional time is needed, organizations can file Form 8868 to request a 6-month automatic extension.

Tax990 offers a simple solution to e-file Form 8868 and obtain the extension seamlessly. E-file 8868 Now

This article provides step-by-step instructions on how to complete Form 990-EZ.

Additional Filing Requirements for Form 990-EZ

Organizations that file Form 990-EZ may be required to provide additional information through various Schedules.

There are 8 different types of 990 schedules may be attached to Form 990-EZ based on your organization type, financial status, and activities.

Schedule A - Public Charity Status & Public Support

Schedule B - Schedule of Contributors

Schedule C - Political Campaign and Lobbying Activities

Schedule E - Schools

Schedule G - Supplemental Information

Schedule L - Transactions with Interested Persons

Schedule N - Liquidation, Termination, Dissolution, or Significant Disposition of Assets

Schedule O - Supplemental Information to Form 990

Tax990 is Here to Make Your 990-EZ Filing Easier!

Tax990, your IRS-authorized 990 e-filing solution provider, makes filing Form 990-EZ effortless with our exclusive features.

Flexible Filing Methods: Choose between Form-based and Interview-Style options that suit your preference.

Automatic Schedule Inclusion: Our system automatically generates the applicable Form 990 Schedule based on your data at no additional cost.

Internal Audit Check: Our built-in audit tool reviews your form for IRS instruction errors and lets you correct them before submission.

Expert Support: Our live support team is available via chat, phone, or email to assist you with any concerns regarding filing.

How to file your Form 990-EZ electronically?

Get Started with Tax990 to prepare and e-file your Form 990-EZ with the IRS. Follow these 5 simple steps to e-file your form 990-EZ with Tax990:

Step 1: Add Organization Details

Enter your organization’s details manually or allow our system to import them from the IRS using your EIN.

Step 2: Choose Tax Year

Tax990 supports filing for the current and previous years. Choose the tax year for which you are filing and then select Form 990-EZ

Step 3: Complete Form 990-EZ Details

Provide all the necessary information to complete your Form 990-EZ.

Step 4: Review your Form Information

Review the completed form to ensure all details are accurate before proceeding.

Step 5: Transmit directly to the IRS

Once you’ve reviewed and verified your information, transmit Form 990-EZ directly to the IRS.

Step 1

Add Organization Details

Enter your organization’s details manually or allow our system to import them from the IRS using your EIN.

Step 2

Choose Tax Year

Tax990 supports filing for the current and previous years. Choose the tax year for which you are filing and then select Form 990-EZ

Step 3

Complete Form 990-EZ Details

Provide all the necessary information to complete your Form 990-EZ.

Step 4

Review your Form Information

Review the completed form to ensure all details are accurate before proceeding.

Step 5

Transmit directly to the IRS

Once you’ve reviewed and verified your information, transmit Form 990-EZ directly to the IRS.

Article Sources

IRS Form 990-EZ: https://www.irs.gov/pub/irs-pdf/f990ez.pdf

IRS about Form 990-EZ: https://www.irs.gov/forms-pubs/about-form-990-ez

IRS Form 990-EZ instructions: https://www.irs.gov/pub/irs-pdf/i990ez.pdf