Table of Contents

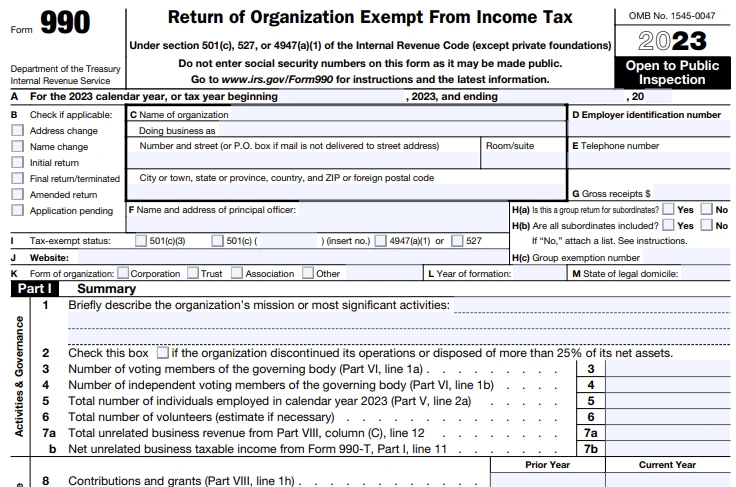

- Basic Organization details

- Part I - Summary

- Part II - Signature Block

- Part III - Program Service Accomplishments

- Part IV - Checklist of Required Schedules

- Part V - Other IRS Filings and Tax Compliance

- Part VI - Governance, Management, and Disclosure

- Part VII- Compensation of organization members

- Part VIII - Statement of Revenue

- Part IX - Statement of Functional Expenses

- Part X - Balance Sheet

- Part XI - Reconciliation of Net Assets

- Part XII - Financial Statements and Reporting

Form 990 Filing Instructions for 2025: Step-by-Step instructions

- Updated December 23, 2024 - 2.00 PM - Admin, Tax990

Form 990 is an annual information return that must be filed by most tax-exempt organizations, nonexempt charitable trusts, and section 527 political organizations with gross receipts of $200,000 or more or total assets of $500,000 or more to report the annual information required by Section 6033 to the IRS.

For these organizations, the deadline to file Form 990 is the 15th day of the fifth month after their accounting period ends.

Tax990 offers a simple solution to e-file your 8868 extension with ease. E-file 8868 Now

You can find out more details on how to complete Form 990 in this article.

Additional Filing Requirements for Form 990

The organizations filing Form 990 may also be required to report additional information by attaching various Schedules.

There are 16 Schedules available for Form 990 to provide more information about the organization. Failing to attach the required schedules may result in an incorrect filing, leading to IRS penalties.

Schedule A - Public Charity Status and Public Support

Schedule B - Schedule of Contributors

Schedule C - Political Campaign and Lobbying Activities

Schedule D - Supplemental Financial Statements

Schedule E - Schools

Schedule F - Statement of Activities Outside the United States

Schedule G - Supplemental Information

Schedule H - Hospitals

Schedule I - Grants and Other Assistance to Organizations, Governments, and Individuals in the U.S

Schedule J - Compensation Information

Schedule K - Supplemental Information on Tax-Exempt Bonds

Schedule L - Transactions with Interested Persons

Schedule M - Noncash Contributions

Schedule N - Liquidation, Termination, Dissolution, or Significant Disposition of Assets

Schedule O - Supplemental Information to Form 990

Schedule R - Related Organizations and Unrelated Partnerships

For more information, click here

Get Started with Tax 990 to E-file Form 990 With Complete Ease!

Tax 990, the IRS-authorized e-file provider, offers a simple way to file your Form 990. Our amazing features are sure to make your e-filing experience smooth and hassle-free.

You can fill out your Form 990 easily using our Form-based filing or Interview-style filing options.

The applicable 990 Schedules will be automatically included for free based on the data you enter.

To ensure the accuracy of your Form 990, our Built-in error check system audits it before transmission.

Our Multi-user access allows you to invite your staff to assist you in form preparation.

In case of any issues, you can get in touch with our Dedicated Support Team for instant solutions.

Steps to File your Form 990:

Step 1

Add Organization Details

Search for your EIN, and our system will automatically import your organization’s details from the IRS. You can also enter the information manually.

Step 2

Choose Tax Year

Tax 990 supports current and previous years’ filings. Select the tax year for which you are filing and choose the appropriate Form 990.

Step 3

Enter Required Form Data

Provide all the necessary information to complete your Form 990.

Step 4

Review your Form Information

After entering all required information, review your form, make any necessary changes, and proceed.

Step 5

Transmit directly to the IRS

Once your form is reviewed and approved, you can transmit your Form 990 directly to the IRS.

Article Sources

IRS Form 990: https://www.irs.gov/pub/irs-pdf/f990.pdf

IRS about Form 990: https://www.irs.gov/forms-pubs/about-form-990

IRS Form 990 instructions: https://www.irs.gov/pub/irs-pdf/i990.pdf