IRS Authorized Provider

SOC 2 Certified

FTB

10 Years of Excellence

24/7 Customer Support

Exclusive Features for Filing Form 990-N for Nonprofits

Easy and Secure Filing

You can complete your Form 990-N filing easily and securely with Tax990.

File From Any Device

File your Form 990-N from a desktop, tablet, or mobile device.

Internal Audit Check

Tax990 provides instant IRS status updates via email, you can also opt-in to receive text notifications.

E-File Multiple Returns

File multiple 990-N Forms across multiple EINs from a single Tax990 account.

Retransmit rejected returns for Free

If the IRS rejects your return, you can correct and transmit it at no additional cost.

Dedicated Customer Support

If you have any questions during the filing process, our dedicated support team is available to assist you by phone, email, and live chat

Exclusive PRO Features for Tax Professionals!

Staff Management

Invite your team members and let them prepare and transmit the 990-N filings for your clients. You can assign them specific roles and keep track of their activities

Client Management

Prepare and manage 990-N filings for unlimited clients (multiple EINs) and have your clients review the returns through a secure portal before transmission.

E-Signing Options

We support Form 8453-TE for Paid Preparers and Form 8879-TE for Electronic Return Originators (ERO) to ensure compliance with the IRS guidelines for e-signing 990 forms.

Ready to E-file Form 990-N?

How to file Form 990-N Electronically

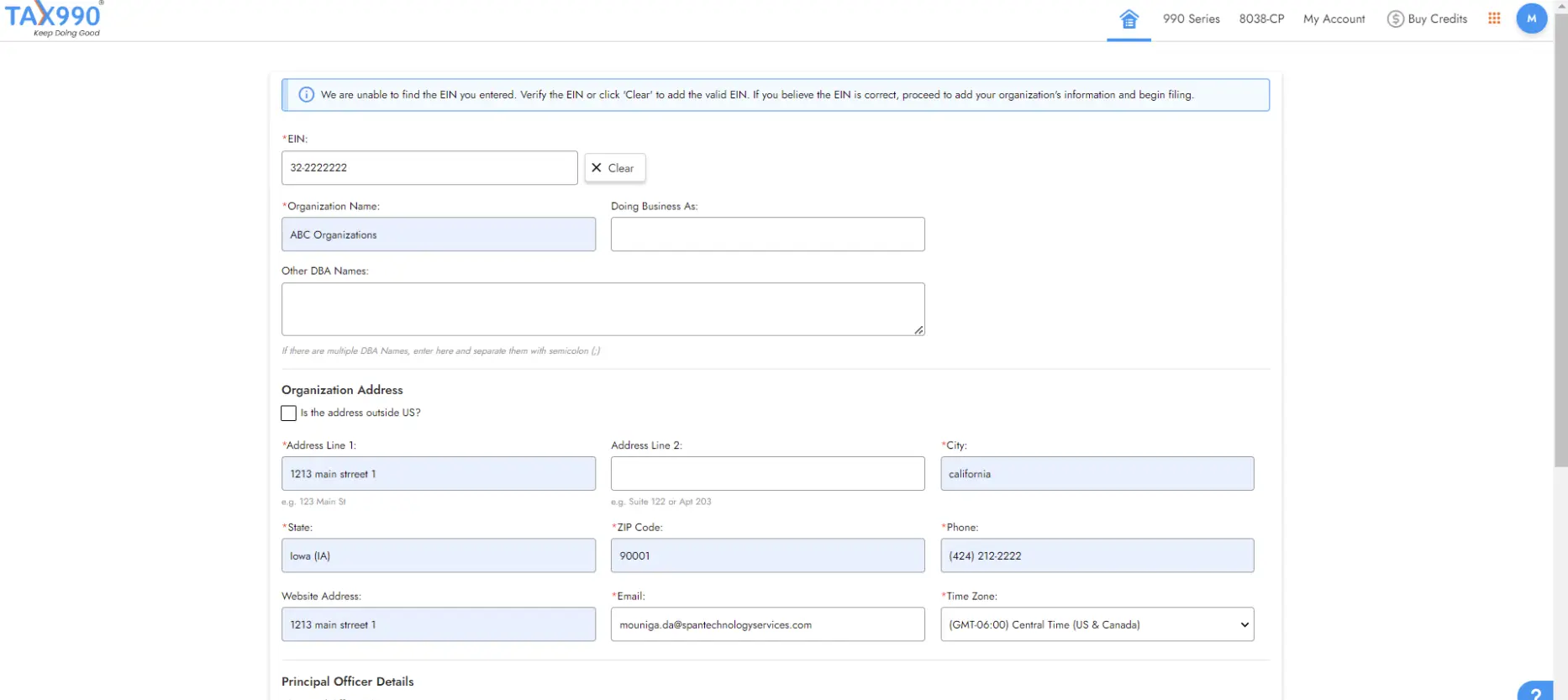

-

Just search for your EIN, and our system will automatically import your organization’s data from the IRS.

-

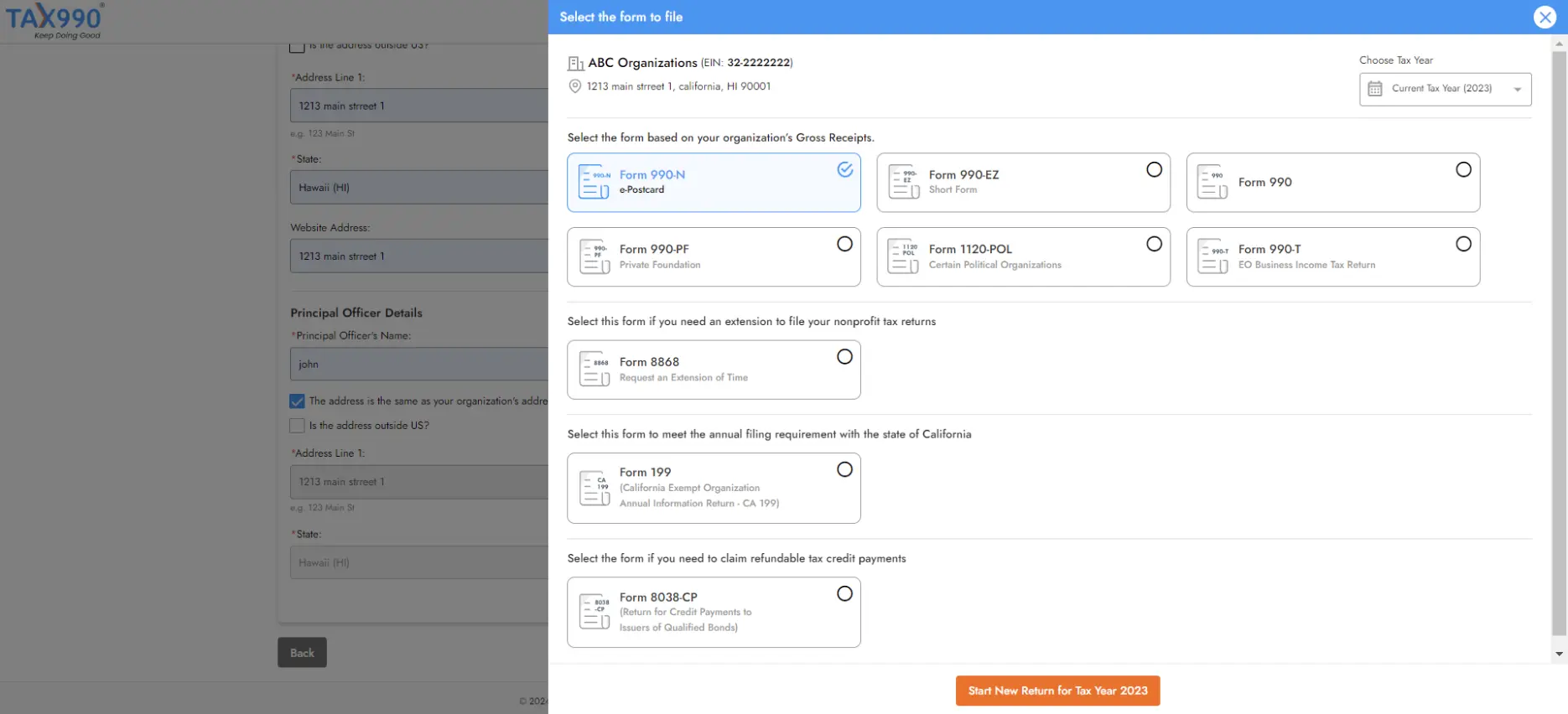

Tax 990 supports 990-N filing for the current and previous tax years. Choose the applicable tax year, select Form 990-N,

and proceed.

-

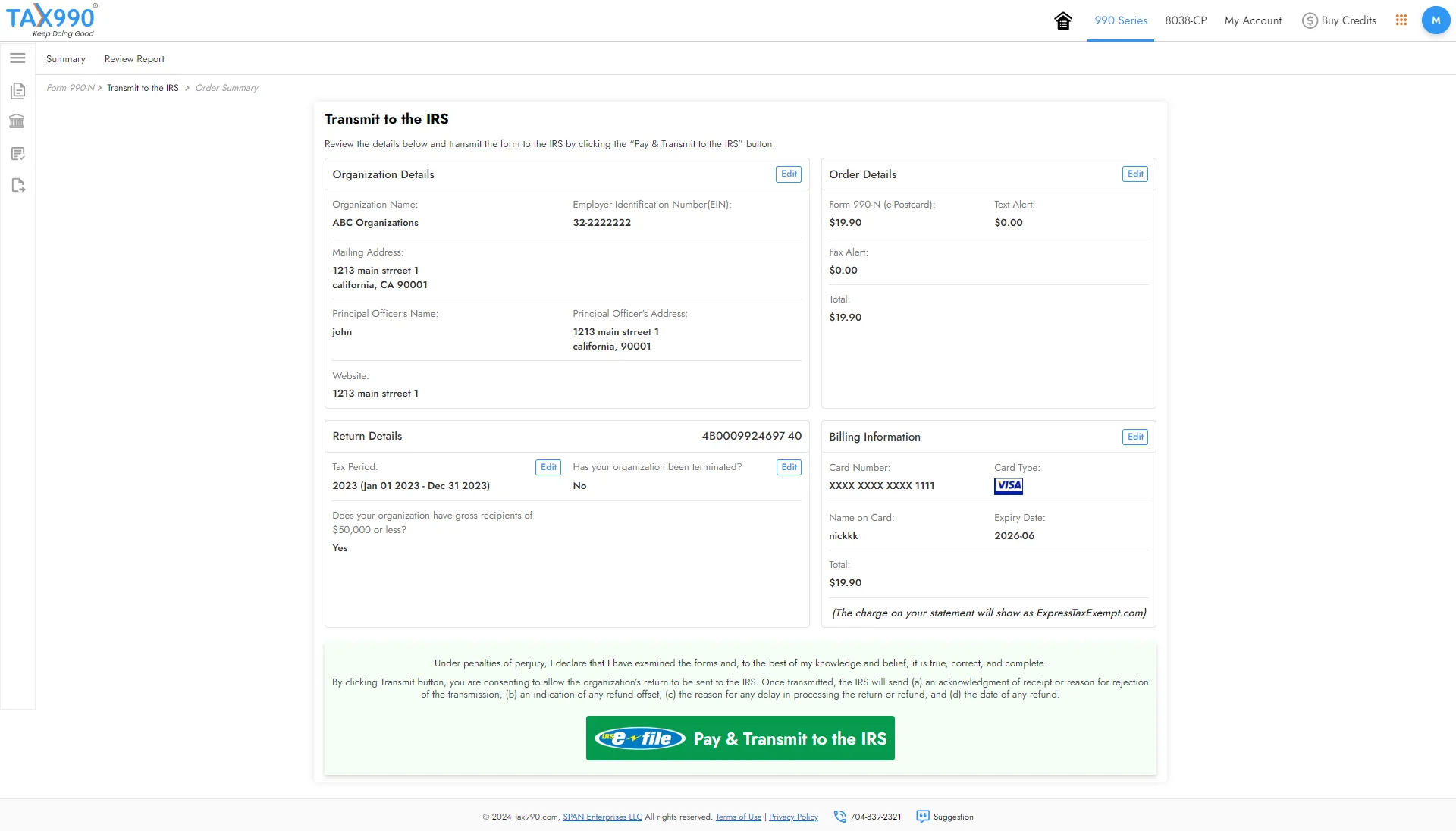

Once you have reviewed your form, you can transmit it to the IRS. Our system will update you on your form status via email

or text.

Ready to E-file Form 990-N?

Trusted by Nonprofits Everywhere

Tax990 Revolutionizes the Tax Filing Process for Nonprofits like Yours!

See what our clients love about Tax 990

Join Thousands of Nonprofits that Trust Tax 990

Form 990 E-File Pricing

| Forms | Pricing per Form | Benefits |

|---|---|---|

| Form 990-N | $19.90 |

|

| Form 990-EZ | $99.90 | |

| Form 990 | $199.90 | |

| Form 990-PF | $169.90 | |

| Form 990-T | $149.90 |

| Forms | Pricing per Form |

|---|---|

| Form 990-N | $19.90 |

| Form 990-EZ | $99.90 |

| Form 990 | $169.90 |

| Form 990-PF | $199.90 |

| Form 990-T | $149.90 |

Features

- Only pay for the returns you file

- No subscription fees or contracts

- Ensures complete protection of your data

- Access to live chat, phone, and email support

Pricing to E-File 990-N with Tax990

- No subscription fee

- Supports prior years' filing

- Ensures complete data protection

- Retransmit rejected returns for free

- Live chat, phone and email support

- No subscription fee

- Supports prior years' filing

- Ensures complete data protection

- Retransmit rejected returns for free

- Live chat, phone and email support