IRS Form 990 Schedule F Instructions

- Updated August 21, 2024 - 2.00 PM - Admin, Tax990

Nonprofit organizations that are required to file Form 990 may also be required to attach Schedule F to report more details about their activities and comply with the additional filing requirements of the IRS.

This article discusses about the purpose, filing instructions for Schedule F.

Table of Contents

What is the Purpose of Form 990 Schedule F?

Form 990 Schedule F is used by organizations to provide the IRS with information regarding the activities they have conducted outside the United States during the corresponding tax year.

The type of activities that can be reported include

- Grants and other assistance

- Program-related investments

- Fundraising activities

- Unrelated trade or business

- Program services and investments

- Maintaining offices, employees, or agents to conduct activities

Who Must File Form 990 Schedule F?

Schedule F must be completed by

Organizations that have aggregate revenues or expenses of more than $10,000 from grantmaking, fundraising, business, investment, and program services outside the U.S (or) aggregate foreign investments of $100,000 or more. (Must enter “Yes” on Part IV, line 14b in their 990 returns)

Organization that offered grants or other assistance of more than $5000 to any foreign organization or individuals. (Must enter “Yes” on Part IV, line 15 or 16 of Form 990)

How to Complete Form 990 Schedule F?

There are 5 parts in Form 990 Schedule F, and you are required to complete the applicable parts based on the answers you provided on Form 990.

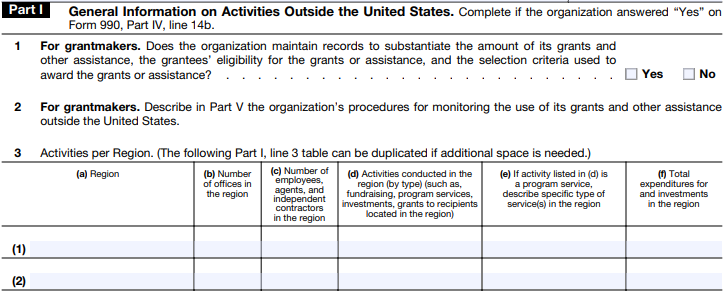

Part I - General Information on Activities Outside the United States

Part I is for the organizations that answered “Yes” on Part IV, line 14b on their

990 Form.

Mention if your organization has made grants or offered assistance to any foreign organizations, governments, or individuals directly or indirectly.

(If “Yes”, provide an explanation in Part V).

Provide the following details regarding the activities conducted by your organization outside the U.S. (region-wise). The details include

a.

Region

b.

Number of offices

c.

Number of employees, agents, and independent contractors

d.

Type of activities conducted (fundraising, program services, etc.)

e.

Description of service (for program services)

f.

Total expenses and investments

Note:

The activities conducted in the following geographic regions can be reported on Schedule F

Antarctica

Central America and the Caribbean

East Asia and the Pacific

Europe (Including Iceland and Greenland)

Middle East and North Africa

North America

Russia and Neighboring States

South America

South Asia

Sub-Saharan Africa

Part II - Grants and Other Assistance to Organizations or Entities Outside the United States

This part needs to be completed by organizations that answered “Yes” on Part IV, line 15 of Form 990.

As the title indicates, this part requires you to report details regarding the grants and noncash assistance (more than $5000) offered by your organization to other foreign organizations

or entities.

The details required to be reported include

a.

Organization name

b.

IRS code section and EIN (if applicable)

c.

Region

d.

Purpose of grant

e.

Amount of cash grant

f.

Manner of cash disbursement

g.

Amount of noncash assistance

h.

Description of noncash assistance

i.

Method of valuation (book, FMV, appraisal, other)

Part III - Grants and other assistance to Individuals outside the United States

This part needs to be completed by organizations that answered “Yes” on Part IV, line 16 of Form 990.

In this part, you are required to report details regarding the grants and noncash assistance (more than $5000) offered by your organization to other foreign organizations or entities.

The details required to be reported include

j.

Organization name

k.

IRS code section and EIN (if applicable)

l.

Region

m.

Purpose of grant

n.

Amount of cash grant

o.

Manner of cash disbursement

p.

Amount of noncash assistance

q.

Description of noncash assistance

r.

Method of valuation (book, FMV, appraisal, other)

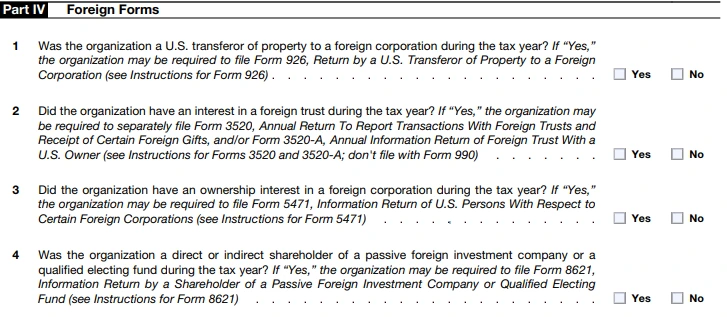

Part IV - Foreign Forms

This part consists of a series of "Yes" or "No" questions that require you to provide answers regarding your organization’s ownership interest, operations, and more.

If you answer "Yes" to any of the questions, your organization may be required to file the

corresponding forms.

Part V - Supplemental Information

In this part, you are required to provide an explanation for some of the answers you have provided in the previous parts.

Also, you can provide additional information regarding any other questions from the part if you need.

Tax 990 Includes Free Schedules F with your Form 990!

You can take advantage of various helpful features by choosing Tax 990 to e-file your 990 return, including the auto-generation of required Free 990 Schedules at no extra cost. Some other features include

Prepare your forms with the utmost convenience using Form-Based or Interview-Style filing options

Add users to manage form preparation and filing. Also, invite board members to review and

approve forms.

Our internal audit check audits your form for errors and ensures the accuracy of returns

Our US-based support team is available via live chat, phone, and email to assist with your questions.