IRS Form 990-T for Nonprofits - Key Takeaways

What is Form 990-T?

Form 990-T is filed by certain tax-exempt organizations to report their details of unrelated business income to the IRS.

Who must file Form 990-T?

Organizations who file their 990 series and also have unrelated business income greater than or equal to $1000 should file Form 990-T.

When is Form 990-T Due Date?

Form 990-T has two deadlines, depending upon the organization type they may file on their appropriate due date.

Tax990 Enables Seamless 990-T E-Filing with Exclusive Features

Includes Supporting Forms

Tax 990 Includes supporting forms 4562, 4797, 1120 Schedule D, 1041 Schedule D, 1041 Schedule I, 8949, 8995, and 3800.

Form-Based Filing

Our filing is Form-based, enabling you to enter the required data directly onto your Form 990-T.

Internal Audit Check

Identify any IRS instruction errors in your form before transmitting it to the IRS.

Supports Form 990-T Schedule A

Our system automatically includes Form 990-T Schedule A for free, based on the information you report.

Amend Returns

You can make corrections on your previously filed 990-T and e-file the amended return to the IRS.

Live Customer Support

Tax 990’s live support team is available to answer your questions via chat, email, or phone.

Ready to start your 990-T E-filing?

Exclusive PRO Features for Tax Professionals!

Staff Management

Invite your team members to prepare and submit the 990 filings for our clients. Assign them the task accordingly.

Client Management

Prepare and handle 990 filings for numerous clients (multiple EINs) and ensure that clients review the returns via a secure portal before they are sent out.

E-Signing Options

We accept Form 8453-TE for Paid Preparers and Form 8879-TE for Electronic Return Originators (ERO).

Ready to File 990-T for your clients?

How to File Form 990-T Electronically?

-

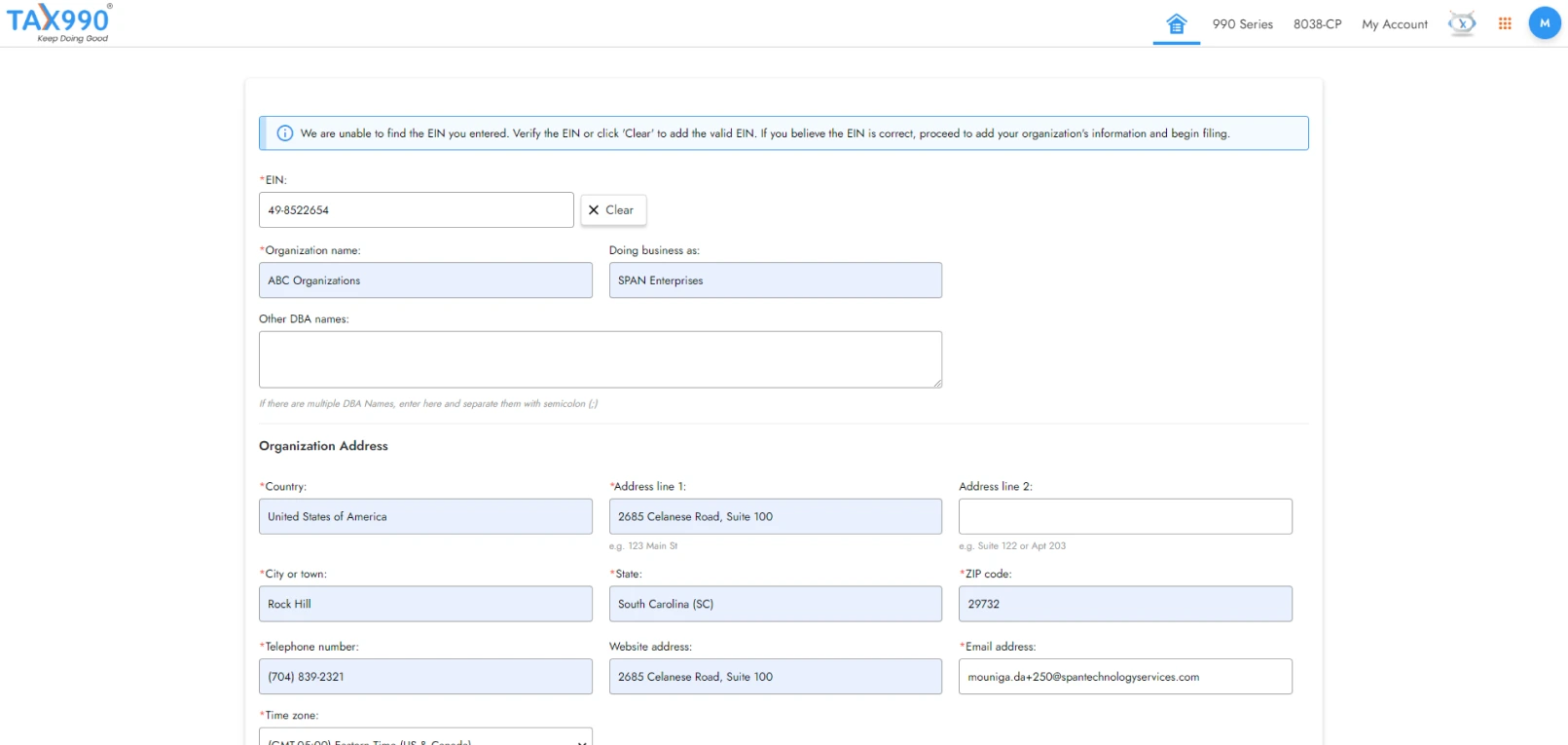

Search for your EIN and import your organization’s details from the IRS directly. You can also manually enter those details.

-

Tax 990 supports Form 990-T filing for the current and previous tax years. Choose the applicable tax year, select Form 990-T, and proceed.

-

Using our Form-Based filing method, enter the required information on your Form 990-T.

-

You can review the form summary and edit details if required. You can also share your form with organization members for their review and approval.

-

Once reviewed, you can transmit the form to the IRS. After transmission, our system provides instant updates about your form's IRS status via email and text.

Ready to E-file Form 990-T?

Information Required to E-file Form 990-T Online

Here is the list of major information that you’ll need to file Form 990-T online,

- Organization’s Basic information

- Details about the Unrelated Business

Income (UBI) - Tax computations

- Tax dues and payments

- Other activities of the organization

Trusted by Nonprofits Everywhere

Tax990 Revolutionizes the Tax Filing Process for Nonprofits like Yours!

Hear From Our Happy Clients

Fees to File Form 990-T Online

- Includes 990-T Schedule A

- Includes certain supporting forms

- Live chat, phone, and email support

- Certified to provide complete

data protection

Ready to e-file Form 990-T?

See what our clients love about Tax 990

Join Thousands of Nonprofits that Trust Tax 990

Frequently Asked Questions about Tax Form 990-T

What is IRS Form 990-T?

Form 990-T is an annual return used by certain tax-exempt organizations and nonprofits to report details regarding unrelated business income to the IRS.

- Reporting proxy tax liability.

- Claiming the refund credit of taxes paid by a regulated investment company (RIC).

- Requesting a credit for certain federal excise taxes or small employer health insurance premiums paid.

Who must file Form 990-T?

Organizations that file Form 990 or 990-EZ and also have unrelated business income of $1000 or more must also file Form 990-T.

When is the due date to file Form 990-T?

Form 990-T due date depends upon the organization type:

| Type of organizations | Due Dates |

|---|---|

|

For Employees' trusts, defined in section 401(a), IRAs (including SEPs and SIMPLEs), Roth IRAs, Coverdell ESAs, or 408(a) (Archer MSAs) |

15th day of the 4th month |

|

For other organizations |

15th day of the 5th month |

Not sure about your 990-T deadline? Use the 990 Due Date Calculator.

How many parts are there in Form 990-T?

IRS Form 990-T consists of 5 different parts, here is the breakdown:

- Part I - Total Unrelated Business Taxable Income

- Part II - Tax Computation

- Part III - Tax and Payments

- Part IV - Statements Regarding Certain Activities and Other Information

- Part V - Supplemental Information

Check out our Form 990-T instructions.

What is Form 990-T Schedule A?

Form 990-T Schedule A is an additional document that the organizations must include to report income and allowable deductions for each of the unrelated businesses or trades they have reported.

A separate Form 990-T Schedule A must be attached for each business or trade.

Should Form 990-T be filed electronically?

Yes! Form 990-T must be filed electronically for tax years ending on or after December 2020.

Get Started with Tax990 and file your Form 990-T electronically with the IRS. Supports current (2024) and prior year filings (2023, 2022).

Can I get an extension to file Form 990-T?

Yes–you can file Form 8868 to extend your 990-T deadline. The IRS will provide an automatic extension of 6 months upon successful filing of Form 8868.

What are the penalties for filing Form 990-T late?

Organizations that fail to file Form 990-T on time may be subject to penalties equivalent to 5% of the unpaid tax for each month or part of a month that Form 990-T is late. The maximum penalty is 25% of the unpaid tax.

What is the difference between Form 990 and 990-T?

| Form 990 | Form 990-T |

|---|---|

|

Form 990 is an IRS form filed by organizations with gross receipts value higher than or equal to $200,000 (or) total assets higher than or equal to $500,000 for their corresponding tax year to fulfill their annual reporting requirements. |

Form 990-T is a supporting form that is filed by nonprofits that file 990, 990-EZ, or 990-PF only when they have an unrelated business income of $1000 or more during the corresponding tax year. |

Can Form 990-T be filed using my Social Security Number

No! Not just Form 990-T, but all the other 990 Forms cannot be filed using a Social Security number (SSN).

Form 990-T and other 990 forms should be filed using EIN (Employer Identification Number). Because SSN is the Taxpayer Identification Number (TIN) for individuals, whereas EIN is for businesses.

What is UBTI?

UBTI stands for Unrelated Business Taxable Income. It is the income generated by tax-exempt organizations such as an IRA that have invested themselves in unrelated business activities to their tax-exempt purpose, subjecting them to income tax.

What are the incomes that qualify as UBTI?

Generally, an income generated by tax-exempt organizations may qualify as Unrelated Business Taxable Income through activities that meet the following criteria.

- A trade or business

- It’s carried out regularly

- The activity is not substantially related to the charitable, educational, or other purpose that is the basis of the organization's exemption.

Can Form 990-T be filed using my Social Security Number?

No! Not just Form 990-T, but all the other 990 Forms cannot be filed using a Social Security number (SSN).

Form 990-T and other 990 forms should be filed using EIN (Employer Identification Number). Because SSN is the Taxpayer Identification Number (TIN) for individuals, whereas EIN is for businesses.

What are all the supporting forms for Form 990-T that Tax990 Supports?

Knowledge Base for E-Filing Form 990-T