and Audits?

We’ve Got You Covered!

and Audits?

We’ve Got You Covered!

-

No additional charges apply!

The Tax990 Commitment

Accepted, Every Time—Nonprofit Tax Filing Made Simple

At Tax990, we’ll do whatever it takes to help you get your forms accepted.

Retransmit Rejected Returns

If your return is rejected by the IRS due to errors, you can correct and resubmit it at no additional cost.

Money-Back Guarantee

If you’re unable to get your form accepted, or it turns out to be a duplicate, we’ll refund your money—no questions asked.

Quick and Easy 990-N Preparation

Get your 990-N done accurately in minutes with our streamlined e-filing solution.

3-Step Filing

You can complete and e-file your e-postcard in just 3 simple steps with Tax 990.

File From Any Device

E-file Form 990-N from any device, including desktop, mobile, or tablet.

View Filing History

Tax990 provides you with the option to view and access the filing history of your organization.

Get Instant Notifications

Receive instant notifications about your filing status and IRS updates as soon as they happen.

Deadline Reminders

Get timely email reminders for your 990-N and CA-199 filing deadlines. You can also set up monthly follow-up reminders.

World-Class Customer Support

Get help anytime from our expert team via chat, phone, or email, or get instant guidance from our 24/7 AI assistant.

Our intuitive features make online filing of Form 990-N easier than ever

Exclusive Tools for Tax Professionals

Tax990 offers many exclusive features that simplify workflows for paid preparers and EROs who handle 990-N filings for their clients!

Enable Efficient Team Management

Bring your team on board—invite them to help prepare and transmit returns, assign specific roles, and track their progress.

The More You File, the More You Save

Maximize savings on filings with our volume-based pricing plans, while ensuring your clients stay compliant.

Elevate Brand Identity

Personalize emails sent from Tax990 to your organization members or clients by adding your brand logo and custom email address.

Want to learn how Tax990 can help you and your clients?

What You’ll Need to File Form 990-N Online

Here is all the information you’ll need to file 990-N Online:

- Organization’s EIN

- Organization’s accounting period

- Legal name and mailing address

- Other names of the organization

- Principal officer details

- Organization’s website address (if applicable)

- Confirmation that the organization's annual gross receipts are $50,000 or less

- Statement of termination (if applicable)

How to File Form 990-N Electronically with Tax990?

Create your free account and follow these simple steps to e-file your Form 990-N effortlessly!

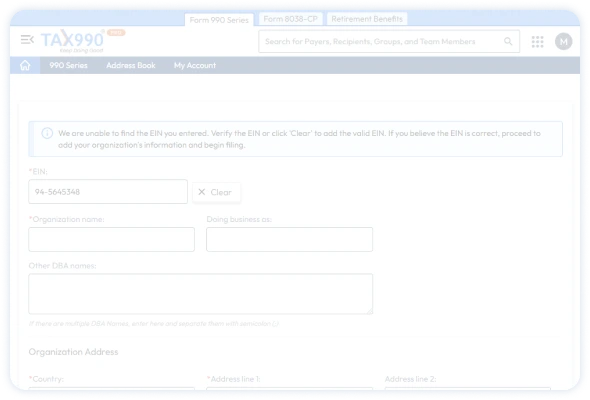

Search the Organization’s EIN

Just search for your EIN, and our system will automatically import your organization’s data from the IRS.

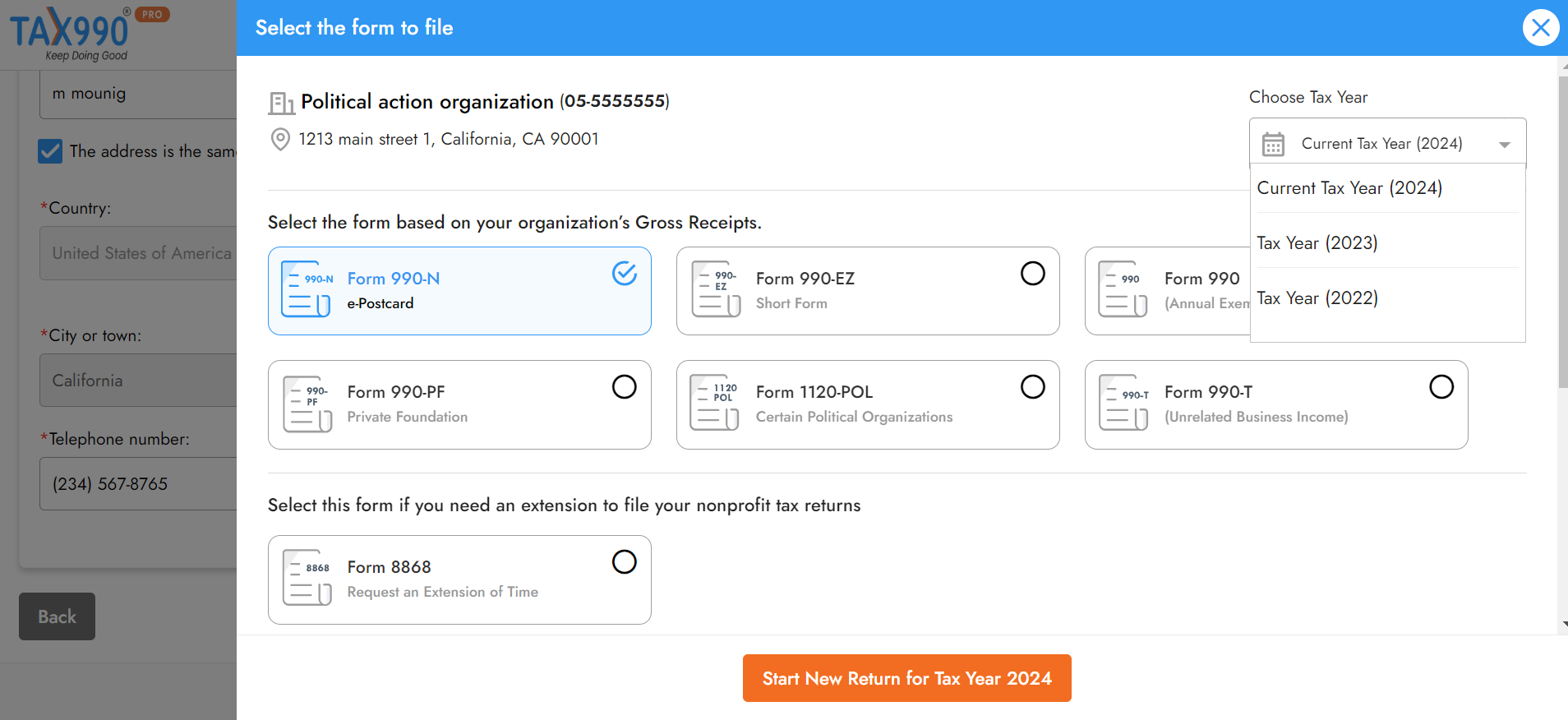

Choose Tax Year and Form

Tax 990 supports 990-N filing for the current and previous tax years. Choose the applicable tax year, select Form 990-N, and proceed.

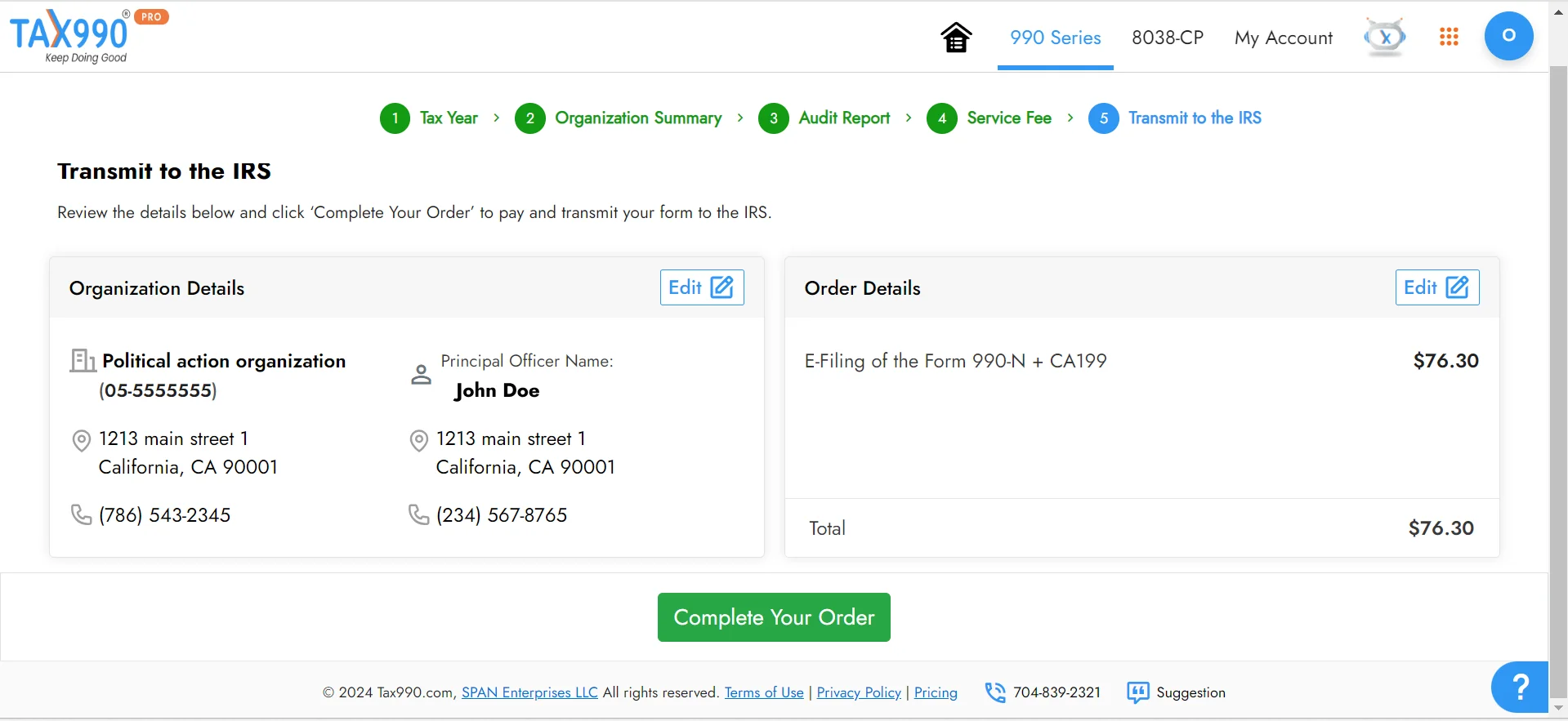

Review and transmit it to the IRS

Once you have reviewed your form, you can transmit it to the IRS. Our system will update you on your form status via email or text.

Ready to file 990-N online?

What We Charge to File Form 990-N Online with Tax990

$19.90/ Form

- Retransmit Rejected Returns

- Guaranteed approval or money-back

- Smart AI assistance

- World-class customer support

File easily and get back to what to matters most!

See why our clients choose Tax990

like you.

Frequently Asked Questions

What is IRS Form 990-N?

Form 990-N (Electronic Notice) is an annual return filed by small tax-exempt organizations with gross receipts less than or equal to $50,000. Form 990-N is also known as an e-postcard.

Who must file Form 990-N?

Generally, Form 990-N is filed by tax-exempt organizations with gross receipts of $50,000 or less.

Organizations that are eligible to file Form 990-N can also file Form 990 or 990-EZ voluntarily.

When is the deadline to file Form 990-N?

The due date to file Form 990-N is the 15th day of the 5th month after the organization’s accounting period ends.

Therefore, if your organization follows a calendar tax year, the deadline to file Form 990-N is May 15.

Does your organization follow a fiscal tax year? Find your 990-N due date.

Are there any additional filing requirements for Form 990-N?

No! Unlike the other 990 forms, such as Form 990, 990-EZ, or 990-PF, the organizations that file Form 990-N aren’t required to include any Schedules.

Can I get an extension for Form 990-N?

No, the Form 990-N deadline cannot be extended (unlike other 990 forms).

Is there any penalty for filing Form 990-N late?

There is no penalty for filing Form 990-N late. However, if the organization fails to file a 990-N for three consecutive years, the IRS will revoke the tax-exempt status of the organization.

Can Form 990-N be amended?

No! You cannot file an amended return for Form 990-N. However, Tax 990 provides you with the option to retransmit the 990-N returns rejected due to IRS

errors for Free.

What is the difference between Form 990-N and Form 990-PF?

Form 990-PF is filed by Private Foundations to report their foundation's activities and financial information to the IRS, whereas 990-N Tax Form is filed by small tax-exempt organizations that have gross receipts of less than or equal to $ 50,000 for the corresponding tax year to sustain the tax-exempt status.

Can I file Form 990-EZ/990 instead of Form 990-N?

Yes! The small exempt organization that is eligible to file Form 990-N may choose to file Form 990-EZ or even Form 990 voluntarily to satisfy its annual

reporting requirements.

Helpful Videos